Concept explainers

a.

Introduction:

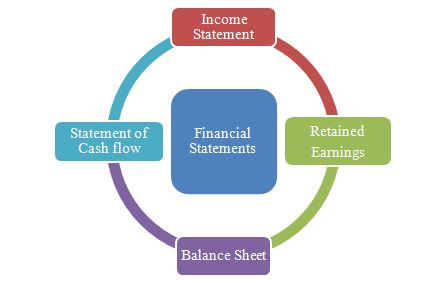

Financial statements are a complete record of the financial transactions that takes place in a company at a particular point of time. It provides important financial information like assets, liabilities, revenues and expenses of the company to its internal and external users. It helps them to know the exact financial position of the company. There are four basic financial statements as shown in the figure below:

Basic Financial Statements

Figure (1)

Figure (1)

Introduction:

To Interpret: Financial facts regarding retained earnings statement.

b.

Introduction:

Statement of

To Interpret: Financial facts regarding cash flow statement.

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

FINANCIAL ACCOUNTING:TOOLS FOR BUSINESS

- I am looking for help with this financial accounting question using proper accounting standards.arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forwardI am looking for the correct answer to this financial accounting question with appropriate explanations.arrow_forward

- Accounting?arrow_forwardWipro Plastics uses the weighted-average method in its process costing system. Department A had 4,000 units in beginning work-in-process (60% complete for conversion costs), started 16,000 new units during the period, and transferred 18,000 completed units to Department B. If the ending work-in-process in Department A was 2,000 units (30% complete for conversion costs), what are the equivalent units for conversion costs for the period?arrow_forwardOn January 1, 2018, Sycamore International reports net assets of $1,245,000, although machinery (with an eight-year life) having a book value of $720,000 is worth $840,000 and an unrecorded trademark is valued at $75,600. Teton Group pays $1,140,000 on that date for a 90 percent ownership in Sycamore. If the trademark is to be written off over a 15-year period, at what amount should it be reported on the consolidated statements on December 31, 2020?arrow_forward

- Viacom Company uses a standard cost system and has established the following standards for one unit of its product: 3 direct labor hours at $24 per hour and 4 pounds of materials at $8 per pound. During April, the company produced 5,000 units using 14,800 direct labor hours at a cost of $25 per hour and 19,800 pounds of materials at a cost of $7.75 per pound. What is the total direct labor variance for April?arrow_forwardGeneral accountingarrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forward

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardCan you help me solve this general accounting problem using the correct accounting process?arrow_forwardCan you help me solve this financial accounting problem using the correct accounting process?arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning