Transfer pricing, perfect and imperfect markets. Letang Company has three divisions (R, S, and T), organized as decentralized profit centers. Division R produces the basic chemical Ranbax, in multiples of 1,000 pounds, and transfers it to divisions S and T. Division S processes Ranbax into the final product Syntex, and division T processes Ranbax into the final product Termix. No material is lost during processing.

Division R has no fixed costs. The variable cost per pound of Ranbax is $0.18. Division R has a capacity limit of 10,000 pounds. Divisions S and T have capacity limits of 4,000 and 6,000 pounds, respectively. Divisions S and T sell their final product in separate markets. The company keeps no inventories of any kind.

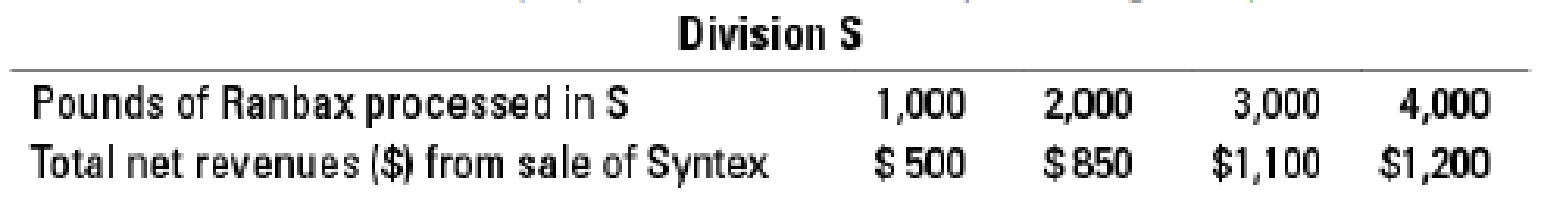

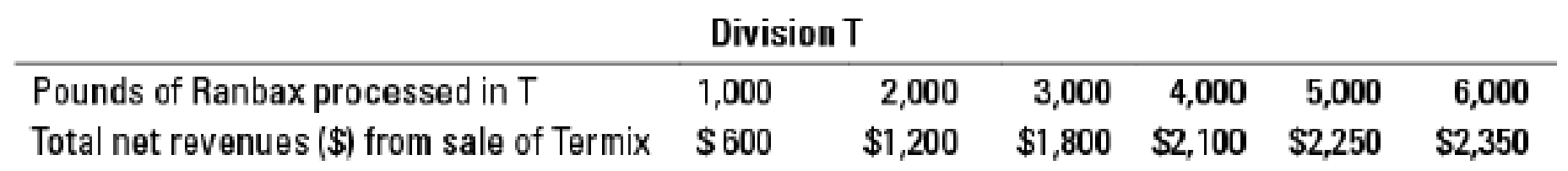

The cumulative net revenues (i.e., total revenues – total

- A. Suppose there is no external market for Ranbax. What quantity of Ranbax should the Letang Company produce to maximize overall income? How should this quantity be allocated between the two processing divisions?

- B. What range of transfer prices will motivate divisions S and T to demand the quantities that maximize overall income (as determined in requirement 1), as well as motivate division R to produce the sum of those quantities?

- C. Suppose that division R can sell any quantity of Ranbax in a

perfectly competitive market for $0.33 a pound. To maximize Letang’s income, how many pounds of Ranbax should division R transfer to divisions S and T, and how much should it sell in the external market? - D. What range of transfer prices will result in divisions R, S, and T taking the actions determined as optimal in requirement 3? Explain your answer.

Want to see the full answer?

Check out a sample textbook solution

Chapter 22 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub