Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

6th Edition

ISBN: 9780134486857

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 23, Problem 25AP

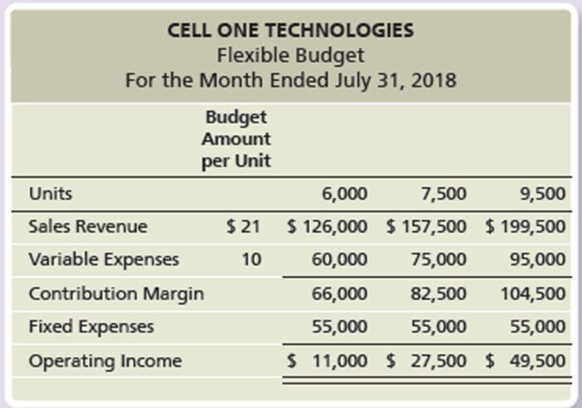

Cell One Technologies manufactures capacitors for cellular base stations and other communications applications. The company’s July 2018 flexible budget shows output levels of 6,000, 7,500, and 9,500 units. The static budget was based on expected sales of 7,500 units.

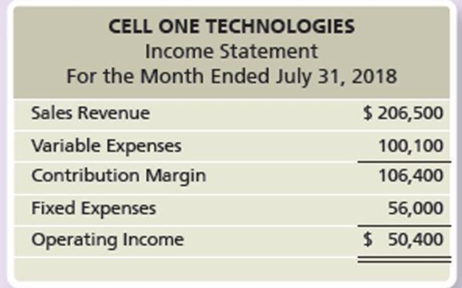

The company sold 9,500 units during July, and its actual operating income was as follows:

Requirements

- 1. Prepare a flexible budget performance report for July.

- 2. What was the effect on Cell One’s operating income of selling 2,000 units more than the static budget level of sales?

- 3. What is Cell One’s static

budget variance for operating income? - 4. Explain why the flexible budget performance report provides more useful information to Cell One’s managers than the simple static budget variance. What insights can Cell One’s managers draw from this performance report?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The industrial enterprise "HUANG S.A." purchased a sorting and packaging machine from a foreign company on 1/4/2017 at a cost of €500,000. The useful life of the machine was estimated by the Management at ten (10) years, while the residual value was estimated at zero.

For the transportation of the machine from abroad to the company's factory, the amount of €20,000 was paid on 15/4/2017. As the insurance coverage of the machine during transportation was the responsibility of the selling company, HUANG S.A. proceeded to insure the machine from 16/4/2017 to 15/4/2018, paying the amount of €1,200. The delivery took place on 15/4/2017.

As adequate ventilation of the multifunction device is essential for its proper operation, the company fitted an air duct on the multifunction device. The cost of the air duct amounted to €2,000 and was paid on 20/4/2017. On 25/4/2017, an external electrician was paid €5,000 for the electrical connection of the device.

The company also paid €5,000 to an…

The industrial enterprise "HUANG S.A." purchased a sorting and packaging machine from a foreign company on 1/4/2017 at a cost of €500,000. The useful life of the machine was estimated by the Management at ten (10) years, while the residual value was estimated at zero.

For the transportation of the machine from abroad to the company's factory, the amount of €20,000 was paid on 15/4/2017. As the insurance coverage of the machine during transportation was the responsibility of the selling company, HUANG S.A. proceeded to insure the machine from 16/4/2017 to 15/4/2018, paying the amount of €1,200. The delivery took place on 15/4/2017.

As adequate ventilation of the multifunction device is essential for its proper operation, the company fitted an air duct on the multifunction device. The cost of the air duct amounted to €2,000 and was paid on 20/4/2017. On 25/4/2017, an external electrician was paid €5,000 for the electrical connection of the device.

The company also paid €5,000 to an…

I need answer typing clear urjent no chatgpt used pls i will give 5 Upvotes.only typing .

Chapter 23 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Ch. 23 - Garland Company expects to sell 600 wreaths in...Ch. 23 - Match the variance to the correct definition....Ch. 23 - Match the variance to the correct definition....Ch. 23 - Match the variance to the correct definition....Ch. 23 - Match the variance to the correct definition....Ch. 23 - Match the variance to the correct definition....Ch. 23 - Prob. 7TICh. 23 - Prob. 8TICh. 23 - Prob. 9TICh. 23 - Prob. 10TI

Ch. 23 - Prob. 11TICh. 23 - Tipton Company manufactures shirts, During June,...Ch. 23 - Prob. 13TICh. 23 - Prob. 14TICh. 23 - Prob. 15TICh. 23 - This Try It! continues the previous Try It! for...Ch. 23 - Calculate the following variances: Fixed overhead...Ch. 23 - Prob. 18TICh. 23 - Prob. 19TICh. 23 - Prob. 20TICh. 23 - Prob. 21TICh. 23 - Prob. 22TICh. 23 - Prob. 23TICh. 23 - Prob. 24TICh. 23 - Prob. 25TICh. 23 - MajorNet Systems is a start-up company that makes...Ch. 23 - MajorNets sales volume variance for total costs is...Ch. 23 - MajorNets flexible budget variance for total costs...Ch. 23 - MajorNet Systemss managers could set direct labor...Ch. 23 - What is MajorNets direct labor cost variance for...Ch. 23 - What is MajorNets direct labor efficiency variance...Ch. 23 - FrontGrades standard variable manufacturing...Ch. 23 - Calculate the variable overhead cost variance for...Ch. 23 - Calculate the variable overhead efficiency...Ch. 23 - Prob. 10QCCh. 23 - MajorNet Systemss static budget predicted...Ch. 23 - Prob. 1RQCh. 23 - Prob. 2RQCh. 23 - What is a static budget performance report?Ch. 23 - How do flexible budgets differ from static...Ch. 23 - Prob. 5RQCh. 23 - What are the two components of the static budget...Ch. 23 - What is a flexible budget performance report?Ch. 23 - Prob. 8RQCh. 23 - Prob. 9RQCh. 23 - Give the general formulas for determining cost and...Ch. 23 - How does the static budget affect cost and...Ch. 23 - List the direct materials variances, and briefly...Ch. 23 - Prob. 13RQCh. 23 - Prob. 14RQCh. 23 - List the fixed overhead variances, and briefly...Ch. 23 - Prob. 16RQCh. 23 - Prob. 17RQCh. 23 - Prob. 18RQCh. 23 - Prob. 19RQCh. 23 - Prob. 20RQCh. 23 - Prob. 1SECh. 23 - Moje, Inc. manufactures travel locks. The budgeted...Ch. 23 - Complete the flexible budget variance analysis by...Ch. 23 - Prob. 4SECh. 23 - Setting standards for a product may involve many...Ch. 23 - Prob. 6SECh. 23 - Martin, Inc. manufactures lead crystal glasses....Ch. 23 - Martin, Inc. is a manufacturer of lead crystal...Ch. 23 - Prob. 9SECh. 23 - Prob. 10SECh. 23 - Prob. 11SECh. 23 - Prob. 12SECh. 23 - Prob. 13SECh. 23 - Prob. 14SECh. 23 - Prob. 15ECh. 23 - Murphy Company managers received the following...Ch. 23 - Prob. 17ECh. 23 - Prob. 18ECh. 23 - Prob. 19ECh. 23 - Prob. 20ECh. 23 - Prob. 21ECh. 23 - Prob. 22ECh. 23 - Prob. 23ECh. 23 - McCarthy Fender, which uses a standard cost...Ch. 23 - Cell One Technologies manufactures capacitors for...Ch. 23 - Morton Recliners manufactures leather recliners...Ch. 23 - Hear Smart manufactures headphone cases. During...Ch. 23 - Moss manufactures coffee mugs that it sells to...Ch. 23 - Review your results from Problem P23-28A. Mosss...Ch. 23 - Prob. 30BPCh. 23 - McKnight Recliners manufactures leather recliners...Ch. 23 - Headset manufactures headphone cases. During...Ch. 23 - Prob. 33BPCh. 23 - Review your results from Problem P23-33B....Ch. 23 - Download an Excel template for this problem online...Ch. 23 - This continues the Piedmont Computer Company...Ch. 23 - Prob. 1TIATCCh. 23 - Suppose you manage the local Scoopys ice cream...Ch. 23 - Drew Gastello, general manager of Sunflower...Ch. 23 - In 75 words or fewer, explain what a cost variance...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Risk Premiums and Discount Rates. Top hedge fund manager Sally Buffit believes that a stock with the same marke...

FUNDAMENTALS OF CORPORATE FINANCE

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

2. Identify four people who have contributed to the theory and techniques of operations management.

Operations Management

Mary Williams, owner of Williams Products, is evaluating whether to introduce a new product line. After thinkin...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY