Concept explainers

1.

Record the

1.

Explanation of Solution

The journal entries for given transactions of Company R are as follows:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| 2021 | Cash | 20,000 | ||

| February 15 | Common stock | 20,000 | ||

| (To record the common stock issued) | ||||

| 2021 | Cash | 35,000 | ||

| May, 20 | Account receivable | 30,000 | ||

| Service revenue | 65,000 | |||

| (To record the service revenue provided to customer on account and in cash) | ||||

| 2021 | Salaries expense | 23,000 | ||

| August 31 | Cash | 23,000 | ||

| (To record the cash received from issuance of common stock) | ||||

| 2021 | Prepaid rent | 12,000 | ||

| October 1 | Cash | 12,000 | ||

| (To record payment of one-year advance rent) | ||||

| 2021 | Supplies | 22,000 | ||

| November 17 | Accounts payable | 22,000 | ||

| (To record the purchase of supplies on account) | ||||

| 2021 | Dividends | 2,000 | ||

| December 30 | Cash | 2,000 | ||

| (To record the payment of dividend to stockholder) | ||||

Table (1)

2.

Record the adjusting entry for prepaid insurance.

2.

Explanation of Solution

Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Adjusting entries of Company R are as follows:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| 2021 | Salaries expense | 4,000 | ||

| December 31 | Salaries payable | 4,000 | ||

| (To record salaries expense incurred at the end of accounting year) | ||||

| 2021 | Rent expense (1) | 3,000 | ||

| December 31 | Prepaid rent | 3,000 | ||

| (To record the rent expense incurred at the end of the accounting period) | ||||

| 2021 | Supplies expense (2) | 25,000 | ||

| December 31 | Supplies | 25,000 | ||

| (To record supplies expense incurred at the end of the accounting year) | ||||

| 2021 | Deferred revenue | 5,000 | ||

| December 31 | Service revenue | 5,000 | ||

| (To record service revenue recognized at the end of the accounting year) |

Table (2)

Working Note:

Calculate the rent expense:

Calculate the supplies expense:

3.

Prepare an adjusted

3.

Explanation of Solution

Adjusted trial balance:

Adjusted trial balance is that statement which contains complete list of accounts with their adjusted balances, after all relevant adjustments have been made. This statement is prepared at the end of every financial period.

Adjusted trial balance of Company R is as follows:

| Company R | ||

| Adjusted Trial Balance | ||

| December 31, 2021 | ||

| Accounts | Debit ($) | Credit ($) |

| Cash | $30,000 | |

| 30,000 | ||

| Supplies | 5,000 | |

| Prepaid Rent | 9,000 | |

| Land | 60,000 | |

| Accounts Payable | $22,000 | |

| Salaries Payable | 4,000 | |

| Common Stock | 70,000 | |

| 25,000 | ||

| Dividends | 2,000 | |

| Service Revenue | 70,000 | |

| Salaries Expense | 27,000 | |

| Rent Expense | 3,000 | |

| Supplies Expense | 25,000 | |

| Total | $191,000 | $191,000 |

Table (3)

Therefore, the total of debit, and credit columns of adjusted trial balance is $191,000.

4.

Prepare the income statement,

4.

Explanation of Solution

Income statement:

Income statement of Company R is as follows:

| Company R | ||

| Income Statement | ||

| For the year ended December 31, 2021 | ||

| Particulars | ($) | ($) |

| Revenues: | ||

| Service revenue | 70,000 | |

| Total revenues | 70,000 | |

| Expenses: | ||

| Rent expense | 3,000 | |

| Salaries expense | 27,000 | |

| Supplies expense | 25,000 | |

| Total expenses | 55,000 | |

| Net income | 15,000 | |

Table (4)

Therefore, the net income of Company R is $15,000.

Statement of stockholder’s equity:

The statement of stockholder’s equity of Company R for the year ended December 31, 2021 is as follows:

| Company R | |||

| Statement of Stockholders’ Equity | |||

| For the period ended December 31, 2021 | |||

| Common stock ($) | Retained earnings ($) | Total stockholders' equity ($) | |

| Balance at January 1 | 50,00 | $25,000 | $75,000 |

| Issuance of common stock | 20,000 | 20,000 | |

| Add: Net income for 2021 | 15,000 | 15,000 | |

| Less: Dividends | (2,000) | (2,000) | |

| Balance at December 31 | $70,000 | $38,000 | $108,000 |

Table (5)

Therefore, the total stockholder’s equity of Company R for the year ended December 31, 2021 is $108,000.

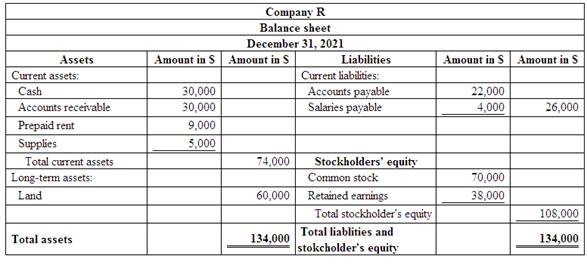

Classified balance sheet:

Classified balance sheet of Company R is as follows:

Figure (1)

Therefore, the total assets of Company R are equal to the total liabilities and stockholders’ equity by $134,000.

5.

Prepare the closing entries of Company R.

5.

Explanation of Solution

Closing entries:

The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Closing entries of Company R is as follows:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| 2021 | Service revenue | 70,000 | ||

| December 31 | Retained earnings | 70,000 | ||

| (To close all revenue account) | ||||

| 2021 | Retained earnings | 55,000 | ||

| December 31 | Salaries expense | 27,000 | ||

| Rent expense | 3,000 | |||

| Supplies expense | 25,000 | |||

| (To close all the expenses account) | ||||

| 2021 | Retained earnings | 2,000 | ||

| December 31 | Dividends | 2,000 | ||

| (To close the dividends account) | ||||

Table (6)

Closing entry for revenue account:

In this closing entry, the service revenue account is closed by transferring the amount of service revenue to the retained earnings in order to bring the revenue accounts balance to zero.

Closing entry for expenses account:

In this closing entry, salaries expense, rent expense, and supplies expense are closed by transferring the amount of all expenses to the retained earnings in order to bring all the expense accounts balance to zero.

Want to see more full solutions like this?

Chapter 3 Solutions

Financial Accounting

- I am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forwardPlease provide the accurate answer to this general accounting problem using appropriate methods.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education