Average

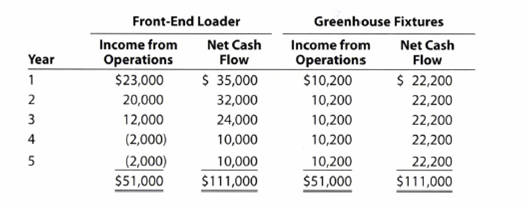

The capital Investment committee of Touch of Eden Landscaping Company is considering two capital investments. The estimated income from operations and net

Each project requires an investment of $60,000. Straight-line

Instructions

1. Compute the following:

a. The average rate of

b. The net present value for each investment. Use the present value of $1 table appearing in this chapter (Exhibit 2). Round present values to the nearest dollar.

2. Prepare a brief report for the capital investment committee, advising it on the relative merits of the two investments .

Trending nowThis is a popular solution!

Chapter 26 Solutions

Working Papers, Chapters 1-17 for Warren/Reeve/Duchac's Accounting, 26th and Financial Accounting, 14th

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning