College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 23, Problem 5SEA

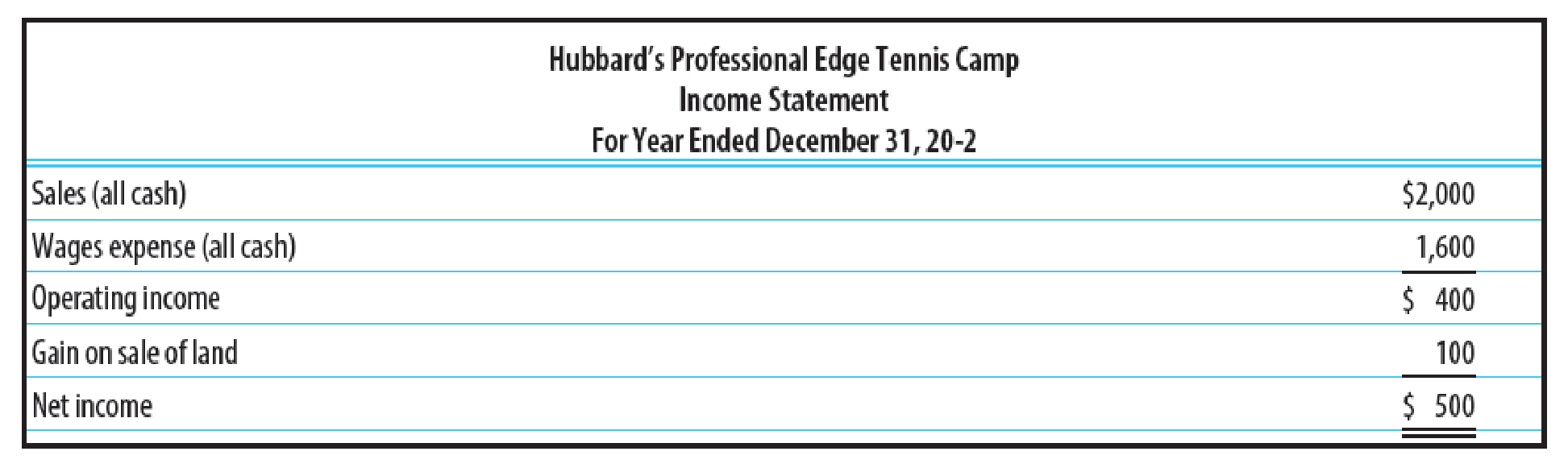

GAINS AND LOSSES ON THE SALE OF LONG-TERM ASSETS The income statement for Hubbard’s Professional Edge Tennis Camp follows. Assume that all revenues and expenses were for cash and that land was sold for $500. There were no other investing or financing activities during the year. The Cash balances at the beginning and end of the year were $100 and $1,000, respectively. Prepare a statement of

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

General accounting

How did you calculate the number?

What is the maturity value of the note ?

Chapter 23 Solutions

College Accounting, Chapters 1-27

Ch. 23 - True/False The purpose of the statement of cash...Ch. 23 - Investing activities are those transactions...Ch. 23 - An increase in accounts receivable is deducted...Ch. 23 - Prob. 4TFCh. 23 - Prob. 5TFCh. 23 - Prob. 1MCCh. 23 - Prob. 2MCCh. 23 - Prob. 3MCCh. 23 - Prob. 4MCCh. 23 - Prob. 5MC

Ch. 23 - Prob. 1CECh. 23 - Prob. 2CECh. 23 - Prob. 3CECh. 23 - Prob. 4CECh. 23 - Prob. 5CECh. 23 - Prob. 6CECh. 23 - Prob. 7CECh. 23 - Prob. 8CECh. 23 - Prob. 1RQCh. 23 - Prob. 2RQCh. 23 - Prob. 3RQCh. 23 - Prob. 4RQCh. 23 - Prob. 5RQCh. 23 - Prob. 6RQCh. 23 - Prob. 7RQCh. 23 - Prob. 8RQCh. 23 - Prob. 9RQCh. 23 - Prob. 10RQCh. 23 - Prob. 11RQCh. 23 - Prob. 12RQCh. 23 - Prob. 13RQCh. 23 - Prob. 14RQCh. 23 - Prob. 15RQCh. 23 - Prob. 16RQCh. 23 - Prob. 17RQCh. 23 - Prob. 18RQCh. 23 - Prob. 19RQCh. 23 - Prob. 20RQCh. 23 - Prob. 21RQCh. 23 - SERIES A EXERCISES IDENTIFICATION OF OPERATING,...Ch. 23 - CHANGE IN CASH AND CASH EQUIVALENTS Olsen Companys...Ch. 23 - Prob. 3SEACh. 23 - Prob. 4SEACh. 23 - GAINS AND LOSSES ON THE SALE OF LONG-TERM ASSETS...Ch. 23 - Prob. 6SEACh. 23 - Prob. 7SEACh. 23 - CASH PAID FOR INTEREST Ball Companys income...Ch. 23 - Prob. 9SPACh. 23 - Prob. 10SPACh. 23 - COMPUTE CASH PROVIDED BY OPERATING ACTIVITIES Horn...Ch. 23 - EXPANDED STATE MENT OF CASH FLOWS Financial...Ch. 23 - Prob. 1SEBCh. 23 - Prob. 2SEBCh. 23 - Prob. 3SEBCh. 23 - Prob. 4SEBCh. 23 - Prob. 5SEBCh. 23 - Prob. 6SEBCh. 23 - Prob. 7SEBCh. 23 - Prob. 8SEBCh. 23 - Prob. 9SPBCh. 23 - Prob. 10SPBCh. 23 - COMPUTE CASH PROVIDED BY OPERATING ACTIVITIES...Ch. 23 - EXPANDED STATEMENT OF CASH FLOWS Financial...Ch. 23 - MANAGING YOUR WRITING Direct Method A friend of...Ch. 23 - MASTERY PROBLEM Financial statements for...Ch. 23 - CHALLENGE PROBLEM The long-term liabilities...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2009, Teja Corporation purchased for $987,000, equipment having a useful life of ten years and an estimated salvage value of $84,400. Teja has recorded monthly depreciation of the equipment on the straight-line method. On December 31, 2017, the equipment was sold for $321,000. As a result of this sale, Teja should recognize a gain ofarrow_forwardDon't use ai given answer accounting questionsarrow_forwardI want to this question answer general Accountingarrow_forward

- A piece of equipment is purchased for $23,500 and has a salvage value of $3,200. The estimated life is 10 years and the method of depreciation is straight-line. Shipping costs total $750 and installation costs are $630. The book value at the end of year 10 is: a. $3,110 b. $3,200 c. $2,000 d. $1,110arrow_forwardRinga Clothing finished goods inventory for jan 1arrow_forwardI need solutionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License