Concept explainers

Sales, production, direct materials purchases, and direct labor cost budgets

The budget director of Gourmet Grill Company requests estimates of sales, production, and other operating data from the various administrative units every month. Selected information concerning sales and production for July is summarized as follows:

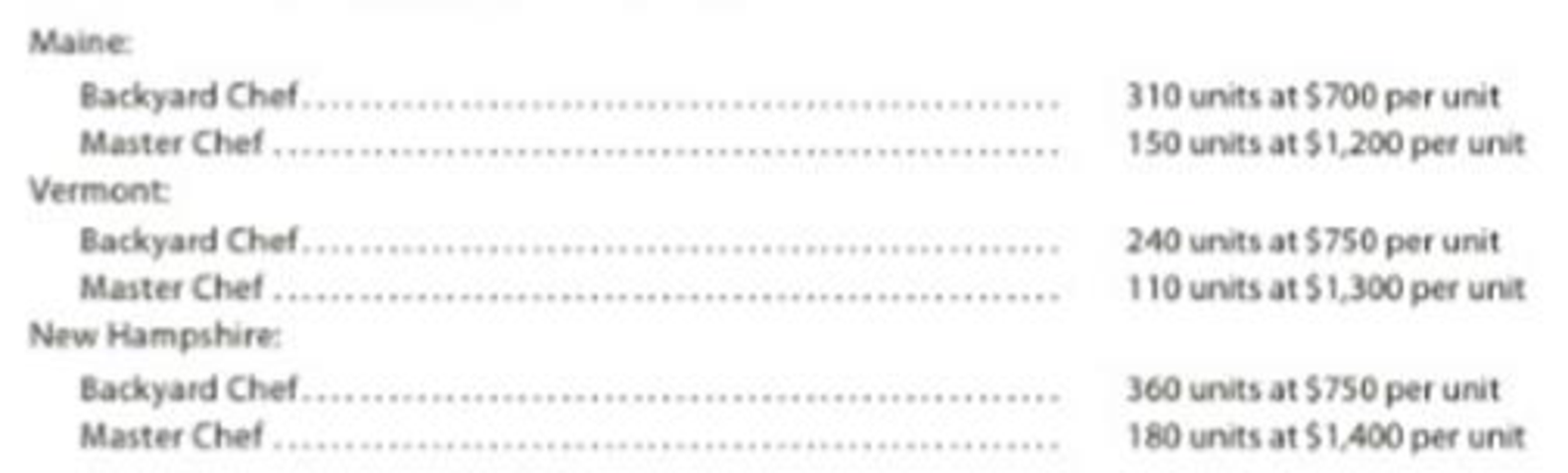

Estimated sales for July by sales territory:

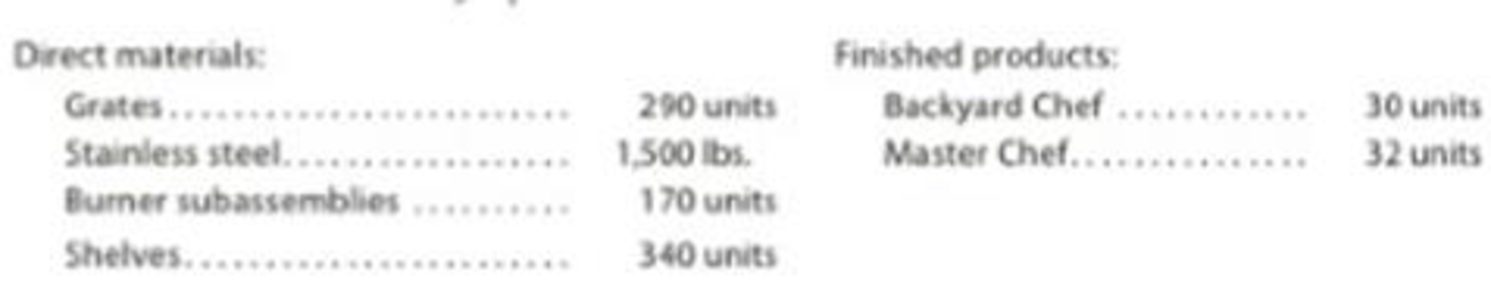

Estimated inventories at July 1:

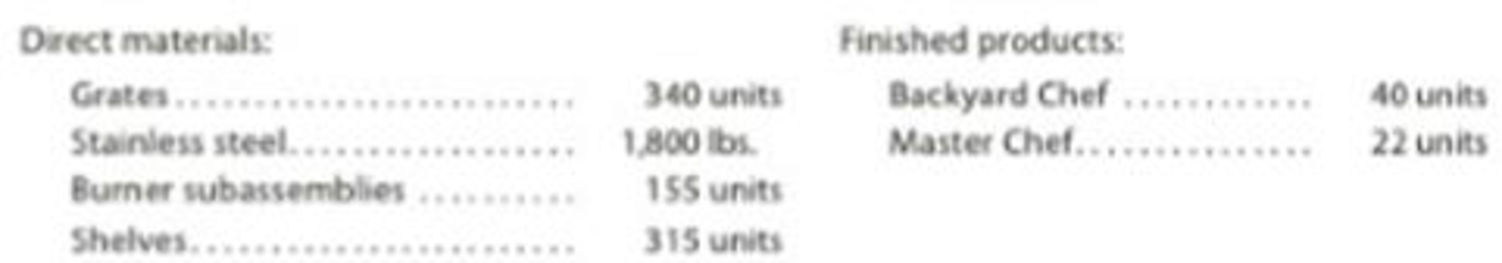

Desired inventories at July 31:

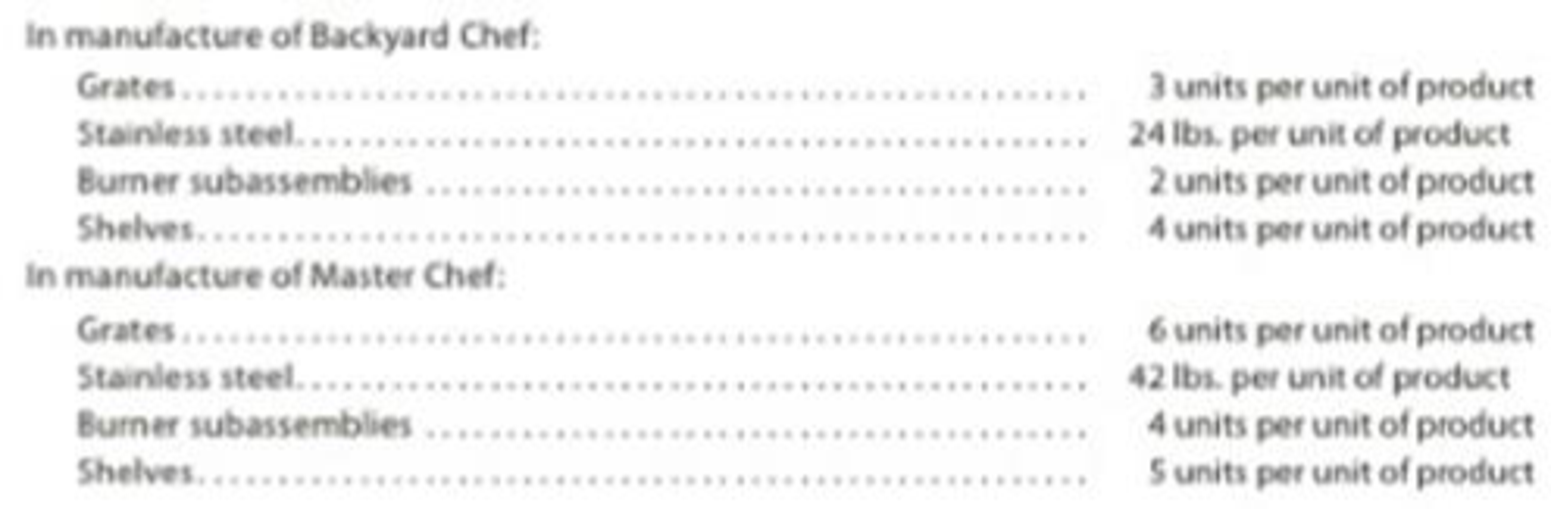

Direct materials used in production:

Anticipated purchase price for direct materials:

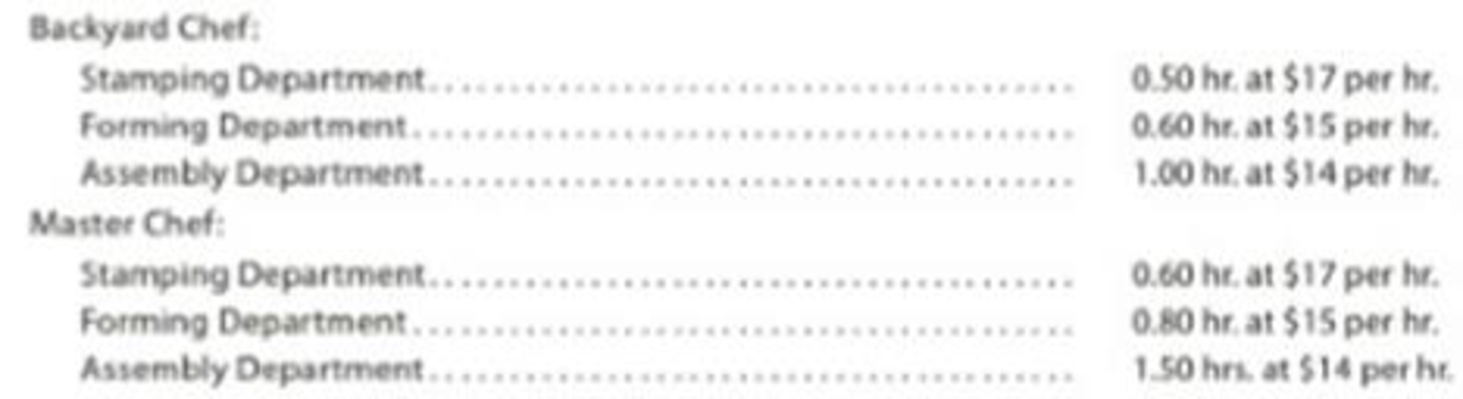

Direct labor requirements:

Instructions

Prepare a sales budget for July.

Prepare a production budget for July.

Prepare a direct materials purchases budget for July.

Prepare a direct labor cost budget for July.

1.

Prepare the sales budget for the month ending July 31.

Explanation of Solution

Budgeting:

Budgeting is a process to prepare the financial statement by the manager to estimate the organization’s future actions. It is also helpful to satisfy the everyday activities.

The following table shows the sales budget.

|

Company G Sales Budget For the Month Ending July 31 | |||

| Product and Area | Unit Sales Volume | Unit Selling Price ($) | Total Sales ($) |

| (A) | (B) | (A) × (B) | |

| Backyard Chef: | |||

| M | 310 | 700 | 217,000 |

| V | 240 | 750 | 180,000 |

| N | 360 | 750 | 270,000 |

| Total | 1,070 | 667,000 | |

| Master Chef: | |||

| M | 150 | 1,200 | 180,000 |

| V | 110 | 1,300 | 143,000 |

| N | 180 | 1,400 | 252,000 |

| Total | 440 | 575,000 | |

| Total Revenue from Sales | 1,242,000 | ||

Table (1)

2.

Prepare the production budget for the month ending July 31.

Explanation of Solution

The following table shows the production budget.

|

Company G Production Budget For the Month Ending July 31 | ||

| Details | Units | |

| Backyard Chef | Master Chef | |

| Expected Units to be Sold | 910 | 440 |

| Add: Desired Inventory, July 31 | 40 | 22 |

| Total Units Required | 950 | 462 |

| Less: Estimated Inventory, July 1 | (30) | (32) |

| Total Units to be Produced | 920 | 430 |

Table (2)

3.

Prepare the direct materials purchase budget for the month ending July 31.

Explanation of Solution

The following table shows the direct materials purchase budget.

|

Company G Direct Materials Purchase Budget For the Month Ending July 31 | ||||

| Details | Units | |||

| Grates | Stainless Steel | Burner | Shelves | |

| Required units for production: | ||||

| Backyard Chef | 2,760 (1) | 22,080 (2) | 1,840 (3) | 3,680 (4) |

| Master Chef | 2,580 (5) | 18,060 (6) | 1,720 (7) | 2,150 (8) |

| Add: Desired inventory, July 31 | 340 | 1,800 | 155 | 315 |

| Total units required | 5,680 | 41,940 | 3,715 | 6,145 |

| Less: Estimated inventory, July 1 | (290) | (1,500) | (170) | (340) |

| Total units to be purchased (A) | 5,390 | 40,440 | 3,545 | 5,805 |

| Unit price (B) | $15 | $6 | $110 | $10 |

| Total (A) × (B) | $80,850 | $242,640 | $389,950 | $58,050 |

| Total direct materials to be purchased | 771,490 | |||

Table (3)

Working Note (1):

Calculate the direct material (grates) for backyard chef.

Working Note (2):

Calculate the direct material (stainless steel) for backyard chef.

Working Note (3):

Calculate the direct material (burner) for backyard chef.

Working Note (4):

Calculate the direct material (shelves) for backyard chef.

Working Note (5):

Calculate the direct material (grates) for master chef.

Working Note (6):

Calculate the direct material (stainless steel) for master chef.

Working Note (7):

Calculate the direct material (burner) for master chef.

Working Note (8):

Calculate the direct material (shelves) for master chef.

4.

Prepare the direct labor cost budget of Company G.

Explanation of Solution

The following table shows the direct labor cost budget for stamping, forming, and assembly department.

| Company G | |||

| Direct Labor Cost Budget | |||

| For the Month Ending July 31 | |||

| Particulars | Stamping Department |

Forming Department |

Assembly Department |

| Hours Required for Production: | |||

| Backyard Chef | 460 (9) | 552 (10) | 920 (11) |

| Master Chef | 258 (12) | 344 (13) | 645 (14) |

| Total Hours Required (A) | 718 | 896 | 1,565 |

| Hourly Rate (B) | $17 | $15 | $14 |

| Total Cost (A) × (B) | $12,206 | $13,440 | $21,910 |

| Total Direct Labor Cost | $47,556 | ||

Table (4)

Working Note (9):

Calculate the hours required for the production of backyard chef in stamping department.

Working Note (10):

Calculate the hours required for the production of backyard chef in forming department.

Working Note (11):

Calculate the hours required for the production of backyard chef in assembly department.

Working Note (12):

Calculate the hours required for the production of master chef in stamping department.

Working Note (13):

Calculate the hours required for the production of master chef in forming department.

Working Note (14):

Calculate the hours required for the production of master chef in assembly department.

Want to see more full solutions like this?

Chapter 22 Solutions

Financial And Managerial Accounting

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning