Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 28, Problem 3MAD

Analyze CSR initiatives at Green Manufacturing

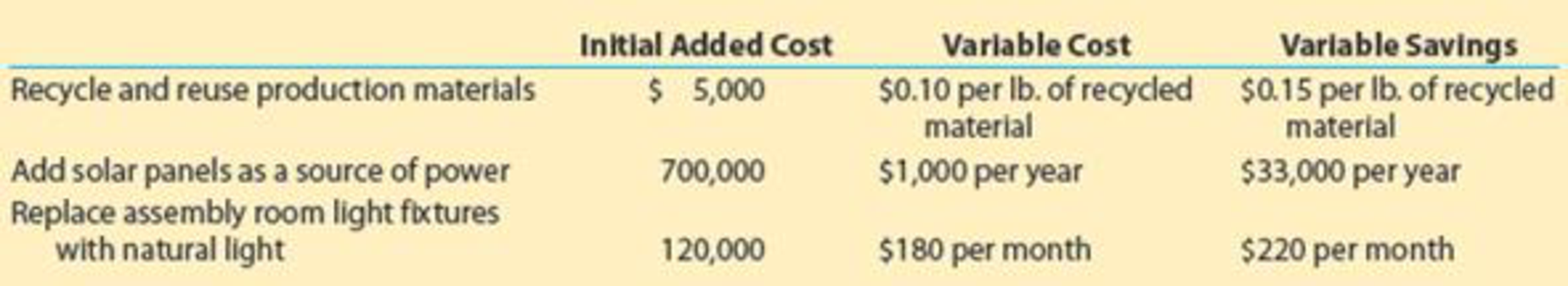

Green Manufacturing is a traditional manufacturing company located in the midwestern United States. The company’s operations manager is developing a strategy to become more CSR-oriented. In an effort to evaluate possible areas where CSR initiatives can be implemented, the manager has gathered the following data regarding three potential CSR activities:

The recycling activity would carry on indefinitely. The solar panels would have a useful life of 30 years. The replacement of assembly room light fixtures with natural light is assumed to have an 80-year effect.

- A. Identify which CSR activities Green Manufacturing should implement.

- B. For each CSR activity you recommend, identify an appropriate related performance metric.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

managerial accoun

What will be the amount of depreciation recognized in 2023 on these financial accounting question?

Hi expert

Chapter 28 Solutions

Financial And Managerial Accounting

Ch. 28 - How does a strategic performance measurement...Ch. 28 - What is the difference between a leading indicator...Ch. 28 - Prob. 3DQCh. 28 - How are strategic objectives and strategic...Ch. 28 - What do strategy maps show, and how do they add...Ch. 28 - Prob. 6DQCh. 28 - Prob. 7DQCh. 28 - Prob. 8DQCh. 28 - Prob. 9DQCh. 28 - Prob. 10DQ

Ch. 28 - 72 Inc. has developed a balanced scorecard with...Ch. 28 - Bluetiful Inc. has the following strategic...Ch. 28 - Moses Moonrocks Inc. has developed a balanced...Ch. 28 - Prob. 4BECh. 28 - Lonnies Shipping Co. is considering switching to...Ch. 28 - Henrys Cafe is a local restaurant that is growing...Ch. 28 - American Express Company is a major financial...Ch. 28 - Eat-n-Run Inc. owns and operates 10 food trucks...Ch. 28 - Prob. 4ECh. 28 - Apples Oranges Inc. is trying to become more...Ch. 28 - The following is the balanced scorecard for Smith...Ch. 28 - Prob. 7ECh. 28 - Coulson and Company is a large retail business...Ch. 28 - Rizzo Goal Inc. produces and sells hockey...Ch. 28 - Silver Lining Inc. has a balanced scorecard with a...Ch. 28 - Two departments within Cougar Gear Inc. are...Ch. 28 - Sunny Nights Inc. is completely powered by the...Ch. 28 - Instructions 1.Label each element of the balanced...Ch. 28 - Strategic initiatives and CSR Obj. 2, 4 Get...Ch. 28 - Hyperflash Inc. has a balanced scorecard that...Ch. 28 - Instructions 1.Based on the balanced scorecard and...Ch. 28 - Strategic initiatives and CSR Blue Skies Inc. is a...Ch. 28 - Eye Swear Inc. has a balanced scorecard that...Ch. 28 - Den-Tex Company is evaluating a proposal to...Ch. 28 - Prob. 2MADCh. 28 - Analyze CSR initiatives at Green Manufacturing...Ch. 28 - Prob. 1TIFCh. 28 - Blake McKenzie Tax Services is a company serving...Ch. 28 - Young Manufacturing Company is a startup...Ch. 28 - The fundamental concept behind strategic...Ch. 28 - Which of the following statements regarding the...Ch. 28 - The balanced scorecard provides an action plan for...Ch. 28 - Which of the following statements best describes...Ch. 28 - A sign of the successful implementation of a...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Elements of cost | Direct and Indirect: Material, Labor, & Expenses; Author: Educationleaves;https://www.youtube.com/watch?v=UFBaj6AHjHQ;License: Standard youtube license