Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

16th Edition

ISBN: 9780134475585

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 22, Problem 22.28P

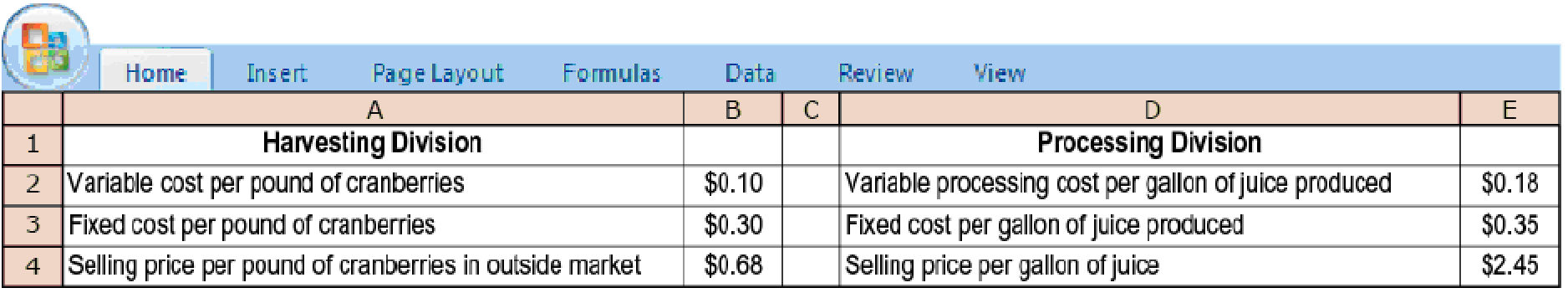

Effect of alternative transfer-pricing methods on division operating income. Cran Health Products is a cranberry cooperative that operates two divisions, a harvesting division and a processing division. Currently, all of harvesting’s output is converted into cranberry juice by the processing division, and the juice is sold to large beverage companies that produce cranberry juice blends. The processing division has a yield of 500 gallons of juice per 1,000 pounds of cranberries. Cost and market price data for the two divisions are as follows:

- A. Compute Cran Health’s operating income from harvesting 480,000 pounds of cranberries during June 2017 and processing them into juice.

- B. Cran Health rewards its division managers with a bonus equal to 6% of operating income. Compute the bonus earned by each division manager in June 2017 for each of the following transfer-pricing methods:

- a. 225% of full cost

- b. Market price

- C. Which transfer-pricing method will each division manager prefer? How might Cran Health resolve any conflicts that may arise on the issue of transfer pricing?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Cullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1,

2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800,

direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was

part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1.

During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and

50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during

the month.

1.

Purchased additional raw materials of $75,600 on account.

2.

Incurred factory labor costs of $58,800.

3.

Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…

Cullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1,

2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800,

direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was

part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1.

During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and

50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during

the month.

1.

Purchased additional raw materials of $75,600 on account.

2.

Incurred factory labor costs of $58,800.

3.

Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…

General Accounting question

Chapter 22 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Ch. 22 - Prob. 22.1QCh. 22 - Describe three criteria you would use to evaluate...Ch. 22 - What is the relationship among motivation, goal...Ch. 22 - Name three benefits and two costs of...Ch. 22 - Organizations typically adopt a consistent...Ch. 22 - Transfer pricing is confined to profit centers. Do...Ch. 22 - What are the three methods for determining...Ch. 22 - What properties should transfer-pricing systems...Ch. 22 - All transfer-pricing methods give the same...Ch. 22 - Prob. 22.10Q

Ch. 22 - Prob. 22.11QCh. 22 - Prob. 22.12QCh. 22 - Prob. 22.13QCh. 22 - Under the general guideline for transfer pricing,...Ch. 22 - How should managers consider income tax issues...Ch. 22 - Evaluating management control systems, balanced...Ch. 22 - Cost centers, profit centers, decentralization,...Ch. 22 - Prob. 22.18ECh. 22 - Prob. 22.19ECh. 22 - Multinational transfer pricing, effect of...Ch. 22 - Prob. 22.21ECh. 22 - Multinational transfer pricing, global tax...Ch. 22 - Prob. 22.23ECh. 22 - Prob. 22.24ECh. 22 - Transfer-pricing problem (continuation of 22-24)....Ch. 22 - Prob. 22.26PCh. 22 - Prob. 22.27PCh. 22 - Effect of alternative transfer-pricing methods on...Ch. 22 - Goal-congruence problems with cost-plus...Ch. 22 - Multinational transfer pricing, global tax...Ch. 22 - Transfer pricing, external market, goal...Ch. 22 - Prob. 22.32PCh. 22 - Transfer pricing, goal congruence, ethics. Cocoa...Ch. 22 - Prob. 22.34PCh. 22 - Transfer pricing, perfect and imperfect markets....Ch. 22 - Prob. 22.36PCh. 22 - Prob. 22.37P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What Is the correct answer A B ?? General Accounting questionarrow_forwardCullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardAccounting questionarrow_forward

- Determine the cost of the patent.arrow_forwardAccounting questionarrow_forwardMs. Sharon Washton was born 26 years ago in Bahn, Germany. She is the daughter of a Canadian High Commissioner serving in that country. However, Ms. Washton is now working in Prague, Czech Republic. The only income that she earns in the year is from her Prague marketing job, $55,000 annually, and is subject to income tax in Czech Republic. She has never visited Canada. Determine the residency status of Sharon Washtonarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

HR Basics: Compensation; Author: HR Basics: Compensation;https://www.youtube.com/watch?v=wZoRId6ADuo;License: Standard Youtube License