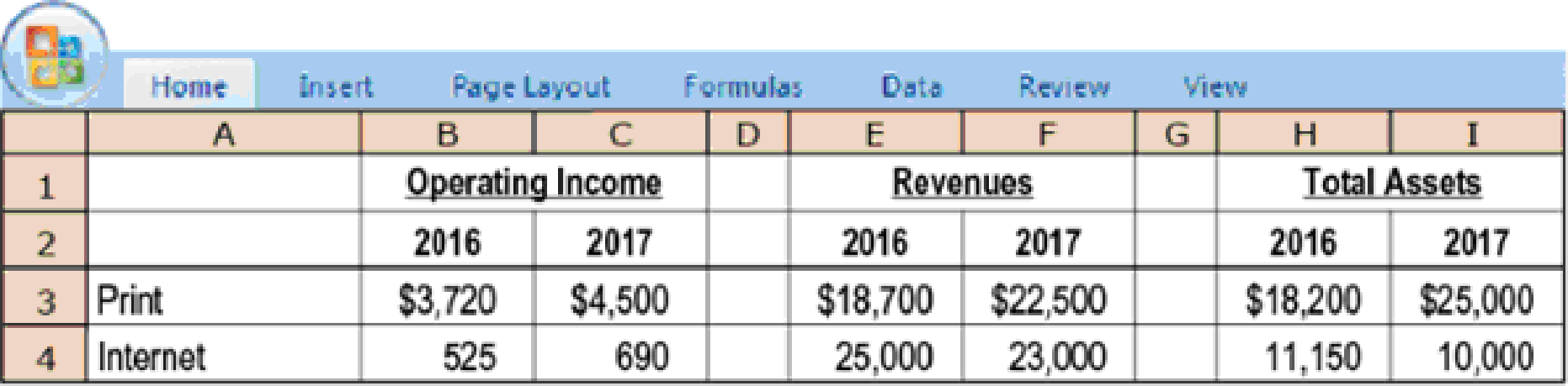

ROI, Rl, DuPont method, investment decisions, balanced scorecard. News Report Group has two major divisions: Print and Internet. Summary financial data (in millions) for 2016 and 2017 are as follows:

The two division managers’ annual bonuses are based on division ROI (defined as operating income divided by total assets). If a division reports an increase in ROI from the previous year, its management is automatically eligible for a bonus; however, the management of a division reporting a decline in ROI has to present an explanation to the News Report Group board and is unlikely to get any bonus. Carol Mays, manager of the Print division, is considering a proposal to invest $2,580 million in a new computerized news reporting and printing system. It is estimated that the new system’s state-of-the-art graphics and ability to quickly incorporate late-breaking news into papers will increase 2018 division operating income by $360 million. News Report Group uses a 10% required rate of

- 1. Use the DuPont method of profitability analysis to explain differences in 2017 ROIs between the two divisions. Use 2017 total assets as the investment base.

- 2. Why might Mays be less than enthusiastic about accepting the investment proposal for the new system despite her belief in the benefits of the new technology?

- 3. John Mendenhall, CEO of News Report Group, is considering a proposal to base division executive compensation on division RI.

- a. Compute the 2017 RI of each division.

- b. Would adoption of an RI measure reduce Mays’s reluctance to adopt the new computerized system investment proposal?

- 4. Mendenhall is concerned that the focus on annual ROI could have an adverse long-run effect on News Report Group’s customers. What other measurements, if any, do you recommend that Mendenhall use? Explain briefly.

Want to see the full answer?

Check out a sample textbook solution

Chapter 23 Solutions

EBK HORNGREN'S COST ACCOUNTING

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning