Managerial Accounting: Tools for Business Decision Making

7th Edition

ISBN: 9781118334331

Author: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Publisher: WILEY

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 3.5E

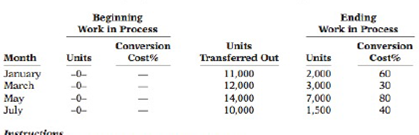

In Shady Company, materials are entered at the beginning of each process. Work in process inventories, with the percentage of work done on conversion costs, and production data for its Sterilizing Department in selected months during 2017 are as follows.

Compute physical units and equivalent units of production. (LO 3,4), AP

Instructions

(a) Compute the physical units for January and May.

(b) Compute the equivalent units of production for (1) materials and (2) conversion costs for each month.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Luctor

Actual overhead costs

Actual qty of the allocation base used

Estimated overhead costs

Estimated qty of the allocation base

Predetermined OH allocation rate

Data table

Activity

Allocation Base

Supplies

Number of square feet

Travel

Number of customer sites

Allocation Rate

$0.07 per square foot

$23.00 per site

Print

Done

Clear all

Check answer

12:58 PM

Were the overheads over applied or under applied and by how much for this general accounting question?

The Trainer Tire Company provided the following partial trial balance for the current year ended December 31. The company is subject to a 45% income tax rate.

Chapter 3 Solutions

Managerial Accounting: Tools for Business Decision Making

Ch. 3 - Identify which costing systemjob order or process...Ch. 3 - Contrast the primary focus of job order cost...Ch. 3 - What are the similarities between a job order and...Ch. 3 - Your roommate is confused about the features of...Ch. 3 - Sam Bowyer believes there are no significant...Ch. 3 - (a) What source documents are used in assigning...Ch. 3 - At Ely Company, overhead is assigned to production...Ch. 3 - Prob. 8QCh. 3 - Prob. 9QCh. 3 - Prob. 10Q

Ch. 3 - Sanchez Co. has zero units of beginning work in...Ch. 3 - Coats Company had zero units of beginning work in...Ch. 3 - Sanchez Co. has zero units of beginning work in...Ch. 3 - Hindi Co. started 3,000 units during the period....Ch. 3 - Clauss Company transfers out 14,000 units and has...Ch. 3 - Prob. 16QCh. 3 - What purposes are served by a production cost...Ch. 3 - As Trent Company, there are 500 units of ending...Ch. 3 - What is the difference between operations costing...Ch. 3 - How does a company decide whether to use a job...Ch. 3 - Soria Co. started and completed 2,000 units for...Ch. 3 - Reyes Company transfers out 12,000 units and has...Ch. 3 - Journalize entries for accumulating costs. (LO 2)....Ch. 3 - Data for Warner Company are given in BE3-1....Ch. 3 - Compute equivalent units of production. (LO 3), AP...Ch. 3 - Compute equivalent units of production. (LO 3), AP...Ch. 3 - Compute unit costs of production.. (LO 4), AP In...Ch. 3 - Assign costs to units transferred out and in...Ch. 3 - Compute unit costs. (LO 4), AP Production costs...Ch. 3 - Prepare cost reconciliation schedule. (LO 4), AP...Ch. 3 - Assign costs to units transferred out and in...Ch. 3 - Assign costs to units transferred out and in...Ch. 3 - Compute unit costs. (LO 5), AP Production costs...Ch. 3 - Indicate whether each of the following statements...Ch. 3 - Kopa Company manufactures CH-21 through two...Ch. 3 - The Assembly Department for Right pens has the...Ch. 3 - In March, Kelly Company had the following unit...Ch. 3 - Robert Wilkins has prepared the following list of...Ch. 3 - Journalize transactions. (LO 2), AP Harrelson...Ch. 3 - The ledger of American Company has the following...Ch. 3 - Journalize transaction for two processes. (LO 2),...Ch. 3 - In Shady Company, materials are entered at the...Ch. 3 - The Cutting Department of Cassel Company has the...Ch. 3 - The Sanding Department of Quik Furniture Company...Ch. 3 - The Blending Department of Luongo Company has the...Ch. 3 - Determine equivalent units, unit costs, and...Ch. 3 - Determine equivalent units, unit costs, and...Ch. 3 - The Polishing Department of Major Company has the...Ch. 3 - Prob. 3.12ECh. 3 - The Welding Department of Healthy Company has the...Ch. 3 - Remington Inc. is contemplating the use of process...Ch. 3 - Santana Mortgage Company uses a process cost...Ch. 3 - Compute equivalent units, unit costs, and costs...Ch. 3 - Determine equivalent units, unit costs, and...Ch. 3 - Compute equivalent units, unit costs, and costs...Ch. 3 - Answer questions on costs and production. (LO 5),...Ch. 3 - The Welding Department of Majestic Company has the...Ch. 3 - Fire Out Company manufactures its product,...Ch. 3 - Complete four steps necessary to prepare a...Ch. 3 - Thakin Industries Inc. manufactures dorm furniture...Ch. 3 - Rivera Company has several processing departments....Ch. 3 - Polk Company manufactures basketballs. Materials...Ch. 3 - Hamilton Processing Company uses a weighted...Ch. 3 - Determine equivalent units and unit costs and...Ch. 3 - CURRENT DESIGNS CDJ Building a kayak using the...Ch. 3 - Decision-Making Across the Organization Florida...Ch. 3 - Harris Furniture Company manufactures living room...Ch. 3 - CRITICAL THINKING Communication Activity Diane...Ch. 3 - Ethics Case R. B. Dillman Company manufactures a...Ch. 3 - In a recent year, an oil refinery Texas City,...

Additional Business Textbook Solutions

Find more solutions based on key concepts

E4-1 The following independent situations require professional judgment for determining when to recognize reven...

Financial Accounting: Tools for Business Decision Making, 8th Edition

Graphically portray the Keynesian transmission mechanism under the following conditions: a. A decrease in the m...

Macroeconomics

Describe the distinctive characteristic of weighted-average computations in assigning costs to units completed ...

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

To what does the lifetime value of the customer refer, and how is it calculated?

MARKETING:REAL PEOPLE,REAL CHOICES

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Provide correct answer this general accounting questionarrow_forwardNeedam Company has analyzed its production process and identified two primary activities. These activities, their allocation bases, and their estimated costs are listed below. BEE (Click on the icon to view the estimated costs data.) The company manufactures two products: Regular and Super. The products use the following resources in March: BEE (Click on the icon to view the actual data for March.) Read the requirements. Requirement 5. Compute the predetermined overhead allocation rates using activity-based costing. Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter the amounts to compute the all Actual overhead costs Actual qty of the allocation base used Estimated overhead costs Estimated qty of the allocation base Predetermined OH allocation rate Data table Data table Regular Super Number of purchase orders 10 purchase orders Number of parts 600 parts 13 purchase orders 800 parts Activity Purchasing Materials handling - X…arrow_forwardMakenna is a waiter at Albicious Foods in South Carolina. Makenna is single with one other dependent and receives the standard tipped hourly wage. During the week ending October 25, 2024, Makenna worked 44 hours and received $210 in tips. Calculate Makenna's gross pay, assuming tips are included in the overtime rate determination. Use Table 3-2. Required: 1. Complete the payroll register for Makenna. 2a. Does Albicious Foods need to contribute to Makenna’s wages to meet FLSA requirements? 2b. If so, how much should be contributed?arrow_forward

- 10. Record the journal entries for Holley Company for August. 11. Post appropriate entries to the Conversion Costs T-account to determine the amount of underallocated or overallocated overhead. Record the adjusting entry. 10. Record the journal entries for Holley Company for August. (Record debits first, then credits. Exclude explanations from journal entries) Journalize the purchase of raw materials. Date 5 a. Accounts Debit Credit Accounts Payable Accounts Receivable Conversion Costs Cost of Goods Sold Finished Goods Inventory Raw and In-Process Inventory Sales Revenue Wages Payable, Accumulated Depreciation, etc. More info a. Purchased raw materials on account, $30,000. b Incurred labor and overhead costs, $65,000. C d. Completed 900 units with standard costs of $75 for direct materials and $180 for conversion costs. Sold on account 600 units for $400 each. Print Done - Xarrow_forwardThe Coyle Shirt Company manufactures shirts in two departments: Cutting and Sewing. The company allocates manufacturing overhead using a single plantwide rate with direct labor hours as the allocation base. Estimated overhead costs for the year are $630,000, and estimated direct labor hours are 210,000. In June, the company incurred 18,200 direct labor hours. 1. 2. Compute the predetermined overhead allocation rate. Determine the amount of overhead allocated in June. The Coyle Shirt Company has refined its allocation system by separating manufacturing overhead costs into two cost pools-one for each department. (Click the icon to view the estimated costs and allocation data for each department.) 3. Compute the predetermined overhead allocation rates for each department. 4. Determine the total amount of overhead allocated in June. 1. Compute the predetermined overhead allocation rate. Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter…arrow_forwardDecentralized businesses can have three responsibility centers that must be evaluated differently because of their functions. • Describe the three responsibility centers and give an example of each from your work. • Give an explanation about how each is evaluated. • Tell us why you would prefer to work in a centralized or decentralized organization. • Discuss which type of responsibility center you would prefer to manage and why.arrow_forward

- Do fast this question answer general Accountingarrow_forward12. Identify the following costs as preveron, appraisal, internal failure, or external failure: a. Inspection of final products b. Sales returns of defective products c. Employee training d. Reworking defective products e. Working with suppliers to ensure delivery of high-quality raw materials f. Costs of warranty repairs g. Product testing Type of cost Prevention Appraisal Internal failure External failurearrow_forwardYou invest $1,500 today to purchase a new machine that is expected to generate the following revenues over the next 4 years: Year 0 1 2 3 4 Cash flow -1500 300 475 680 490 Find the internal rate of return (IRR) from this investment. What would be the net present value (NPV) if the interest rate is 10%? An investment project provides cash inflows of $560 per year for 10 years. What is the project’s payback period if the initial cost is $2,500? What if the initial cost is $3,250? An investment project has annual cash inflows of $2,000, $2,500, $3,000, and $4,000, and a discount rate of 11%. What is the discounted payback period for these cash flows if the initial cost is $4,800? What if the initial cost is $5,600?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY