Concept explainers

Requirement – 1

Prepare the

Requirement – 1

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

The journal entries for given transactions of Company G are as follows:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| 2021 | Cash | 10,000 | ||

| July 1 | Common stock | 10,000 | ||

| (To record the issuance of common stock in cash to Company S) | ||||

| 2021 | Cash | 10,000 | ||

| July, 1 | Common stock | 10,000 | ||

| (To record the issuance of common stock in cash to Company T) | ||||

| 2021 | Prepaid insurance | 4,800 | ||

| July 1 | Cash | 4,800 | ||

| (To record the purchase of one year insurance policy in cash) | ||||

| 2021 | Legal fees expense | 1,500 | ||

| July, 2 | Cash | 1,500 | ||

| (To record the payment of legal fees) | ||||

| 2021 | Supplies (office) | 1,800 | ||

| July, 4 | Accounts payable | 1,800 | ||

| (To record purchase of office supplies on account) | ||||

| 2021 | Advertising expense | 300 | ||

| July, 7 | Cash | 300 | ||

| (To record payment of advertising expense) | ||||

| 2021 | Equipment (Bikes) | 12,000 | ||

| July, 7 | Cash | 12,000 | ||

| (To record the purchase of mountain bike) | ||||

| 2021 | Cash | 2,000 | ||

| July, 15 | Service revenue (Clinic) | 2,000 | ||

| ( To record the cash received for service revenue) | ||||

| 2021 | Cash | 2,300 | ||

| July, 22 | Service revenue (Clinic) | 2,300 | ||

| ( To record the cash received for service revenue) | ||||

| 2021 | Advertising expense | 700 | ||

| July, 22 | Cash | 700 | ||

| (To record the payment of advertising expense in cash) | ||||

| 2021 | Cash | 4,000 | ||

| July, 30 | Deferred revenue | 4,000 | ||

| (To record advance cash received from customer) | ||||

| 2021 | Cash | 30,000 | ||

| August, 1 | Notes payable | 30,000 | ||

| (To record loan received from city council) | ||||

| 2021 | Equipment (Kayaks) | 28,000 | ||

| August, 4 | Cash | 28,000 | ||

| (To record the purchase of equipment in cash) | ||||

| 2021 | Cash | 3,000 | ||

| August, 10 | Deferred revenue | 4,000 | ||

| Service revenue | 7,000 | |||

| (To record the cash received from service revenue and recognized service revenue) | ||||

| 2021 | Cash | 10,500 | ||

| August, 17 | Service revenue | 10,500 | ||

| (To record cash received from service revenue) | ||||

| 2021 | Accounts payable | 1,800 | ||

| August, 24 | Cash | 1,800 | ||

| ( To record payment of cash to creditors) | ||||

| 2021 | Prepaid rent | 2,400 | ||

| September 1 | Cash | 2,400 | ||

| (To record the payment of one year advance rent) | ||||

| 2021 | Cash | 13,200 | ||

| September 21 | Service revenue (Clinic) | 13,200 | ||

| (To record the cash received from customer) | ||||

| 2021 | Cash | 17,900 | ||

| October 17 | Service revenue (Clinic) | 17,900 | ||

| (To record the cash received from customer) | ||||

| 2021 | Miscellaneous expense | 1,200 | ||

| December 8 | Cash | 1,200 | ||

| (To record the payment of miscellaneous expense) | ||||

| 2021 | Supplies (Racing) | 2,800 | ||

| December 12 | Accounts payable | 2,800 | ||

| (To record purchase of supplies on account) | ||||

| 2021 | Cash | 20,000 | ||

| December 15 | Service revenue (Racing) | 20,000 | ||

| (To record cash received from service revenue) | ||||

| 2021 | Salaries expense | 2,000 | ||

| December 16 | Cash | 2,000 | ||

| (To record the supplies expense incurred) | ||||

| 2021 | Dividend | 4,000 | ||

| December 31 | Cash | 4,000 | ||

| (To record the payment of cash dividends) |

Table (1)

Requirement – 2

Prepare the adjusting journal entries on December 31.

Requirement – 2

Explanation of Solution

The adjusting journal entries for given transactions of Company G are as follows:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| 2021 | 8,000 | |||

| December 31 | 8,000 | |||

| (To record depreciation expense incurred at the end of the accounting year) | ||||

| 2021 | Insurance expense | 2,400 | ||

| December 31 | Prepaid insurance | 2,400 | ||

| (To record the insurance expense incurred at the end of the accounting period) | ||||

| 2021 | Rent expense | 800 | ||

| December 31 | Prepaid rent | 800 | ||

| (To record the rent expense incurred at the end of the accounting year) | ||||

| 2021 | Supplies expense (Office) | 1,500 | ||

| December 31 | Supplies | 1,500 | ||

| (To record supplies expense incurred at the end of the accounting year) | ||||

| 2021 | Interest expense | 750 | ||

| December 31 | Interest payable | 750 | ||

| (To record interest expense incurred at the end of the accounting year) | ||||

| 2021 | Supplies expense (Racing) | 2,600 | ||

| December 31 | Supplies | 2,600 | ||

| (To record supplies expense incurred at the end of the accounting year) | ||||

| 2021 | Income tax expense | 14,000 | ||

| December 31 | Income tax payable | 14,000 | ||

| (To record the income tax expense incurred at the end of the accounting year) |

Table (2)

Requirement – 3

Prepare the T-accounts and post the transactions in the T-accounts of Company G.

Requirement – 3

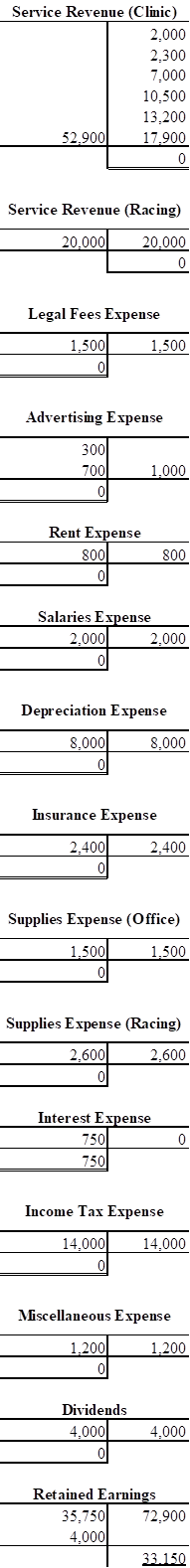

Explanation of Solution

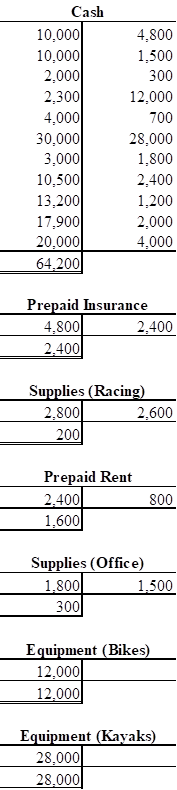

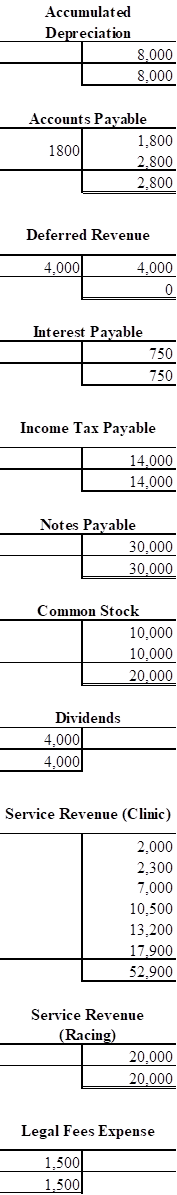

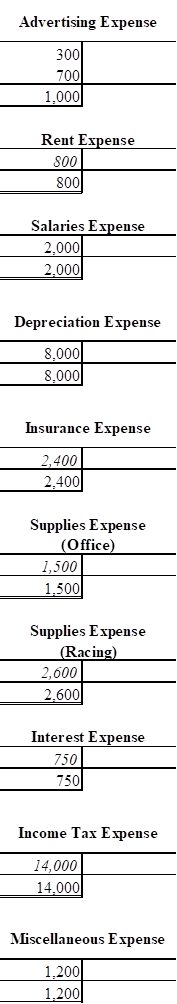

T-account:

T-account refers to an individual account, where the increases or decreases in the value of specific asset, liability,

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

- (a) The title of the account

- (b) The left or debit side

- (c) The right or credit side

T-accounts for above transactions are as follows:

Requirement – 4

Prepare an adjusted

Requirement – 4

Explanation of Solution

Adjusted trial balance:

Adjusted trial balance is a summary of all the ledger accounts, and it contains the balances of all the accounts after the adjustment entries are journalized, and posted.

Adjusted trial balance of Company G is as follows:

| Company G | ||

| Adjusted Trial Balance | ||

| December 31, 2021 | ||

| Accounts | Debit ($) | Credit ($) |

| Cash | 64,200 | |

| Prepaid Insurance | 2,400 | |

| Prepaid Rent | 1,600 | |

| Supplies (Office) | 300 | |

| Supplies (Racing) | 200 | |

| Equipment (Bikes) | 12,000 | |

| Equipment (Kayaks) | 28,000 | |

| Accumulated Depreciation | $8,000 | |

| Accounts Payable | 2,800 | |

| Income Tax Payable | 14,000 | |

| Interest Payable | 750 | |

| Notes Payable | 30,000 | |

| Common Stock | 20,000 | |

| Dividends | 4,000 | |

| Service Revenue (Clinic) | 52,900 | |

| Service Revenue (Racing) | 20,000 | |

| Advertising Expense | 1,000 | |

| Depreciation Expense | 8,000 | |

| Income Tax Expense | 14,000 | |

| Insurance Expense | 2,400 | |

| Interest Expense | 750 | |

| Legal Fees Expense | 1,500 | |

| Miscellaneous Expense | 1,200 | |

| Rent Expense | 800 | |

| Salaries Expense | 2,000 | |

| Supplies Expense (Office) | 1,500 | |

| Supplies Expense (Racing) | 2,600 | |

| Totals | 148,450 | 148,450 |

Table (3)

Requirement –5

Prepare an income statement, stockholders’ equity and classified balance sheet of Company G.

Requirement –5

Explanation of Solution

Income statement:

The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement for Company G:

| Company G | ||

| Income Statement | ||

| For the year ended December 31, 2021 | ||

| ($) | ($) | |

| Revenues: | ||

| Service revenue (clinic) | 52,900 | |

| Service revenue (racing) | 20,000 | |

| Total revenues | 72,900 | |

| Expenses: | ||

| Advertising expense | 1,000 | |

| Depreciation expense | 8,000 | |

| Income tax expense | 14,000 | |

| Insurance expense | 2,400 | |

| Interest expense | 750 | |

| Legal fees expense | 1,500 | |

| Miscellaneous expense | 1,200 | |

| Rent expense | 800 | |

| Salaries expense | 2,000 | |

| Supplies expense (office) | 1,500 | |

| Supplies expense (racing) | 2,600 | |

| Total expenses | 35,750 | |

| Net income | 37,150 | |

Table (4)

Therefore, the net income of Company G is $37,150.

Statement of stockholders’ equity:

This statement reports the beginning stockholder’s equity and all the changes, which led to ending stockholder’s’ equity. Additional capital, net income from income statement is added to and drawings are deducted from beginning stockholder’s equity to arrive at the result of closing balance of stockholders’ equity.

Prepare the statement of stockholders’ equity:

| Company G | |||

| Statement of Stockholders’ Equity | |||

| For the period ended December 31, 2021 | |||

| Particulars | Common stock ($) | earnings | Total stockholders' equity ($) |

| Balance at July 1 | $0 | $0 | $0 |

| Issuance of common stock | 20,000 | 20,000 | |

| Add: Net income for 2021 | 37,150 | 37,150 | |

| Less: Dividends | (4,000) | (4,000) | |

| Balance at December 31 | $20,000 | $33,150 | $53,150 |

Table (5)

Therefore, the total stockholder’s equity of Company G for the year ended December 31, 2021 is $53,150.

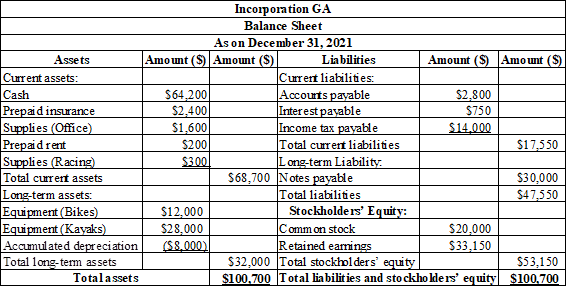

Classified balance sheet:

The main elements of balance sheet assets, liabilities, and stockholders’ equity are categorized or classified further into sections, and sub-sections in a classified balance sheet. Assets are further classified as current assets, long-term investments, property, plant, and equipment (PPE), and intangible assets. Liabilities are classified into two sections current and long-term. Stockholders’ equity comprises of common stock and retained earnings. Thus, the classified balance sheet includes all the elements under different sections.

Prepare the classified balance sheet:

Table (6)

Therefore, the total assets of Company G are $100,700, and the total liabilities and stockholders’ equity are $100,700.

Requirement – 6

Record the closing entries of Company G.

Requirement – 6

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Closing entries of Company G is as follows:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| 2021 | Service revenue (Clinic) | 52,900 | ||

| December 31 | Service revenue (Racing) | 20,000 | ||

| Retained earnings | 72,900 | |||

| (To close all revenue account) | ||||

| 2021 | Retained earnings | 37,750 | ||

| December 31 | Advertising expense | 1,000 | ||

| Depreciation expense | 8,000 | |||

| Income tax expense | 14,000 | |||

| Insurance expense | 2,400 | |||

| Interest expense | 750 | |||

| Legal fees expense | 1,500 | |||

| Miscellaneous expense | 1,200 | |||

| Rent expense | 800 | |||

| Salaries expense | 2,000 | |||

| Supplies expense (office) | 1,500 | |||

| Supplies expense (Racing) | 2,600 | |||

| (To close all the expenses account) | ||||

| 2021 | Retained earnings | 4,000 | ||

| December 31 | Dividends | 4,000 | ||

| (To close the dividends account) | ||||

Table (6)

Requirement – 7

Prepare the T-account and post the closing entries to the T-accounts.

Requirement – 7

Explanation of Solution

Requirement – 8

Prepare a post-closing trial balance of Company G.

Requirement – 8

Explanation of Solution

Post-closing trial balance:

The post-closing trial balance is a summary of all ledger accounts, and it shows the debit and the credit balances after the closing entries are journalized and posted. The post-closing trial balance contains only permanent (balance sheet) accounts, and the debit and the credit balances of permanent accounts should agree.

Prepare a post-closing trial balance:

| Company G | ||

| Post-closing Trial Balance | ||

| For the year ended December 31, 2021 | ||

| Accounts | Debit ($) | Credit ($) |

| Cash | $64,200 | |

| Prepaid Insurance | 2,400 | |

| Prepaid Rent | 1,600 | |

| Supplies (Office) | 300 | |

| Supplies (Racing) | 200 | |

| Equipment (Bikes) | 12,000 | |

| Equipment (Kayaks) | 28,000 | |

| Accumulated Depreciation | $8,000 | |

| Accounts Payable | 2,800 | |

| Income Tax Payable | 14,000 | |

| Interest Payable | 750 | |

| Notes Payable | 30,000 | |

| Common Stock | 20,000 | |

| Retained Earnings | 33,150 | |

| Total | $108,700 | $108,700 |

Table (7)

Therefore, the total of debit, and credit columns of post-closing trial balance is $108,700.

Want to see more full solutions like this?

Chapter 3 Solutions

Financial Accounting

- Which of the following is an example of an operating activity?A) Issuing stockB) Borrowing moneyC) Purchasing equipmentD) Receiving cash from customersexplarrow_forwardHow can I solve this financial accounting problem using the appropriate financial process?arrow_forwardWhich of the following is an example of an operating activity?A) Issuing stockB) Borrowing moneyC) Purchasing equipmentD) Receiving cash from customersarrow_forward

- Solutionarrow_forwardIf a company has total liabilities of $250,000 and total equity of $450,000, what is the total value of the company’s assets?A) $700,000B) $450,000C) $250,000D) $1,000,000arrow_forwardJuno Textiles computes its predetermined overhead rate annually based on direct labor hours. At the beginning of the year, the company estimated 28,500 direct labor hours would be needed for the expected level of production. It also estimated $510,000 in fixed manufacturing overhead and $4 per direct labor hour in variable manufacturing overhead. Required: Compute Juno Textiles' predetermined overhead rate for the year.arrow_forward

- The matching principle in accounting requires that: A) Revenues and expenses be recognized in the period when cash is received or paidB) Revenues are recorded only when cash is collectedC) Expenses are matched with the revenues they help generateD) Financial statements must be prepared at the end of every quarterarrow_forwardNeed explanation.arrow_forwardCan you show me the correct approach to solve this financial accounting problem using suitable standards?arrow_forward

- 2. Which of the following accounts is classified as a liability?A) Accounts ReceivableB) Common StockC) Accounts PayableD) Revenuearrow_forwardThe total factory overhead for Leicester Manufacturing is budgeted for the year at $756,000. Leicester manufactures two product lines: standard lamps and premium lamps. These products each require 4 direct labor hours to manufacture. Each product is budgeted for 8,000 units of production for the year. Determine the factory overhead allocated per unit for premium lamps using the single plantwide factory overhead rate.arrow_forwardSolve this Accounting problemarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education