Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

6th Edition

ISBN: 9780134486857

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 26, Problem 3SE

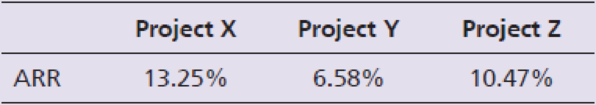

Carter Company is considering three investment opportunities with the following accounting

Use the decision rule for ARR to rank the projects from most desirable to least desirable. Carter Company’s required rate of return is 8%.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Determine the following requirements of this financial accounting question

Provide correct answer this financial accounting question

Chapter 15 Homework

13

Saved

Help

Save & Exit Submit

Part 1 of 2

0.83

points

eBook

Ask

Required information

Use the following information to answer questions. (Algo)

[The following information applies to the questions displayed below.]

Information on Kwon Manufacturing's activities for its first month of operations follows:

a. Purchased $100,800 of raw materials on credit.

b. Materials requisitions show the following materials used for the month.

Job 201

Job 202

Total direct materials

Indirect materials

Total materials used

$ 49,000

24,400

73,400

9,420

$ 82,820

c. Time tickets show the following labor used for the month.

Print

References

Job 201

$ 40,000

Job 202

13,400

Total direct labor

53,400

25,000

$ 78,400

Indirect labor

Total labor used

d. Applied overhead to Job 201 and to Job 202 using a predetermined overhead rate of 80% of direct materials cost.

e. Transferred Job 201 to Finished Goods Inventory.

f. Sold Job 201 for $166,160 on credit.

g. Incurred the following actual other…

Chapter 26 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Ch. 26 - Match the following business activities to the...Ch. 26 - Match the following business activities to the...Ch. 26 - Prob. 3TICh. 26 - Prob. 4TICh. 26 - Prob. 5TICh. 26 - Match the following business activities to the...Ch. 26 - Prob. 7TICh. 26 - Prob. 8TICh. 26 - Prob. 9TICh. 26 - Based on your answers to the above questions,...

Ch. 26 - Prob. 11TICh. 26 - Prob. 12TICh. 26 - Prob. 13TICh. 26 - What is the NPV of the project?Ch. 26 - Prob. 15TICh. 26 - Prob. 16TICh. 26 - What is the second step of capital budgeting? a....Ch. 26 - Which of the following methods does not consider...Ch. 26 - Suppose Francine Dunkelbergs Sweets is considering...Ch. 26 - Your rich aunt has promised to give you 2,000 per...Ch. 26 - Prob. 5QCCh. 26 - Prob. 6QCCh. 26 - In computing the IRR on an expansion at Mountain...Ch. 26 - Prob. 8QCCh. 26 - Which of the following is the most reliable method...Ch. 26 - Prob. 10QCCh. 26 - Explain the difference between capital assets,...Ch. 26 - Describe the capital budgeting process.Ch. 26 - What is capital rationing?Ch. 26 - Prob. 4RQCh. 26 - Prob. 5RQCh. 26 - List some common cash outflows from capital...Ch. 26 - What is the payback method of analyzing capital...Ch. 26 - Prob. 8RQCh. 26 - Prob. 9RQCh. 26 - Prob. 10RQCh. 26 - What are some criticisms of the payback method?Ch. 26 - What is the accounting rate of return?Ch. 26 - How is ARR calculated?Ch. 26 - What is the decision rule for ARR?Ch. 26 - Prob. 15RQCh. 26 - What is an annuity? How does it differ from a lump...Ch. 26 - Prob. 17RQCh. 26 - Explain the difference between the present value...Ch. 26 - Prob. 19RQCh. 26 - Prob. 20RQCh. 26 - Prob. 21RQCh. 26 - Prob. 22RQCh. 26 - What is the decision rule for NPV?Ch. 26 - What is the profitability index? When is it used?Ch. 26 - What is the internal rate of return?Ch. 26 - Prob. 26RQCh. 26 - Prob. 27RQCh. 26 - What is the decision rule for IRR?Ch. 26 - Prob. 29RQCh. 26 - Why should both quantitative and qualitative...Ch. 26 - Review the following activities of the capital...Ch. 26 - Carter Company is considering three investment...Ch. 26 - Carter Company is considering three investment...Ch. 26 - Consider how Hunter Valley Snow Park Lodge could...Ch. 26 - Consider how Hunter Valley Snow Park Lodge could...Ch. 26 - Prob. 6SECh. 26 - Consider how Hunter Valley Snow Park Lodge could...Ch. 26 - Suppose Hunter Valley is deciding whether to...Ch. 26 - Prob. 9SECh. 26 - Prob. 10SECh. 26 - Prob. 11SECh. 26 - Refer to the Hunter Valley Snow Park Lodge...Ch. 26 - Consider how Hunter Valley Snow Park Lodge could...Ch. 26 - Prob. 14SECh. 26 - Prob. 15SECh. 26 - Match each capital budgeting method with its...Ch. 26 - Fill in each statement with the appropriate...Ch. 26 - Prob. 18ECh. 26 - Prob. 19ECh. 26 - Prob. 20ECh. 26 - Prob. 21ECh. 26 - Prob. 22ECh. 26 - Prob. 23ECh. 26 - Holmes Industries is deciding whether to automate...Ch. 26 - Use the NPV method to determine whether Hawkins...Ch. 26 - Refer to the data regarding Hawkins Products in...Ch. 26 - Hudson Manufacturing is considering three capital...Ch. 26 - Prob. 28ECh. 26 - You are planning for a very early retirement. You...Ch. 26 - Splash Nation is considering purchasing a water...Ch. 26 - Hill Company operates a chain of sandwich shops....Ch. 26 - Henderson Manufacturing, Inc. has a manufacturing...Ch. 26 - Hayes Company is considering two capital...Ch. 26 - You are planning for an early retirement. You...Ch. 26 - Water City is considering purchasing a water park...Ch. 26 - Howard Company operates a chain of sandwich shops....Ch. 26 - Hughes Manufacturing, Inc. has a manufacturing...Ch. 26 - Prob. 38BPCh. 26 - Prob. 39PCh. 26 - This problem continues the Piedmont Computer...Ch. 26 - Darren Dillard, majority stockholder and president...Ch. 26 - Prob. 1TIATCCh. 26 - Spencer Wilkes is the marketing manager at Darby...Ch. 26 - Prob. 1FCCh. 26 - Prob. 1CA

Additional Business Textbook Solutions

Find more solutions based on key concepts

A case study in this chapter discusses the federal minimum-wage law. a. Suppose the minimum wage is above the e...

Principles of Economics (MindTap Course List)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

Assume the United States is an importer of televisions and there are no trade restrictions. US consumers buy 1 ...

Principles of Microeconomics (MindTap Course List)

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Mary Williams, owner of Williams Products, is evaluating whether to introduce a new product line. After thinkin...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- quesrion 2arrow_forwardAnti-Pandemic Pharma Co. Ltd. reports the following information in its income statement: Sales = $5,250,000; Costs = $2, 173,000; Other expenses = $187,400; Depreciation expense = $79,000; Interest expense= $53,555; Taxes $76,000; Dividends $69,000. $136,700 worth of new shares were also issued during the year and long-term debt worth $65,300 was redeemed. a) Compute the cash flow from assets b) Compute the net change in working capital (325 marks)arrow_forwardQS 15-18 (Algo) Computing and recording over- or underapplied overhead LO P4 A company applies overhead at a rate of 170% of direct labor cost. Actual overhead cost for the current period is $1,081,900, and direct labor cost is $627,000. 1. Compute the under- or overapplied overhead. 2. Prepare the journal entry to close over- or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the under- or overapplied overhead.arrow_forward

- Question 6 During 2019, Bitsincoins Corporation had EBIT of $100,000, a change in net fixed assets of $400,000, an increase in net current assets of $100,000, an increase in spontaneous current liabilities of $400,000, a depreciation expense of $50,000, and a tax rate of 30%. Based on this information, what is Bitsincoin's free cash flow? (3 marks)arrow_forwardQuestion 4 Waterfront Inc. wishes to borrow on a short-term basis without reducing its current ratio below 1.25. At present its current assets and current liabilities are $1,600 and $1,000 respectively. How much can Waterfront Inc. borrow? (5 marks)arrow_forwarddiscus extensivery source of bussines finances requaments not less than 4 pages font size 12 spacing 1.5 roman times references must be less thhan 5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License