Judgment Case 3–5

Balance sheet; errors

• LO3–2 through LO3–4

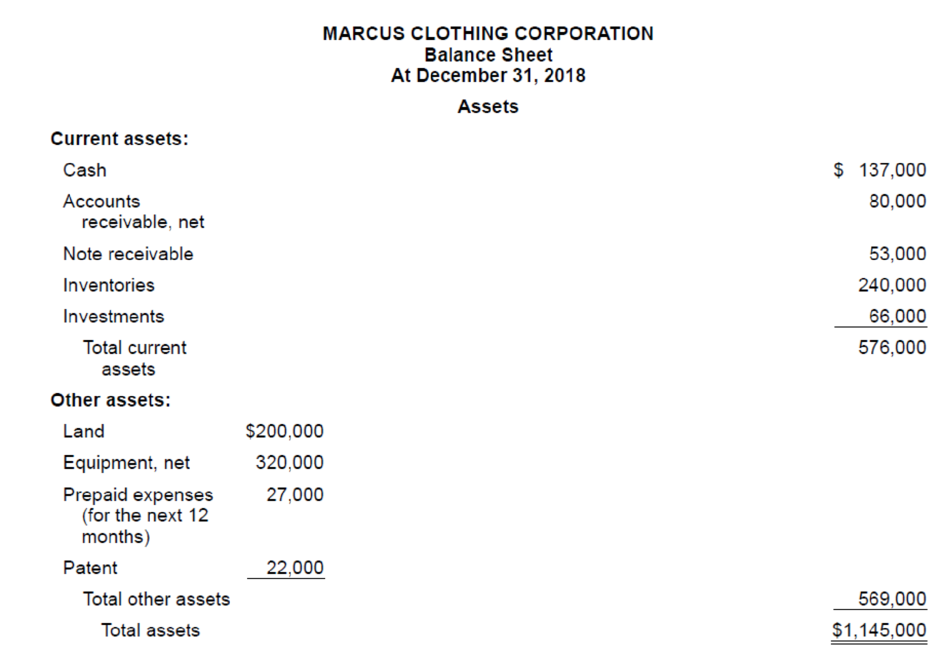

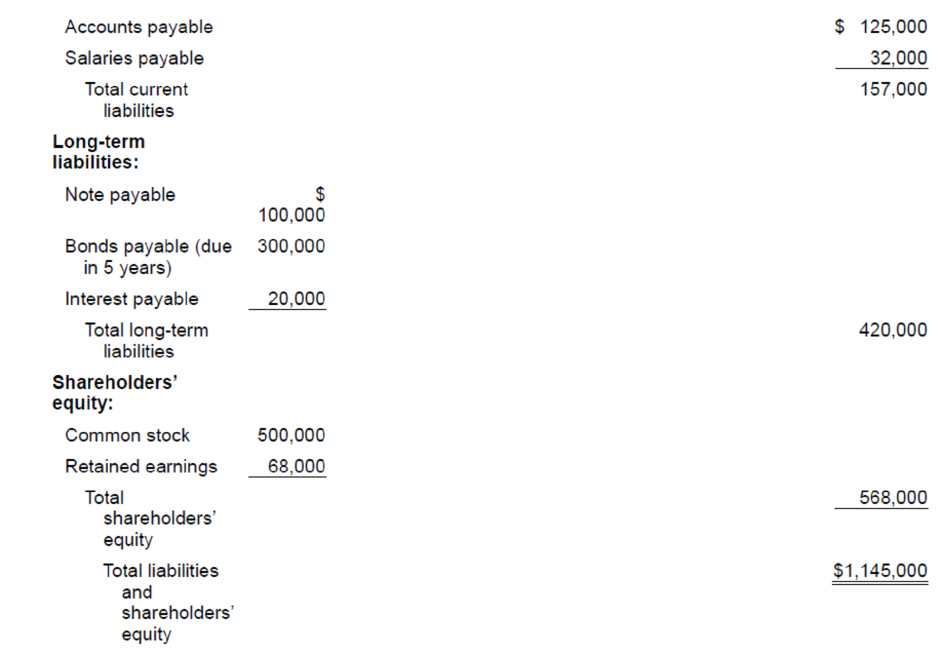

You recently joined the internal auditing department of Marcus Clothing Corporation. As one of your first assignments, you are examining a balance sheet prepared by a staff accountant.

In the course of your examination you uncover the following information pertaining to the balance sheet:

1. The company rents its facilities. The land that appears in the statement is being held for future sale.

2. The note receivable is due in 2020. The balance of $53,000 includes $3,000 of accrued interest. The next interest payment is due in July 2019.

3. The note payable is due in installments of $20,000 per year. Interest on both the notes and bonds is payable annually.

4. The company’s investments consist of marketable equity securities of other corporations. Management does not intend to liquidate any investments in the coming year.

Required:

Identify and explain the deficiencies in the statement prepared by the company’s accountant. Include in your answer items that require additional disclosure, either on the face of the statement or in a note.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Intermediate Accounting

- 10. Which statement is prepared first in the accounting cycle?A. Balance SheetB. Statement of Retained EarningsC. Income StatementD. Cash Flow Statementhelp mearrow_forwardI need help The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetarrow_forwardNo use chatgpt 1. If an adjusting entry is not made for accrued wages, what will be the result?A. Assets overstatedB. Liabilities understatedC. Equity understatedD. Expenses overstatedarrow_forward

- 1. If an adjusting entry is not made for accrued wages, what will be the result?A. Assets overstatedB. Liabilities understatedC. Equity understatedD. Expenses overstatedarrow_forwardDon't use chatgpt The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetarrow_forwardThe normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetneed help in this .arrow_forward

- The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the asset Help!arrow_forwardNo AI The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetarrow_forwardWhich item would appear on the statement of retained earnings?A. DividendsB. InventoryC. Prepaid RentD. Notes Payablearrow_forward

- What does a classified balance sheet do that an unclassified one does not?A. Uses the cash basis of accountingB. Categorizes assets and liabilities into current and long-termC. Shows only owner’s equityD. Omits depreciationarrow_forward4. The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetno aiarrow_forward4. The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetneed helparrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning