Concept explainers

Communication

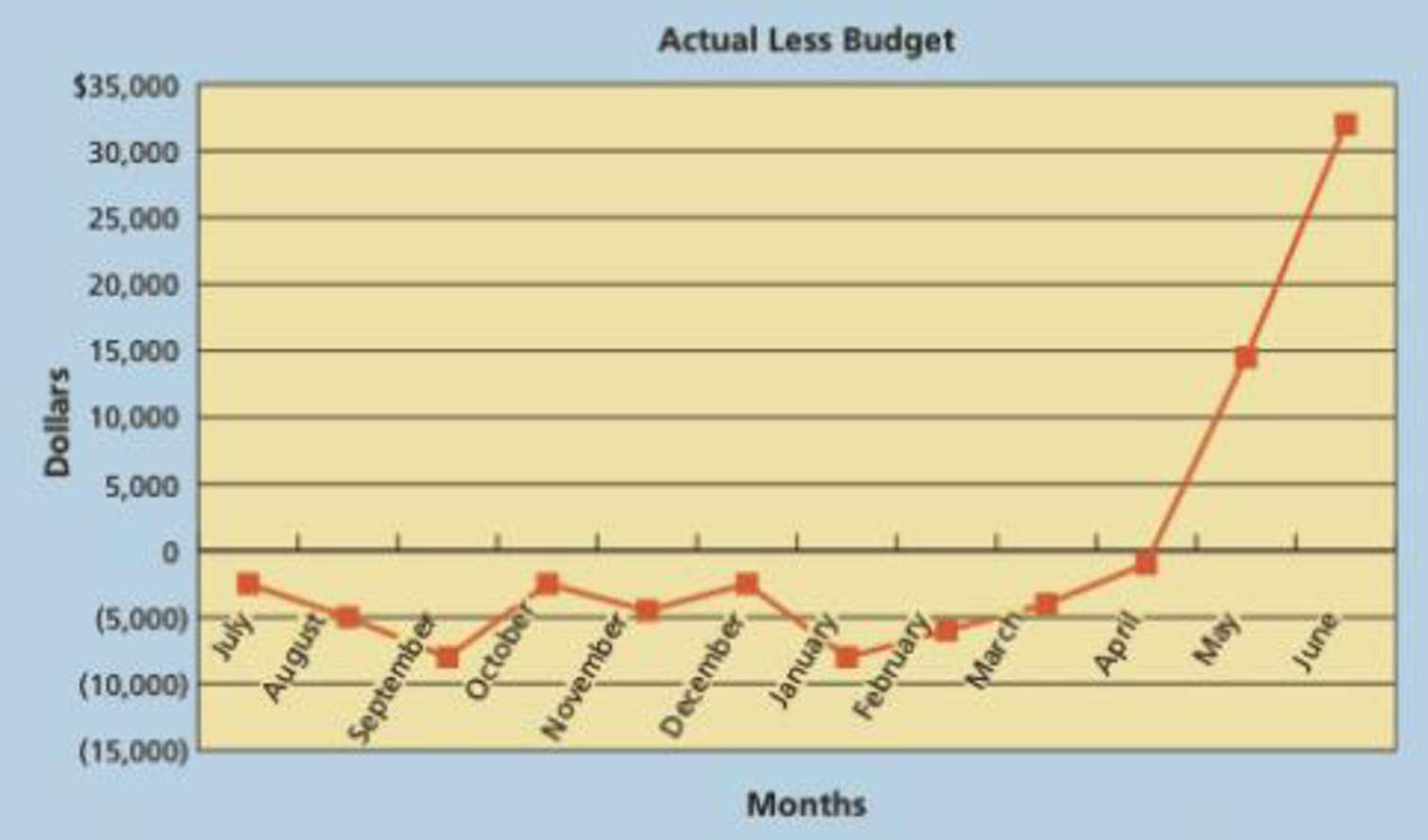

The city of Milton has an annual budget cycle that begins on July 1 and ends on June 30. At the beginning of each budget year, an annual budget is established for each department. The annual budget is divided equally among the 12 months to provide a constant monthly static budget. On June 30, all unspent budgeted monies for the budget year from the various city departments must be “returned” to the General Fund. Thus, if department heads fail to use their budget by year-end, they will lose it. A budget analyst prepared a chart of the difference between the monthly actual and budgeted amounts for all departments in a recent fiscal year. The chart was as follows:

Write a memo to Stacy Poindexter, the city manager, interpreting the chart and suggesting improvements to the budgeting system.

Want to see the full answer?

Check out a sample textbook solution

Chapter 22 Solutions

Financial And Managerial Accounting

- Give me true answer this general accounting questionarrow_forwardCarry Manufacturing Inc. had a variable costing operating income of $95,200 in 2018. Ending inventory decreased during 2018 from 50,000 units to 47,000 units. During both 2017 and 2018, fixed manufacturing overhead was $900,000, and 120,000 units were produced. Determine the absorption costing operating income for 2018.arrow_forwardIf revenue = $135 and variable cost revenue, then contribution margin = 45% of = $79.25. a. True. b. False.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning