Concept explainers

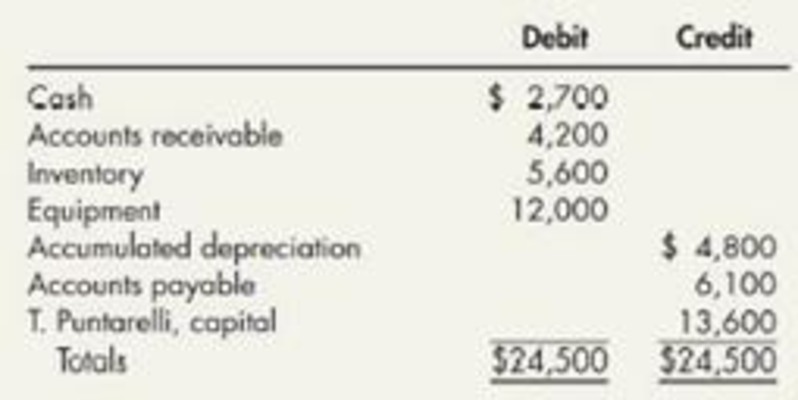

(Appendix 3.1) Cash-Basis Accounting Puntarelli Contracting keep its accounting records on a cash basis during the year. At year end, it adjusts its books to the accrual basis for preparing its financial statements. At the end of 2018, Puntarelli reported the following

It is now the end of 2019. The company’s checkbook shows a balance of $4,700, which includes cash receipts from customers of $51,300 and cash payments of $49,300.

An examination of the cash payments shows that: (1) $30,600 was paid to suppliers, (2) $12,700 was paid for other operating costs (including $7,200 paid on January 1 for 2 years’ annual rent), and (3) $6,000 was withdrawn by T. Puntarelli.

On December 51, 2019, (1) customers owed Puntarelli Contracting 55,900, (2) Puntarelli owed suppliers and employees $7,000 and $900, respectively, and (3) the ending inventory was $6,300. Puntarelli is

Required:

- 1. Using accrual based accounting, prepare a 2019 income statement (show supporting calculations).

- 2. Using accrual-based accounting, prepare a December 31, 2019, balance sheet (show supporting calculations).

Trending nowThis is a popular solution!

Chapter 3 Solutions

INTERM.ACCT.:REPORTING...-CENGAGENOWV2

- Accounting Question: Lexington Enterprises requires $750,000 in assets and will be 100% equity financed. If the Earnings Before Interest and Taxes (EBIT) is $60,000 and the tax rate is 25%, what is the Return on Equity (ROE)?arrow_forwardfinancial accountingarrow_forwardneed this general account subjects solutionsarrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College