Connect Access Card for Fundamental Accounting Principles

23rd Edition

ISBN: 9781259693878

Author: John J Wild

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 21, Problem 4E

Exercise 21-4

Measurement of cost behavior using a scatter diagram

P1

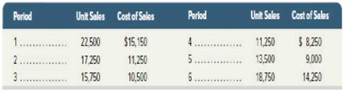

A company reports the Mowing information about its unit sales and its cost of sales. Each unit sells for $500. Use these data to prepare a scatter diagram.

Draw an estimated line of cost behavior and determine whether the cost appears to be variable, fixed, or mixed.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

For the year manufacturing overhead was?

need this general accounting subjects solutions

What is the percentage return on your investment of this financial accounting question?

Chapter 21 Solutions

Connect Access Card for Fundamental Accounting Principles

Ch. 21 - Prob. 1DQCh. 21 - Prob. 2DQCh. 21 - When output volume increases, do fixed costs per...Ch. 21 - Prob. 4DQCh. 21 - Prob. 5DQCh. 21 - Describe the contribution margin ratio in...Ch. 21 - Prob. 7DQCh. 21 - Prob. 8DQCh. 21 - Prob. 9DQCh. 21 - Prob. 10DQ

Ch. 21 - How does assuming that operating activity occurs...Ch. 21 - Prob. 12DQCh. 21 - Prob. 13DQCh. 21 - Prob. 14DQCh. 21 - Prob. 15DQCh. 21 - Prob. 16DQCh. 21 - Prob. 17DQCh. 21 - Prob. 18DQCh. 21 - Prob. 19DQCh. 21 - Prob. 20DQCh. 21 - Prob. 21DQCh. 21 - Prob. 22DQCh. 21 - Prob. 1QSCh. 21 - Prob. 2QSCh. 21 - Prob. 3QSCh. 21 - Prob. 4QSCh. 21 - Prob. 5QSCh. 21 - Prob. 6QSCh. 21 - Prob. 7QSCh. 21 - Prob. 8QSCh. 21 - Prob. 9QSCh. 21 - Prob. 10QSCh. 21 - Prob. 11QSCh. 21 - Prob. 12QSCh. 21 - Prob. 13QSCh. 21 - Prob. 14QSCh. 21 - Prob. 15QSCh. 21 - Prob. 16QSCh. 21 - Prob. 17QSCh. 21 - Prob. 18QSCh. 21 - Prob. 19QSCh. 21 - Prob. 20QSCh. 21 - Prob. 21QSCh. 21 - Prob. 1ECh. 21 - Prob. 2ECh. 21 - Prob. 3ECh. 21 - Exercise 21-4 Measurement of cost behavior using a...Ch. 21 - Prob. 5ECh. 21 - Prob. 6ECh. 21 - Prob. 7ECh. 21 - Prob. 8ECh. 21 - Prob. 9ECh. 21 - Prob. 10ECh. 21 - Prob. 11ECh. 21 - Prob. 12ECh. 21 - Prob. 13ECh. 21 - Prob. 14ECh. 21 - Prob. 15ECh. 21 - Prob. 16ECh. 21 - Prob. 17ECh. 21 - Prob. 18ECh. 21 - Prob. 19ECh. 21 - Prob. 20ECh. 21 - Prob. 21ECh. 21 - Prob. 22ECh. 21 - Prob. 23ECh. 21 - Prob. 24ECh. 21 - Prob. 25ECh. 21 - Prob. 26ECh. 21 - Prob. 27ECh. 21 - Prob. 1APSACh. 21 - Prob. 2APSACh. 21 - Prob. 3APSACh. 21 - Prob. 4APSACh. 21 - Prob. 5APSACh. 21 - Prob. 6APSACh. 21 - Prob. 7APSACh. 21 - Prob. 1BPSBCh. 21 - Prob. 2BPSBCh. 21 - Prob. 3BPSBCh. 21 - Prob. 4BPSBCh. 21 - Prob. 5BPSBCh. 21 - Prob. 6BPSBCh. 21 - Prob. 7BPSBCh. 21 - Prob. 21SPCh. 21 - Prob. 1BTNCh. 21 - Prob. 2BTNCh. 21 - Prob. 3BTNCh. 21 - Prob. 4BTNCh. 21 - Prob. 5BTNCh. 21 - Prob. 6BTNCh. 21 - Prob. 7BTNCh. 21 - Prob. 8BTNCh. 21 - Prob. 9BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hello tutor please provide this question solution general accountingarrow_forwardSummit Mechanical Co. has a normal capacity of 25,000 direct labor hours. The company's variable costs are $32,500, and its fixed costs are $18,750 when operating at normal capacity. What is its standard manufacturing overhead rate per unit? Want a solutionarrow_forwardCalculate the net sales revenue?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning

Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting Information Systems

Finance

ISBN:9781337552127

Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Markup and Markdown; Author: GreggU;https://www.youtube.com/watch?v=EFtodgI46UM;License: Standard Youtube License