Horngren's Accounting, Student Value Edition (12th Edition)

12th Edition

ISBN: 9780134487151

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 23, Problem S23.12SE

Journalizing materials entries

Learning Objectives 6

The following direct material

Requirements

1. Record Moore’s direct materials

2. Explain what management will do with this variance information.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the gross margin percentage of this financial accounting question?

managerial accoun

What will be the amount of depreciation recognized in 2023 on these financial accounting question?

Chapter 23 Solutions

Horngren's Accounting, Student Value Edition (12th Edition)

Ch. 23 - Prob. 1QCCh. 23 - MajorNet Systems is a start-up company that makes...Ch. 23 - MajorNet Systems is a start-up company that makes...Ch. 23 - MajorNet Systems is a start-up company that makes...Ch. 23 - MajorNet Systems has budgeted three hours of...Ch. 23 - MajorNet Systems has budgeted three hours of...Ch. 23 - FrontGrade Systems allocates manufacturing...Ch. 23 - FrontGrade Systems allocates manufacturing...Ch. 23 - FrontGrade Systems allocates manufacturing...Ch. 23 - The person probably most responsible for the...

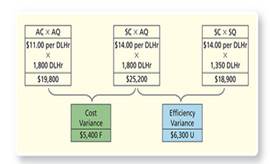

Ch. 23 - HajorNet System’s static budget predicted...Ch. 23 - What is a variance?Ch. 23 - Explain the difference between a favorable and an...Ch. 23 - What is a static budget performance report?Ch. 23 - How do flexible budgets differ from static...Ch. 23 - How is a flexible budget used?Ch. 23 - What are the two components of the static budget...Ch. 23 - What is a flexible budget performance report?Ch. 23 - What is a standard cost system?Ch. 23 - Explain the difference between a cost standard and...Ch. 23 - Give the general formulas for determining cost and...Ch. 23 - How does the static budget affect cost and...Ch. 23 - List the direct materials variances, and briefly...Ch. 23 - List the direct labor variances, and briefly...Ch. 23 - List the variable overhead variances, and briefly...Ch. 23 - List the fixed overhead variances, and briefly...Ch. 23 - How is the fixed overhead volume variance...Ch. 23 - What is management by exception?Ch. 23 - List the eight product variances and the manager...Ch. 23 - Briefly describe how journal entries differ in a...Ch. 23 - What is a standard cost income statement?Ch. 23 - Matching terms Learning Objective 1 Match each...Ch. 23 - Preparing flexible budgets Learning Objective 1...Ch. 23 - Calculating flexible budget variances Learning...Ch. 23 - Matching terms Learning Objective 2 Match each...Ch. 23 - Identifying the benefits of standard costs...Ch. 23 - Calculating materials variances Learning Objective...Ch. 23 - Calculating labor variances Learning Objective 3...Ch. 23 - Interpreting material and labor variances Learning...Ch. 23 - Computing standard overhead allocation rates...Ch. 23 - Computing overhead variances Learning Objective 4...Ch. 23 - Understanding variance relationships Learning...Ch. 23 - Journalizing materials entries Learning Objectives...Ch. 23 - Journalizing labor entries Learning Objectives 6...Ch. 23 - Preparing a standard cost income statement...Ch. 23 - Preparing a flexible budget Learning Objective 1...Ch. 23 - Preparing a flexible budget performance report...Ch. 23 - Preparing a flexible budget performance report...Ch. 23 - Defining the benefits of setting cost standards...Ch. 23 - Calculating materials and labor variances Learning...Ch. 23 - Computing overhead variances Learning Objective 4...Ch. 23 - Calculating overhead variances Learning Objective...Ch. 23 - Preparing a standard cost income statement...Ch. 23 - Preparing journal entries Learning Objective 6 MOH...Ch. 23 - Preparing a standard cost income statement...Ch. 23 - Preparing a flexible budget performance report...Ch. 23 - Preparing a flexible budget computing standard...Ch. 23 - Computing standard cost variances and reporting to...Ch. 23 - Computing and journalizing standard cost variances...Ch. 23 - Prob. P23.29APGACh. 23 - Preparing a flexible budget performance report...Ch. 23 - Preparing a flexible budget and computing standard...Ch. 23 - Prob. P23.32BPGBCh. 23 - Prob. P23.33BPGBCh. 23 - Preparing a standard cost income statement...Ch. 23 - Prob. P23.35CTCh. 23 - Preparing a flexible budget and performance report...Ch. 23 - Prob. 23.1TIATCCh. 23 - Decision Case 23-1 Suppose you manage the local...Ch. 23 - Fraud Case 23-1 Drew Castello, general manager of...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY