FINANCIAL ACCOUNTING:TOOLS FOR BUSINESS

19th Edition

ISBN: 9781119493624

Author: Kimmel

Publisher: WILEY

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 3.12BE

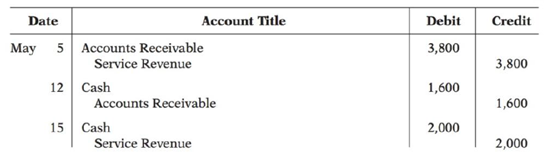

Selected transactions for Montes Company are presented below in journal form (without explanations).

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the percent change in sales for year 2 compared to the base year of this financial accounting question?

Phoenix Industries has twelve million shares outstanding, generates free cash flows of $75 million each year, and has a cost of capital of 12%. It also has $50 million of cash on hand. Phoenix wants to decide whether to repurchase stock or invest the cash in a project that generates free cash flows of $3 million each year. Should Phoenix invest or repurchase the shares? A) Repurchase B) Invest C) Indifferent between options D) Cannot say for sure provide answer

provide correct answer

Chapter 3 Solutions

FINANCIAL ACCOUNTING:TOOLS FOR BUSINESS

Ch. 3 - Prob. 1QCh. 3 - Can a business enter into a transaction that...Ch. 3 - Are the followingevents recorded in the accounting...Ch. 3 - Prob. 4QCh. 3 - Prob. 5QCh. 3 - Prob. 6QCh. 3 - Prob. 7QCh. 3 - Misty Reno, a beginning accounting student,...Ch. 3 - Prob. 9QCh. 3 - What is the normal balance for each of these...

Ch. 3 - Prob. 11QCh. 3 - Prob. 12QCh. 3 - Prob. 13QCh. 3 - Prob. 14QCh. 3 - Prob. 15QCh. 3 - (a) When entering a transaction in the journal,...Ch. 3 - (a) Should accounting transaction debits and...Ch. 3 - Journalize these accounting transactions. (a)...Ch. 3 - Prob. 19QCh. 3 - Prob. 20QCh. 3 - Prob. 21QCh. 3 - Prob. 22QCh. 3 - Prob. 3.1BECh. 3 - For each of the following accounts, indicate the...Ch. 3 - Prob. 3.6BECh. 3 - Prob. 3.7BECh. 3 - Prob. 3.9BECh. 3 - Tilton Corporation has the following transactions...Ch. 3 - Prob. 3.11BECh. 3 - Selected transactions for Montes Company are...Ch. 3 - Prob. 3.1DIECh. 3 - Prob. 3.2DIECh. 3 - Prob. 3.3DIECh. 3 - Prob. 3.4DIECh. 3 - Prob. 3.1ECh. 3 - Prob. 3.6ECh. 3 - Prob. 3.7ECh. 3 - Prob. 3.8ECh. 3 - Prob. 3.9ECh. 3 - Prob. 3.10ECh. 3 - Prob. 3.11ECh. 3 - Prob. 3.12ECh. 3 - Prob. 3.15ECh. 3 - Prob. 3.20ECh. 3 - Prob. 3.23ECh. 3 - Prob. 3.1APCh. 3 - Prob. 3.4APCh. 3 - Prob. 3.11APCh. 3 - Prob. 3.2EYCTCh. 3 - Prob. 3.3EYCTCh. 3 - Prob. 3.4EYCTCh. 3 - Prob. 3.7EYCTCh. 3 - Prob. 3.8EYCTCh. 3 - Prob. 3.9EYCTCh. 3 - Prob. 3.11EYCTCh. 3 - Prob. 3.1IFRS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- abc general accountingarrow_forwardStep by step answerarrow_forwardAt the beginning of the year, Anderson Corporation's assets are $275,000 and its equity is $198,000. During the year, assets increase by $95,000 and liabilities increase by $58,000. What is the equity at the end of the year? Helparrow_forward

- Morgan & Co. is currently an all-equity firm with 100,000 shares of stock outstanding at a market price of $30 per share. The company's earnings before interest and taxes are $120,000. Morgan & Co. has decided to add leverage to its financial operations by issuing $750,000 of debt at an 8% interest rate. This $750,000 will be used to repurchase shares of stock. You own 2,500 shares of Morgan & Co. stock. You also loan out funds at an 8% interest rate. How many of your shares of stock in Morgan & Co. must you sell to offset the leverage that the firm is assuming? Assume that you loan out all of the funds you receive from the sale of your stock.arrow_forwardWhat is the new price after the mark up for this financial accounting question?arrow_forwardhi expert please help me financial accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub  Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Accounting Basics Explained Through a Story; Author: Leila Gharani;https://www.youtube.com/watch?v=VYNTBWBqncU;License: Standard Youtube License