Concept explainers

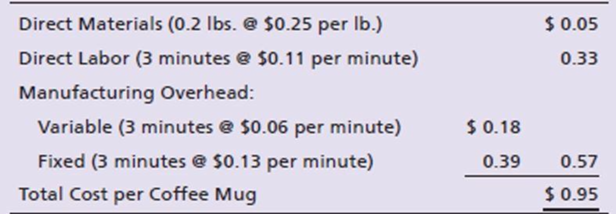

Moss manufactures coffee mugs that it sells to other companies for customizing with their own logos. Moss prepares flexible budgets and uses a

Actual cost and production information for July 2018 follows:

- a. There were no beginning or ending inventory balances. All expenditures were on account.

- b. Actual production and sales were 62,500 coffee mugs.

- c. Actual direct materials usage was 11,000 lbs. at an actual cost of $0.17 per lb.

- d. Actual direct labor usage was 197,000 minutes at a total cost of $25,610.

- e. Actual

overhead cost was $10,835 variable and $29,765 fixed. - f. Selling and administrative costs were $95,000.

Requirements

- 1. Compute the cost and efficiency variances for direct materials and direct labor.

- 2. Journalize the purchase and usage of direct materials and the assignment of direct labor, including the related variances.

- 3. For manufacturing overhead, compute the variable overhead cost and efficiency variances and the fixed overhead cost and volume variances.

- 4. Journalize the actual manufacturing overhead and the allocated manufacturing overhead. Journalize the movement of all production costs from Work-in-Process Inventory. Journalize the adjusting of the Manufacturing Overhead account.

- 5. Moss intentionally hired more highly skilled workers during July. How did this decision affect the cost variances? Overall, was the decision wise?

Want to see the full answer?

Check out a sample textbook solution

Chapter 23 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Additional Business Textbook Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Business Essentials (12th Edition) (What's New in Intro to Business)

Marketing: An Introduction (13th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Economics of Money, Banking and Financial Markets, The, Business School Edition (5th Edition) (What's New in Economics)

- Cullen Beatty plans to start a consulting business-Cullen Consulting Services. In preparation to do this, on April 1, 20X1, he invested $56,000 in cash and $23,000 in equipment, and opened an account at Office Plus by purchasing $1,750 in office supplies which is due by the end of the month. He then signed a one-year lease agreement on an office building for $8,400, paying the full amount in advance. Prepare a Balance Sheet for Cullen Consulting Services as of April 1, 20X1, before he conducts any services. Cash Equipment Prepaid rent CULLEN CONSULTING SERVICES Balance Sheet April 1, 20X1 Assets Liabilities $ 47,600 Accounts payable 23,000 8,400 Owner's Equity $ 1,750 Cullen Beatty, Capital 77,250 Total Assets $ 79,000 Total Liabilities and Owner's Equity $ 79,000arrow_forwardThe December 31, 2021, balance sheet of Chen, Incorporated, showed long-term debt of $1,420,000, $144,000 in the common stock account, and $2,690,000 in the additional paid-in surplus account. The December 31, 2022, balance sheet showed long-term debt of $1,620,000, $154,000 in the common stock account and $2,990,000 in the additional paid-in surplus account. The 2022 income statement showed an interest expense of $96,000 and the company paid out $149,000 in cash dividends during 2022. The firm’s net capital spending for 2022 was $1,000,000, and the firm reduced its net working capital investment by $129,000. What was the firm's 2022 operating cash flow, or OCF?arrow_forwardRiver is a salaried exempt worker who earns $73,630 per year for a 35-hour workweek. During a biweekly pay period, River worked 105 hours. What is the gross pay?arrow_forward

- The industrial enterprise "HUANG S.A." purchased a sorting and packaging machine from a foreign company on 1/4/2017 at a cost of €500,000. The useful life of the machine was estimated by the Management at ten (10) years, while the residual value was estimated at zero. For the transportation of the machine from abroad to the company's factory, the amount of €20,000 was paid on 15/4/2017. As the insurance coverage of the machine during transportation was the responsibility of the selling company, HUANG S.A. proceeded to insure the machine from 16/4/2017 to 15/4/2018, paying the amount of €1,200. The delivery took place on 15/4/2017. As adequate ventilation of the multifunction device is essential for its proper operation, the company fitted an air duct on the multifunction device. The cost of the air duct amounted to €2,000 and was paid on 20/4/2017. On 25/4/2017, an external electrician was paid €5,000 for the electrical connection of the device. The company also paid €5,000 to an…arrow_forwardThe industrial enterprise "HUANG S.A." purchased a sorting and packaging machine from a foreign company on 1/4/2017 at a cost of €500,000. The useful life of the machine was estimated by the Management at ten (10) years, while the residual value was estimated at zero. For the transportation of the machine from abroad to the company's factory, the amount of €20,000 was paid on 15/4/2017. As the insurance coverage of the machine during transportation was the responsibility of the selling company, HUANG S.A. proceeded to insure the machine from 16/4/2017 to 15/4/2018, paying the amount of €1,200. The delivery took place on 15/4/2017. As adequate ventilation of the multifunction device is essential for its proper operation, the company fitted an air duct on the multifunction device. The cost of the air duct amounted to €2,000 and was paid on 20/4/2017. On 25/4/2017, an external electrician was paid €5,000 for the electrical connection of the device. The company also paid €5,000 to an…arrow_forwardI need answer typing clear urjent no chatgpt used pls i will give 5 Upvotes.only typing .arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College