Concept explainers

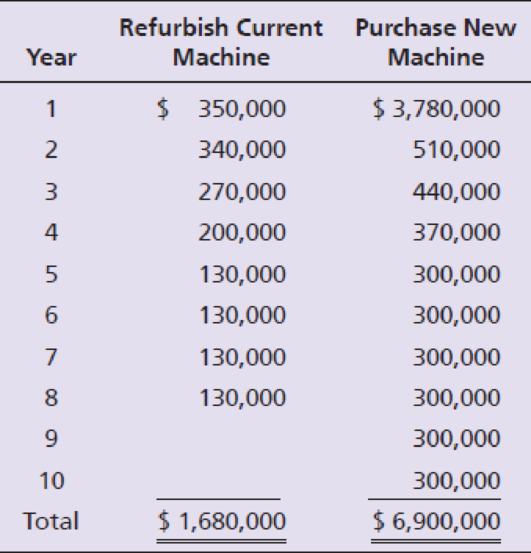

Henderson Manufacturing, Inc. has a manufacturing machine that needs attention. The company is considering two options. Option 1 is to refurbish the current machine at a cost of $1,200,000. If refurbished, Henderson expects the machine to last another eight years and then have no residual value. Option 2 is to replace the machine at a cost of $4,600,000. A new machine would last 10 years and have no residual value. Henderson expects the following net

Henderson uses straight-line

Requirements

- 1. Compute the payback, the ARR, the

NPV , and the profitability index of these two options. - 2. Which option should Henderson choose? Why?

Want to see the full answer?

Check out a sample textbook solution

Chapter 26 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Additional Business Textbook Solutions

Fundamentals of Management (10th Edition)

Essentials of MIS (13th Edition)

Management (14th Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Marketing: An Introduction (13th Edition)

FUNDAMENTALS OF CORPORATE FINANCE

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning