Intermediate Financial Management (MindTap Course List)

12th Edition

ISBN: 9781285850030

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 22, Problem 8P

Monitoring of Receivables

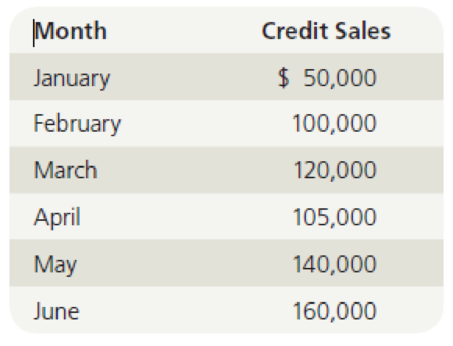

The Russ Fogler Company, a small manufacturer of cordless telephones, began operations on January 1. Its credit sales for the first 6 months of operations were as follows:

Throughout this entire period, the firm’s credit customers maintained a constant payments pattern: 209b paid in the month of sale, 309b paid in the first month following the sale, and 509b paid in the second month following the sale.

- a. What was Fogler’s receivables balance at the end of March and at the end of June?

- b. Assume 90 days per calendar quarter. What were the average daily sales (ADS) and days sales outstanding (DSO) for the first quarter and for the second quarter? What were the cumulative ADS and DSO for the first half-year?

- c. Construct an aging schedule as of June 30. Use account ages of 0-30, 31-60, and 61-90 days.

- d. Construct the uncollected balances schedule for the second quarter as of June 30.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

For EnPro, Please find the following values using the pdf (value line) provided . Please no excle.

When finding R, use the formula: Risk Free Rate + Beta * (Market Rate – Risk Free Rate)

The Risk Free Rate will always be 0.016 and the Market Rate will always be 0.136 for this problem. (For R, I got 17.2%, If I'm wrong can you please explain how)

On Value Line: DPO = All Div'ds to Net Profit

On Value Line: ROE = Return on Shr. Equity

On Value Line: P/E = Avg Ann'l P/E ratio*

The first 4 results should be rated to the year 2025 (r, Average DPO, Growth rate, Average P/E)

r= _

Average DPO= _

Growth rate= _

Average P/E= _

2026 EPS= _

2027 EPS= _

2028 EPS= _

2026 dividend= _

2027 dividend= _

2028 dividend= _

2028 price= _

2028 total cash flow Intrinsic value= _

You want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Gray

Media would let you make quarterly payments of $1,430 for 7 years at an interest rate of 1.59 percent per quarter. Your first payment to

Gray Media would be today. River Media would let you make monthly payments of $X for 8 years at an interest rate of 1.46 percent per

month. Your first payment to River Media would be in 1 month. What is X?

Input instructions: Round your answer to the nearest dollar.

59

You want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Gray

Media would let you make quarterly payments of $14,000 for 6 years at an interest rate of 1.50 percent per quarter. Your first payment

to Gray Media would be in 3 months. Island Media would let you make monthly payments of $X for 4 years at an interest rate of

1.35 percent per month. Your first payment to Island Media would be today. What is X?

Input instructions: Round your answer to the nearest dollar.

99

Chapter 22 Solutions

Intermediate Financial Management (MindTap Course List)

Ch. 22 - Prob. 1QCh. 22 - Prob. 2QCh. 22 - Is it true that if a firm calculates its days...Ch. 22 - Firm A had no credit losses last year, but 1% of...Ch. 22 - Indicate by a (+), (), or (0) whether each of the...Ch. 22 - Cost of Bank Loan On March 1, Minnerly Motors...Ch. 22 - Cost of Bank Loan Mary Jones recently obtained an...Ch. 22 - Del Hawley, owner of Hawleys Hardware, is...Ch. 22 - Gifts Galore Inc. borrowed 1.5 million from...Ch. 22 - Relaxing Collection Efforts The Boyd Corporation...

Ch. 22 - Tightening Credit Terms Kim Mitchell, the new...Ch. 22 - Effective Cost of Short-Term Credit Yonge...Ch. 22 - Monitoring of Receivables

The Russ Fogler Company,...Ch. 22 - Prob. 10PCh. 22 - Prob. 1MCCh. 22 - Prob. 2MCCh. 22 - Prob. 3MCCh. 22 - Prob. 4MCCh. 22 - Prob. 5MCCh. 22 - Prob. 6MCCh. 22 - Prob. 7MCCh. 22 - Assume that it is now July of Year 1 and that the...Ch. 22 - Now assume that it is several years later. The...Ch. 22 - Prob. 10MCCh. 22 - Prob. 11MCCh. 22 - Prob. 12MCCh. 22 - Prob. 13MCCh. 22 - Prob. 14MCCh. 22 - Suppose the firm makes the change but its...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You plan to retire in 7 years with $X. You plan to withdraw $54,100 per year for 15 years. The expected return is 13.19 percent per year and the first regular withdrawal is expected in 7 years. What is X? Input instructions: Round your answer to the nearest dollar. SAarrow_forwardYou plan to retire in 3 years with $911,880. You plan to withdraw $X per year for 18 years. The expected return is 18.56 percent per year and the first regular withdrawal is expected in 3 years. What is X? Input instructions: Round your answer to the nearest dollar. $ 59arrow_forwardYou just borrowed $203,584. You plan to repay this loan by making regular quarterly payments of X for 69 quarters and a special payment of $56,000 in 7 quarters. The interest rate on the loan is 1.94 percent per quarter and your first regular payment will be made today. What is X? Input instructions: Round your answer to the nearest dollar. $arrow_forward

- I got 1.62 but it's wrong why?arrow_forwardYou plan to retire in 8 years with $X. You plan to withdraw $114,200 per year for 21 years. The expected return is 17.92 percent per year and the first regular withdrawal is expected in 9 years. What is X? Input instructions: Round your answer to the nearest dollar. 69 $arrow_forwardHow much do you need in your account today if you expect to make quarterly withdrawals of $6,300 for 7 years and also make a special withdrawal of $25,700 in 7 years. The expected return for the account is 4.56 percent per quarter and the first regular withdrawal will be made today. Input instructions: Round your answer to the nearest dollar. $arrow_forward

- For EnPro, Please find the following values using the pdf (value line) provided . Please no excle. On Value Line: DPO = All Div'ds to Net Profit On Value Line: ROE = Return on Shr. Equity On Value Line: P/E = Avg Ann'l P/E ratio* r= _ Average DPO= _ Growth rate= _ Average P/E= _ 2026 EPS= _ 2027 EPS= _ 2028 EPS= _ 2026 dividend= _ 2027 dividend= _ 2028 dividend= _ 2028 price= _ 2028 total cash flow Intrinsic value= _arrow_forwardDon't used hand raitingarrow_forwardYou want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Gray Media would let you make quarterly payments of $14,000 for 6 years at an interest rate of 1.50 percent per quarter. Your first payment to Gray Media would be in 3 months. Island Media would let you make monthly payments of $X for 4 years at an interest rate of 1.35 percent per month. Your first payment to Island Media would be today. What is X? Input instructions: Round your answer to the nearest dollar. SA $arrow_forward

- You want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Gray Media would let you make quarterly payments of $1,430 for 7 years at an interest rate of 1.59 percent per quarter. Your first payment to Gray Media would be today. River Media would let you make monthly payments of $X for 8 years at an interest rate of 1.46 percent per month. Your first payment to River Media would be in 1 month. What is X? Input instructions: Round your answer to the nearest dollar. $arrow_forwardYou just borrowed $203,584. You plan to repay this loan by making regular quarterly payments of X for 69 quarters and a special payment of $56,000 in 7 quarters. The interest rate on the loan is 1.94 percent per quarter and your first regular payment will be made today. What is X? Input instructions: Round your answer to the nearest dollar. 59arrow_forwardYou plan to retire in 4 years with $698,670. You plan to withdraw $X per year for 17 years. The expected return is 17.95 percent per year and the first regular withdrawal is expected in 5 years. What is X? Input instructions: Round your answer to the nearest dollar. $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License