College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 23, Problem 1CP

CHALLENGE PROBLEM

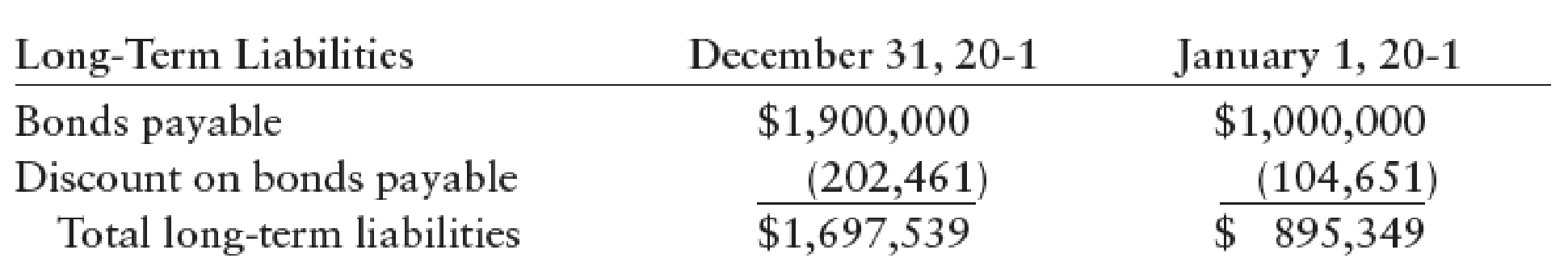

The long-term liabilities section of Guyton Enterprises follows. The bonds outstanding on January 1, 20-1, have an annual coupon rate of 4% and had been issued several years ago at a price to yield 5% per year. The discount is amortized using the effective interest method. On December 31, 20-1, $900,000, 5% bonds were issued at a price to yield 6%.

REQUIRED

Compute the cash received from issuing the bonds on December 31, 20-1. (Hint: If you have not covered the effective interest method, assume that bond interest expense for 20-1 was $44,767.)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The comparative balance sheets and an income statement for Raceway Corporation follow.

Balance Sheets

As of December 31

Year 2

Year 1

Assets

Cash

$ 6,300

$ 48,400

Accounts receivable

10,200

7,260

Inventory

45,200

56,000

Prepaid rent

700

2,140

Equipment

140,000

144,000

Accumulated depreciation

(73,400)

(118,000)

Land

116,000

50,000

Total assets

$ 245,000

$ 189,800

Liabilities

Accounts payable (inventory)

$ 37,200

$ 40,000

Salaries payable

12,200

10,600

Stockholders’ equity

Common stock, $50 par value

150,000

120,000

Retained earnings

45,600

19,200

Total liabilities and stockholders’ equity

$ 245,000

$ 189,800

Income Statement

For the Year Ended December 31, Year 2

Sales

$ 480,000

Cost of goods sold

(264,000)

Gross profit

216,000

Operating expenses

Depreciation expense

(11,400)

Rent expense

(7,000)

Salaries expense

(95,200)

Other operating expenses

(76,000)

Net income

$ 26,400

Other Information

Purchased…

Please help holy tamale I have been staring at this for hours.

Could you explain the steps for solving this financial accounting question accurately?

Chapter 23 Solutions

College Accounting, Chapters 1-27

Ch. 23 - True/False The purpose of the statement of cash...Ch. 23 - Investing activities are those transactions...Ch. 23 - An increase in accounts receivable is deducted...Ch. 23 - Prob. 4TFCh. 23 - Prob. 5TFCh. 23 - Prob. 1MCCh. 23 - Prob. 2MCCh. 23 - Prob. 3MCCh. 23 - Prob. 4MCCh. 23 - Prob. 5MC

Ch. 23 - Prob. 1CECh. 23 - Prob. 2CECh. 23 - Prob. 3CECh. 23 - Prob. 4CECh. 23 - Prob. 5CECh. 23 - Prob. 6CECh. 23 - Prob. 7CECh. 23 - Prob. 8CECh. 23 - Prob. 1RQCh. 23 - Prob. 2RQCh. 23 - Prob. 3RQCh. 23 - Prob. 4RQCh. 23 - Prob. 5RQCh. 23 - Prob. 6RQCh. 23 - Prob. 7RQCh. 23 - Prob. 8RQCh. 23 - Prob. 9RQCh. 23 - Prob. 10RQCh. 23 - Prob. 11RQCh. 23 - Prob. 12RQCh. 23 - Prob. 13RQCh. 23 - Prob. 14RQCh. 23 - Prob. 15RQCh. 23 - Prob. 16RQCh. 23 - Prob. 17RQCh. 23 - Prob. 18RQCh. 23 - Prob. 19RQCh. 23 - Prob. 20RQCh. 23 - Prob. 21RQCh. 23 - SERIES A EXERCISES IDENTIFICATION OF OPERATING,...Ch. 23 - CHANGE IN CASH AND CASH EQUIVALENTS Olsen Companys...Ch. 23 - Prob. 3SEACh. 23 - Prob. 4SEACh. 23 - GAINS AND LOSSES ON THE SALE OF LONG-TERM ASSETS...Ch. 23 - Prob. 6SEACh. 23 - Prob. 7SEACh. 23 - CASH PAID FOR INTEREST Ball Companys income...Ch. 23 - Prob. 9SPACh. 23 - Prob. 10SPACh. 23 - COMPUTE CASH PROVIDED BY OPERATING ACTIVITIES Horn...Ch. 23 - EXPANDED STATE MENT OF CASH FLOWS Financial...Ch. 23 - Prob. 1SEBCh. 23 - Prob. 2SEBCh. 23 - Prob. 3SEBCh. 23 - Prob. 4SEBCh. 23 - Prob. 5SEBCh. 23 - Prob. 6SEBCh. 23 - Prob. 7SEBCh. 23 - Prob. 8SEBCh. 23 - Prob. 9SPBCh. 23 - Prob. 10SPBCh. 23 - COMPUTE CASH PROVIDED BY OPERATING ACTIVITIES...Ch. 23 - EXPANDED STATEMENT OF CASH FLOWS Financial...Ch. 23 - MANAGING YOUR WRITING Direct Method A friend of...Ch. 23 - MASTERY PROBLEM Financial statements for...Ch. 23 - CHALLENGE PROBLEM The long-term liabilities...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help with this General accounting question using the proper accounting approach.arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardKindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forward

- I am searching for the correct answer to this Financial accounting problem with proper accounting rules.arrow_forwardI am looking for the correct answer to this Financial accounting question with appropriate explanations.arrow_forwardEcho Tone Technologies reports annual sales of $90,000, and it expects sales to increase to $135,000 next year. The company has a degree of operating leverage (DOL) of 4.2. By what percentage should net income increase? A. 70% B. 189% C. 150% D. 210%arrow_forward

- Please provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardNo chatgpt Which account will appear in the post-closing trial balance?A. Rent ExpenseB. Sales RevenueC. DividendsD. Capitalarrow_forwardI need help with this financial accounting question using the proper accounting approach.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Bond Valuation - A Quick Review; Author: Pat Obi;https://www.youtube.com/watch?v=xDWTPmqcWW4;License: Standard Youtube License