Intermediate Financial Management (MindTap Course List)

12th Edition

ISBN: 9781285850030

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 22, Problem 15MC

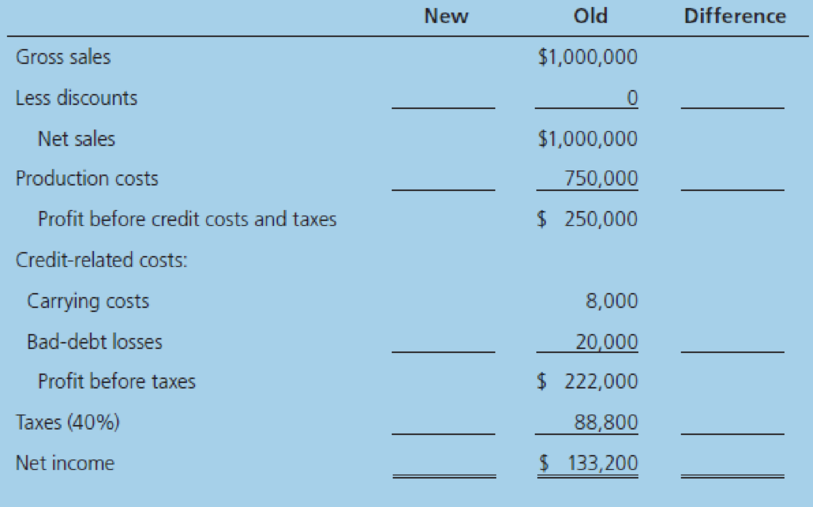

Suppose the firm makes the change but its competitors react by making similar changes to their own credit terms, with the net result being that gross sales remain at the current $1,000,000 level. What would be the impact on the firm’s after-tax profitability?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

You want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Silver

Research would let you make quarterly payments of $9,130 for 3 years at an interest rate of 3.27 percent per quarter. Your first

payment to Silver Research would be today. Island Research would let you make monthly payments of $3,068 for 3 years at an interest

rate of X percent per month. Your first payment to Island Research would be in 1 month. What is X?

Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do

not enter .0986 or 9.86%). Round your answer to at least 2 decimal places.

percent

Make sure you're using the right formula and rounding correctly I have asked this question four times and all the answers have been incorrect.

You plan to retire in 3 years with $911,880. You plan to withdraw $X per year for 18 years. The expected return is 18.56 percent per

year and the first regular withdrawal is expected in 3 years. What is X?

Input instructions: Round your answer to the nearest dollar.

$

Chapter 22 Solutions

Intermediate Financial Management (MindTap Course List)

Ch. 22 - Prob. 1QCh. 22 - Prob. 2QCh. 22 - Is it true that if a firm calculates its days...Ch. 22 - Firm A had no credit losses last year, but 1% of...Ch. 22 - Indicate by a (+), (), or (0) whether each of the...Ch. 22 - Cost of Bank Loan On March 1, Minnerly Motors...Ch. 22 - Cost of Bank Loan Mary Jones recently obtained an...Ch. 22 - Del Hawley, owner of Hawleys Hardware, is...Ch. 22 - Gifts Galore Inc. borrowed 1.5 million from...Ch. 22 - Relaxing Collection Efforts The Boyd Corporation...

Ch. 22 - Tightening Credit Terms Kim Mitchell, the new...Ch. 22 - Effective Cost of Short-Term Credit Yonge...Ch. 22 - Monitoring of Receivables

The Russ Fogler Company,...Ch. 22 - Prob. 10PCh. 22 - Prob. 1MCCh. 22 - Prob. 2MCCh. 22 - Prob. 3MCCh. 22 - Prob. 4MCCh. 22 - Prob. 5MCCh. 22 - Prob. 6MCCh. 22 - Prob. 7MCCh. 22 - Assume that it is now July of Year 1 and that the...Ch. 22 - Now assume that it is several years later. The...Ch. 22 - Prob. 10MCCh. 22 - Prob. 11MCCh. 22 - Prob. 12MCCh. 22 - Prob. 13MCCh. 22 - Prob. 14MCCh. 22 - Suppose the firm makes the change but its...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please make sure you're using the right formula and rounding correctly I have asked this question four times and all the answers have been incorrect.arrow_forwardYou want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Orange Furniture would let you make quarterly payments of $12,540 for 6 years at an interest rate of 1.26 percent per quarter. Your first payment to Orange Furniture would be in 3 months. River Furniture would let you make X monthly payments of $41,035 at an interest rate of 0.73 percent per month. Your first payment to River Furniture would be today. What is X? Input instructions: Round your answer to at least 2 decimal places.arrow_forwardYou want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Silver Leisure would let you make quarterly payments of $3,530 for 7 years at an interest rate of 2.14 percent per quarter. Your first payment to Silver Leisure would be today. Pond Leisure would let you make X monthly payments of $18,631 at an interest rate of 1.19 percent per month. Your first payment to Pond Leisure would be in 1 month. What is X? Input instructions: Round your answer to at least 2 decimal places.arrow_forward

- You plan to retire in 4 years with $659,371. You plan to withdraw $100,000 per year for 12 years. The expected return is X percent per year and the first regular withdrawal is expected in 4 years. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forwardUse the right formula and rounding correctly I have asked this question four times and all the answers have been incorrect.arrow_forwardWhat is the origin of Biblical ethics and how researchers can demonstrate Biblical ethics? How researchers can demonstrate Biblical ethics when conducting a literaturereview? How researchers can demonstrate Biblical ethics when communicating with aresearch team or university committee?arrow_forward

- Equipment is worth $339,976. It is expected to produce regular cash flows of $50,424 per year for 18 years and a special cash flow of $75,500 in 18 years. The cost of capital is X percent per year and the first regular cash flow will be produced today. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter 0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forwardYou want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Silver Leisure would let you make quarterly payments of $3,530 for 7 years at an interest rate of 2.14 percent per quarter. Your first payment to Silver Leisure would be today. Pond Leisure would let you make X monthly payments of $18,631 at an interest rate of 1.19 percent per month. Your first payment to Pond Leisure would be in 1 month. What is X? Input instructions: Round your answer to at least 2 decimal places.arrow_forwardYou plan to retire in 4 years with $659,371. You plan to withdraw $100,000 per year for 12 years. The expected return is X percent per year and the first regular withdrawal is expected in 4 years. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forward

- You want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Gray Media would let you make quarterly payments of $1,430 for 7 years at an interest rate of 1.59 percent per quarter. Your first payment to Gray Media would be today. River Media would let you make monthly payments of $X for 8 years at an interest rate of 1.46 percent per month. Your first payment to River Media would be in 1 month. What is X? Input instructions: Round your answer to the nearest dollar.arrow_forwardYou plan to retire in 8 years with $X. You plan to withdraw $114,200 per year for 21 years. The expected return is 17.92 percent per year and the first regular withdrawal is expected in 9 years. What is X? Input instructions: Round your answer to the nearest dollar. SAarrow_forward69 You plan to retire in 3 years with $911,880. You plan to withdraw $X per year for 18 years. The expected return is 18.56 percent per year and the first regular withdrawal is expected in 3 years. What is X? Input instructions: Round your answer to the nearest dollar.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Debits and credits explained; Author: The Finance Storyteller;https://www.youtube.com/watch?v=n-lCd3TZA8M;License: Standard Youtube License