INTERM.ACCT.:REPORTING...-CENGAGENOWV2

3rd Edition

ISBN: 9781337909358

Author: WAHLEN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 17P

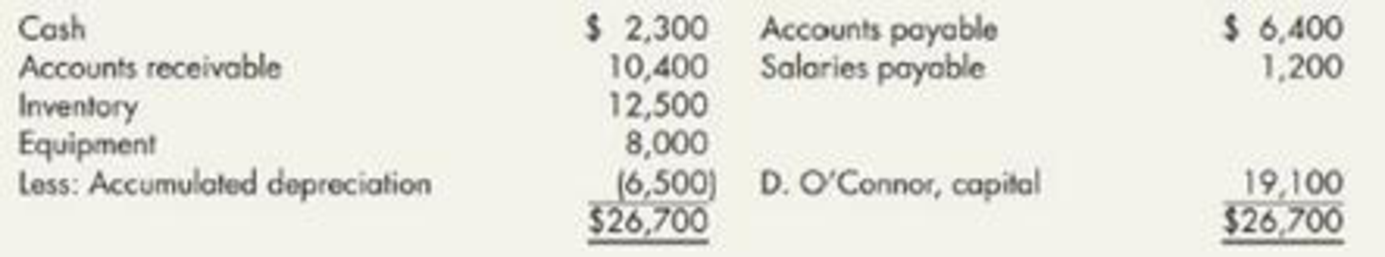

Comprehensive (Appendix 3.1) Dawson O’Connor is the owner of Miller Island Sales, a distributor of fishing supplies. The following is the

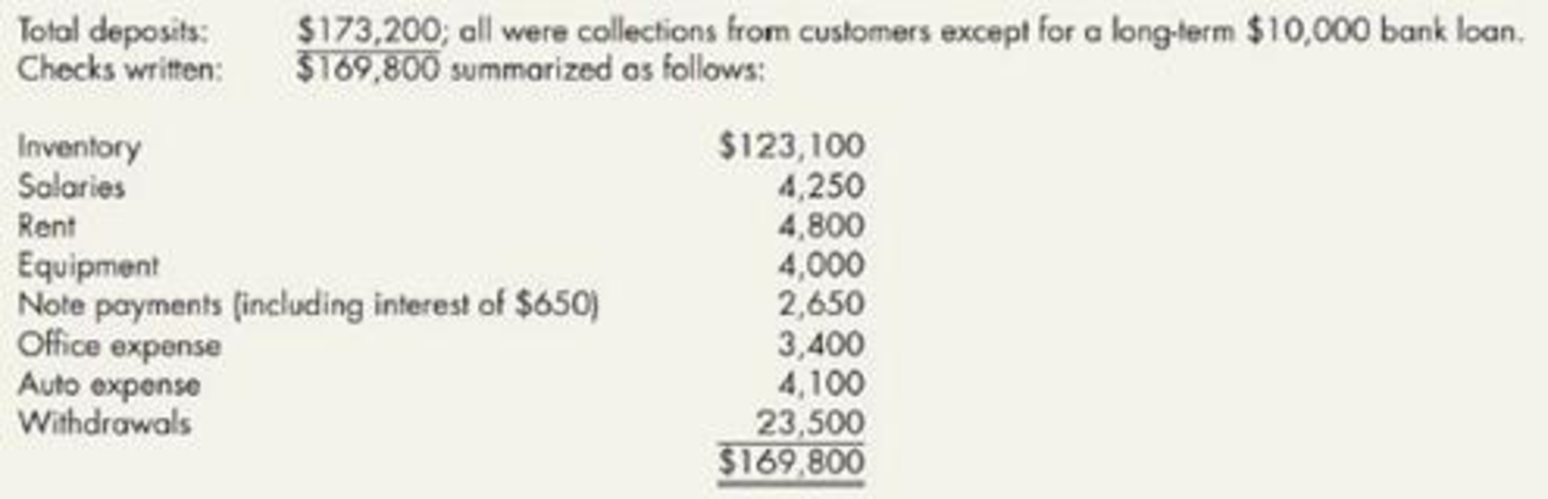

Dawson keeps very few records and has asked you to help him prepare the 2019 financial statements for Miller Island Sales. An analysis of the 2019 cash transactions recorded in the company’s checkbook indicates deposits and checks as follows:

Other information about the company is as follows:

- 1.

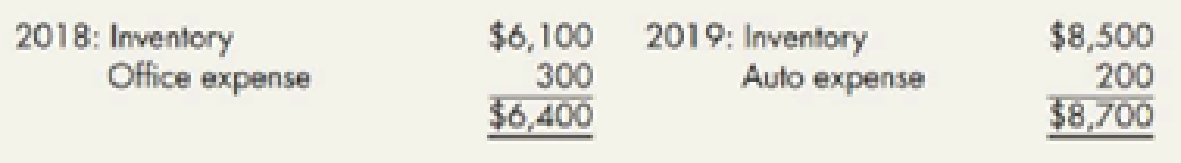

Accounts receivable at December 31, 2019; $9,200. - 2. Accounts payable at December 31:

- 3. Salaries payable at December 31, 2019, $1,800.

- 4. Equipment is

depreciated by the straight-line method over a 10-year life. The equipment purchased in 2019 was acquired on July 1. All of the equipment will have zero salvage value at the end of its useful life. - 5. Interest payable at December 31. 2019: $140.

- 6. The company uses a periodic inventory system Inventory at December 31, 2019: $17,400.

Required:

- 1. Prepare a worksheet to summarize the transactions and adjustments of Miller Island Sales for 2019. (Hint: Include debit and credit columns for both transactions and adjustments.)

- 2. Prepare a 2019 income statement and a balance sheet as of December 31, 2019. (Contributed by Waller A. Parker)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

None

Abc

What is the weighted average of the company's debt ?

Chapter 3 Solutions

INTERM.ACCT.:REPORTING...-CENGAGENOWV2

Ch. 3 - What is the primary purpose of an accounting...Ch. 3 - What is the relationship between the accounting...Ch. 3 - Show the expanded accounting equation using the 10...Ch. 3 - Explain and distinguish between a transaction; an...Ch. 3 - Explain how the accounting equation organizes...Ch. 3 - What is the difference between a permanent and a...Ch. 3 - Prob. 7GICh. 3 - Why is it advantageous to a company to initially...Ch. 3 - What is a perpetual inventory accounting system?...Ch. 3 - Give examples of transactions that: a. Increase an...

Ch. 3 - Give examples of transactions that: a. Increase...Ch. 3 - Prob. 12GICh. 3 - Prob. 13GICh. 3 - Prob. 14GICh. 3 - Prob. 15GICh. 3 - Explain and provide examples of deferrals,...Ch. 3 - Prob. 17GICh. 3 - Prob. 18GICh. 3 - Prob. 19GICh. 3 - Prob. 20GICh. 3 - Prob. 21GICh. 3 - What are the major financial statements of a...Ch. 3 - Prob. 23GICh. 3 - Prob. 24GICh. 3 - Prob. 25GICh. 3 - Prob. 26GICh. 3 - Prob. 27GICh. 3 - Prob. 28GICh. 3 - Prob. 29GICh. 3 - What is cash-basis accounting? What must a company...Ch. 3 - On May 1, Johnson Corporation purchased inventory...Ch. 3 - On January 1, Tolson Company purchased a building...Ch. 3 - On July 1, Friler Company purchased a 1-year...Ch. 3 - Prob. 4RECh. 3 - Garcia Company rents out a portion of its building...Ch. 3 - Prob. 6RECh. 3 - Goldfinger Corporation had account balances at the...Ch. 3 - Prob. 8RECh. 3 - For the current year, Vidalia Company reported...Ch. 3 - Use the information in RE3-6, (a) assuming Ringo...Ch. 3 - (Appendix 3.1) Vickelly Company uses cash-basis...Ch. 3 - Financial Statement Interrelationship Draw a...Ch. 3 - Journal Entries Mead Company uses a perpetual...Ch. 3 - Journal Entries The following are selected...Ch. 3 - Adjusting Entries Your examination of Sullivan...Ch. 3 - Adjusting Entries The following are several...Ch. 3 - Adjusting Entries The following partial list of...Ch. 3 - Basic Income Statement The following are selected...Ch. 3 - Periodic Inventory System Raynolde Company uses a...Ch. 3 - Closing Entries Lloyd Bookstore shows the...Ch. 3 - Financial Statements Turtle Company has prepared...Ch. 3 - Worksheet for Service Company Whitaker Consulting...Ch. 3 - Worksheet, Including Inventory Surian Motors...Ch. 3 - Reversing Entries On December 31, 2019, Kellams...Ch. 3 - Special Journals The following are several...Ch. 3 - (Appendix 3.1) Cash-Basis Accounting Puntarelli...Ch. 3 - Adjusting Entries The following information is...Ch. 3 - Prob. 2PCh. 3 - Adjusting Entries Sarah Companys trial balance on...Ch. 3 - Prob. 4PCh. 3 - Errors in Financial Statements At the end of the...Ch. 3 - Journal Entries, Posting, and Trial Balance Luke...Ch. 3 - Effects of Errors: During the current accounting...Ch. 3 - Financial Statements Mackenzie Inc. uses a...Ch. 3 - Prob. 9PCh. 3 - Worksheet Victoria Company has the following...Ch. 3 - Worksheet Devlin Company has prepared the...Ch. 3 - Comprehensive On November 30, 2019. Davis Company...Ch. 3 - Reversing Entries Thomas Company entered into two...Ch. 3 - Reversing Entries On December 31, 2019, Mason...Ch. 3 - Adjusting Entries At the end of 2019, Richards...Ch. 3 - Prob. 16PCh. 3 - Comprehensive (Appendix 3.1) Dawson OConnor is the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY