FINANCIAL ACCOUNTING:TOOLS FOR BUSINESS

19th Edition

ISBN: 9781119493624

Author: Kimmel

Publisher: WILEY

expand_more

expand_more

format_list_bulleted

Question

Chapter 1, Problem 1Q

To determine

Identify the three basic forms of business organization.

Expert Solution & Answer

Answer to Problem 1Q

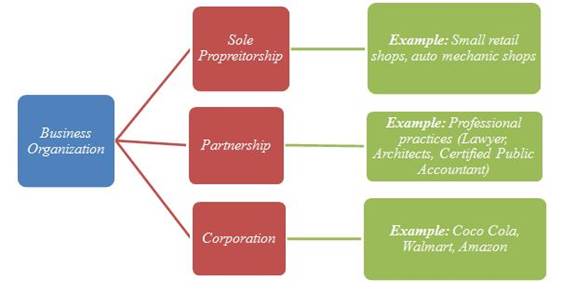

The business organization consists of three basic forms of business organizations as shown in the below figure.

Forms of Business Organization

Figure (1)

Explanation of Solution

Business organization consists of three basic forms. They are sole proprietorship,

Business organization is classified as follows:

- Sole proprietorship: It is one form of simple business that is owned and maintained by a single person. Set up of very simple and taking care of business is very easy. Government provides tax advantages for these firms.

- Partnership: Partnership firms are started by two or more individuals joining together. This form of partnership is very easy to establish and there is a shared control. The duties and formalities of the concern are formalized by making a partnership agreement. In this type of company, individuals with similar interest join together and startup a business. As previously stated for sole proprietorship, partnership firms too enjoy tax advantages.

- Corporation: A business concern where there is a separate legal entity and are owned by shareholders are classified as corporation. Transfer of ownership and raising funds are easy in this form of organization. No personal legal liability exists among the shareholders.

Conclusion

Thus, sole proprietorship, partnership, and corporation are the three basic forms of business organizations.

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

I need help finding the accurate solution to this financial accounting problem with valid methods.

Please explain the accurate process for solving this financial accounting question with proper principles.

I need guidance with this financial accounting problem using the right financial principles.

Chapter 1 Solutions

FINANCIAL ACCOUNTING:TOOLS FOR BUSINESS

Ch. 1 - Prob. 1QCh. 1 - Prob. 2QCh. 1 - Prob. 3QCh. 1 - Accounting is ingrained in our society and is...Ch. 1 - Prob. 5QCh. 1 - Prob. 6QCh. 1 - What are the three main types of business...Ch. 1 - Prob. 8QCh. 1 - Prob. 9QCh. 1 - Prob. 10Q

Ch. 1 - Prob. 11QCh. 1 - What are the three main categories of the...Ch. 1 - Prob. 13QCh. 1 - Prob. 14QCh. 1 - Prob. 15QCh. 1 - Which of these items are liabilities of White...Ch. 1 - How are each of the following financial statements...Ch. 1 - What is the purpose of the management discussion...Ch. 1 - Prob. 19QCh. 1 - Prob. 20QCh. 1 - Prob. 21QCh. 1 - Prob. 1.1BECh. 1 - Match each of the following types of evaluation...Ch. 1 - Indicate in which part of the statement of cash...Ch. 1 - Prob. 1.4BECh. 1 - Prob. 1.6BECh. 1 - Indicate which statement you would examine to find...Ch. 1 - Prob. 1.8BECh. 1 - Prob. 1.9BECh. 1 - Prob. 1.10BECh. 1 - Prob. 1.11BECh. 1 - Prob. 1.1DIECh. 1 - Prob. 1.2DIECh. 1 - Prob. 1.3bDIECh. 1 - Here is a list of words or phi uses discussed in...Ch. 1 - Prob. 1.4ECh. 1 - Prob. 1.9ECh. 1 - Prob. 1.12ECh. 1 - Prob. 1.19ECh. 1 - Prob. 1.21ECh. 1 - Prob. 1.1APCh. 1 - Financial decisions often place heavier emphasis...Ch. 1 - INTERPRETING FINANCIAL STATEMENTS Xerox was not...Ch. 1 - Prob. 1.5EYCTCh. 1 - Prob. 1.9EYCTCh. 1 - Prob. 1.10EYCTCh. 1 - Prob. 1.1IPCh. 1 - Prob. 1.2IPCh. 1 - Prob. 1.3IP

Knowledge Booster

Similar questions

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardPlease show me the correct way to solve this financial accounting problem with accurate methods.arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forward

- Can you explain the process for solving this financial accounting problem using valid standards?arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT