Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

6th Edition

ISBN: 9780134486857

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 26, Problem 33AP

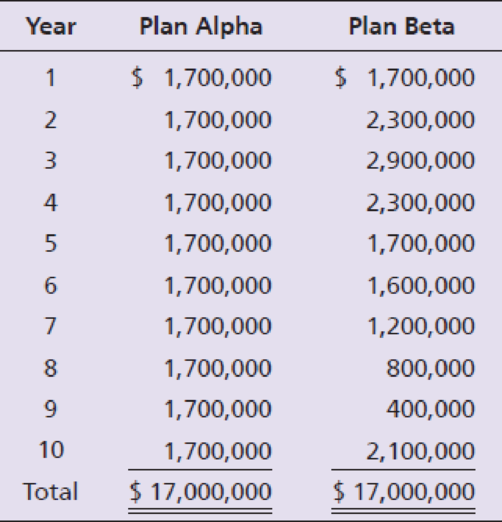

Hayes Company is considering two capital investments. Both investments have an initial cost of $10,000,000 and total net

Requirements

- 1. Use Excel to compute the

NPV andIRR of the two plans. Which plan, if any, should the company pursue? - 2. Explain the relationship between NPV and IRR. Based on this relationship and the company’s required rate of return, are your answers as expected in Requirement 1? Why or why not?

- 3. After further negotiating, the company can now invest with an initial cost of $9,500,000 for both plans. Recalculate the NPV and IRR. Which plan, if any, should the company pursue?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The December 31, 2021, balance sheet of Chen, Incorporated, showed long-term debt of $1,420,000, $144,000 in the common stock account, and $2,690,000 in the additional paid-in surplus account. The December 31, 2022, balance sheet showed long-term debt of $1,620,000, $154,000 in the common stock account and $2,990,000 in the additional paid-in surplus account. The 2022 income statement showed an interest expense of $96,000 and the company paid out $149,000 in cash dividends during 2022. The firm’s net capital spending for 2022 was $1,000,000, and the firm reduced its net working capital investment by $129,000. What was the firm's 2022 operating cash flow, or OCF?

River is a salaried exempt worker who earns $73,630 per year for a 35-hour workweek. During a biweekly pay period, River worked 105 hours. What is the gross pay?

The industrial enterprise "HUANG S.A." purchased a sorting and packaging machine from a foreign company on 1/4/2017 at a cost of €500,000. The useful life of the machine was estimated by the Management at ten (10) years, while the residual value was estimated at zero.

For the transportation of the machine from abroad to the company's factory, the amount of €20,000 was paid on 15/4/2017. As the insurance coverage of the machine during transportation was the responsibility of the selling company, HUANG S.A. proceeded to insure the machine from 16/4/2017 to 15/4/2018, paying the amount of €1,200. The delivery took place on 15/4/2017.

As adequate ventilation of the multifunction device is essential for its proper operation, the company fitted an air duct on the multifunction device. The cost of the air duct amounted to €2,000 and was paid on 20/4/2017. On 25/4/2017, an external electrician was paid €5,000 for the electrical connection of the device.

The company also paid €5,000 to an…

Chapter 26 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Ch. 26 - Match the following business activities to the...Ch. 26 - Match the following business activities to the...Ch. 26 - Prob. 3TICh. 26 - Prob. 4TICh. 26 - Prob. 5TICh. 26 - Match the following business activities to the...Ch. 26 - Prob. 7TICh. 26 - Prob. 8TICh. 26 - Prob. 9TICh. 26 - Based on your answers to the above questions,...

Ch. 26 - Prob. 11TICh. 26 - Prob. 12TICh. 26 - Prob. 13TICh. 26 - What is the NPV of the project?Ch. 26 - Prob. 15TICh. 26 - Prob. 16TICh. 26 - What is the second step of capital budgeting? a....Ch. 26 - Which of the following methods does not consider...Ch. 26 - Suppose Francine Dunkelbergs Sweets is considering...Ch. 26 - Your rich aunt has promised to give you 2,000 per...Ch. 26 - Prob. 5QCCh. 26 - Prob. 6QCCh. 26 - In computing the IRR on an expansion at Mountain...Ch. 26 - Prob. 8QCCh. 26 - Which of the following is the most reliable method...Ch. 26 - Prob. 10QCCh. 26 - Explain the difference between capital assets,...Ch. 26 - Describe the capital budgeting process.Ch. 26 - What is capital rationing?Ch. 26 - Prob. 4RQCh. 26 - Prob. 5RQCh. 26 - List some common cash outflows from capital...Ch. 26 - What is the payback method of analyzing capital...Ch. 26 - Prob. 8RQCh. 26 - Prob. 9RQCh. 26 - Prob. 10RQCh. 26 - What are some criticisms of the payback method?Ch. 26 - What is the accounting rate of return?Ch. 26 - How is ARR calculated?Ch. 26 - What is the decision rule for ARR?Ch. 26 - Prob. 15RQCh. 26 - What is an annuity? How does it differ from a lump...Ch. 26 - Prob. 17RQCh. 26 - Explain the difference between the present value...Ch. 26 - Prob. 19RQCh. 26 - Prob. 20RQCh. 26 - Prob. 21RQCh. 26 - Prob. 22RQCh. 26 - What is the decision rule for NPV?Ch. 26 - What is the profitability index? When is it used?Ch. 26 - What is the internal rate of return?Ch. 26 - Prob. 26RQCh. 26 - Prob. 27RQCh. 26 - What is the decision rule for IRR?Ch. 26 - Prob. 29RQCh. 26 - Why should both quantitative and qualitative...Ch. 26 - Review the following activities of the capital...Ch. 26 - Carter Company is considering three investment...Ch. 26 - Carter Company is considering three investment...Ch. 26 - Consider how Hunter Valley Snow Park Lodge could...Ch. 26 - Consider how Hunter Valley Snow Park Lodge could...Ch. 26 - Prob. 6SECh. 26 - Consider how Hunter Valley Snow Park Lodge could...Ch. 26 - Suppose Hunter Valley is deciding whether to...Ch. 26 - Prob. 9SECh. 26 - Prob. 10SECh. 26 - Prob. 11SECh. 26 - Refer to the Hunter Valley Snow Park Lodge...Ch. 26 - Consider how Hunter Valley Snow Park Lodge could...Ch. 26 - Prob. 14SECh. 26 - Prob. 15SECh. 26 - Match each capital budgeting method with its...Ch. 26 - Fill in each statement with the appropriate...Ch. 26 - Prob. 18ECh. 26 - Prob. 19ECh. 26 - Prob. 20ECh. 26 - Prob. 21ECh. 26 - Prob. 22ECh. 26 - Prob. 23ECh. 26 - Holmes Industries is deciding whether to automate...Ch. 26 - Use the NPV method to determine whether Hawkins...Ch. 26 - Refer to the data regarding Hawkins Products in...Ch. 26 - Hudson Manufacturing is considering three capital...Ch. 26 - Prob. 28ECh. 26 - You are planning for a very early retirement. You...Ch. 26 - Splash Nation is considering purchasing a water...Ch. 26 - Hill Company operates a chain of sandwich shops....Ch. 26 - Henderson Manufacturing, Inc. has a manufacturing...Ch. 26 - Hayes Company is considering two capital...Ch. 26 - You are planning for an early retirement. You...Ch. 26 - Water City is considering purchasing a water park...Ch. 26 - Howard Company operates a chain of sandwich shops....Ch. 26 - Hughes Manufacturing, Inc. has a manufacturing...Ch. 26 - Prob. 38BPCh. 26 - Prob. 39PCh. 26 - This problem continues the Piedmont Computer...Ch. 26 - Darren Dillard, majority stockholder and president...Ch. 26 - Prob. 1TIATCCh. 26 - Spencer Wilkes is the marketing manager at Darby...Ch. 26 - Prob. 1FCCh. 26 - Prob. 1CA

Additional Business Textbook Solutions

Find more solutions based on key concepts

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (5th Edition)

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

2. Identify four people who have contributed to the theory and techniques of operations management.

Operations Management

The Warm and Toasty Heating Oil Company used to deliver heating oil by sending trucks that printed out a ticket...

Essentials of MIS (13th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The industrial enterprise "HUANG S.A." purchased a sorting and packaging machine from a foreign company on 1/4/2017 at a cost of €500,000. The useful life of the machine was estimated by the Management at ten (10) years, while the residual value was estimated at zero. For the transportation of the machine from abroad to the company's factory, the amount of €20,000 was paid on 15/4/2017. As the insurance coverage of the machine during transportation was the responsibility of the selling company, HUANG S.A. proceeded to insure the machine from 16/4/2017 to 15/4/2018, paying the amount of €1,200. The delivery took place on 15/4/2017. As adequate ventilation of the multifunction device is essential for its proper operation, the company fitted an air duct on the multifunction device. The cost of the air duct amounted to €2,000 and was paid on 20/4/2017. On 25/4/2017, an external electrician was paid €5,000 for the electrical connection of the device. The company also paid €5,000 to an…arrow_forwardI need answer typing clear urjent no chatgpt used pls i will give 5 Upvotes.only typing .arrow_forwardCash flow cyclearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License