Concept explainers

(a)

Financial statement

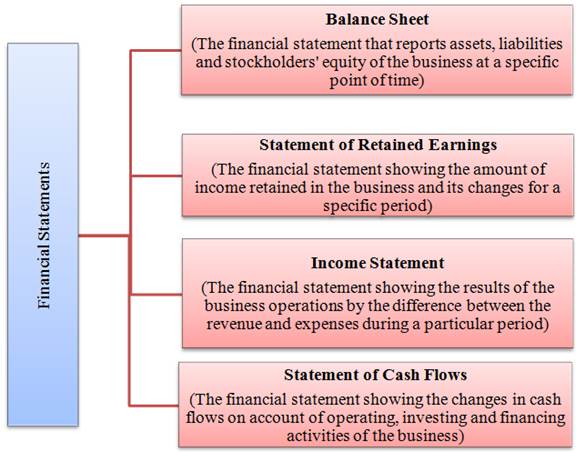

A financial statement is the complete record of financial transactions that take place in a company at a particular point of time. It provides important financial information like assets, liabilities, revenues and expenses of the company to its internal and external users. It helps them to know the exact financial position of the company. There are four basic financial statements; they are:

Figure (1)

To indicate: inwhich financial statement each of the given financial items would appear.

(b)

To indicate: inwhich financial statement each of the given financial items would appear.

(c)

To indicate: inwhich financial statement each of the given financial items would appear.

(d)

To indicate: inwhich financial statement each of the given financial items would appear.

(e)

To indicate: inwhich financial statement each of the given financial items would appear.

(f)

To indicate: inwhich financial statement each of the given financial items would appear.

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

FINANCIAL ACCOUNTING:TOOLS FOR BUSINESS

- I am looking for help with this financial accounting question using proper accounting standards.arrow_forwardCalculate the labor costarrow_forwardEvergreen Systems purchased machinery for $92,000 on January 1, 2020. Additional costs included $4,500 in delivery charges and $8,000 for installation and setup. The machinery is expected to have a salvage value of $20,000 at the end of its 4-year useful life. What is the amount of accumulated depreciation on December 31, 2021, using the straight-line method? Helparrow_forward

- What is the company's contribution margin ratio ?arrow_forwardYour firm purchases a business copier that costs $14,000 and requires $3,000 in maintenance for each year of its four-year life. After four years, the copier will be replaced. The copier falls into the MACRS three-year class life category. Use DDB depreciation. If the tax rate is 32 percent, what is the depreciation tax shield for this project in year 4?arrow_forwardFinancial accountingarrow_forward

- Lynn Inc has provided the following data from its activity-based systemarrow_forwardThe GNR Manufacturing Co. recorded overhead costs of $21,500 at an activity level of 5,000 machine hours and $8,000 at 2,500 machine hours. The records also indicated that overhead of $10,000 was incurred at 4,200 machine hours. Using the high-low method to estimate the cost equation, determine the variable cost per machine hour.arrow_forwardNeed help this question solution pleasearrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College