Preparing a production cost report, second department with beginning W1P; decision making

Lake Bound uses three processes to manufacture lifts for personal watercrafts: forming a lift’s parts from galvanized steel, assembling the lift, and testing the completed lift. The lifts are transferred to finished goods before shipment to materials across the country.

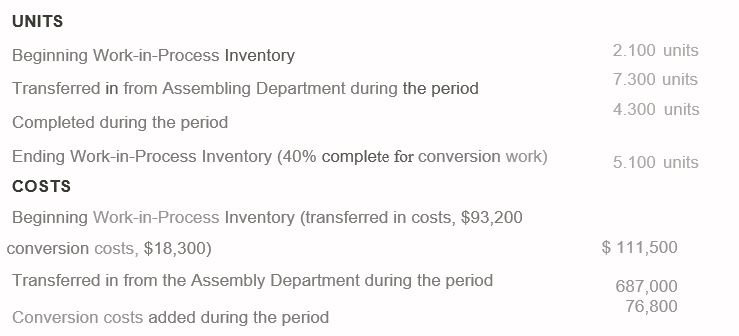

Lake Bound’s Testing Department requires no direct materials. Conversion costs are incurred evenly throughout the testing process. Other information follows for October 2016:

The cost transferred into Finished Goods Inventory is the cost of the lifts transferred

out of the Testing Department. Lake Bound uses weighted-average

Requirements

- Prepare a production cost report for the Testing Department.

- What is the cost per unit for lifts completed and transferred out to Finished Goods Inventory? Why would management he interested in this cost'

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

MyLab Accounting with Pearson eText -- Access Card -- for Horngren's Accounting

- Data for the two departments of Gurley Industries for September of the current fiscal year are as follows: Drawing Department Winding Department Work in process, September 1 4,900 units, 20% completed 3,000 units, 65% completed Completed and transferred to next processing department during September 67,100 units 66,000 units Work in process, September 30 3,700 units, 55% completed 4,100 units, 20% completed Production begins in the Drawing Department and finishes in the Winding Department. Question Content Area a. If all direct materials are placed in process at the beginning of production, determine the direct materials and conversion equivalent units of production for September for the Drawing Department. If an amount is zero, enter in "0". Drawing DepartmentDirect Materials and Conversion Equivalent Units of ProductionFor September Line Item Description Whole Units Direct MaterialsEquivalent Units ConversionEquivalent Units Inventory in process,…arrow_forwardThe charges to Work in Process—Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Work in Process-Assembly Department Transaction Debit amount Transaction Credit amount Bal., 3,000 units, 45% completed 6,900 To Finished Goods, 69,000 units ? Direct materials, 71,000 units @ $1.4 99,400 Direct labor 106,400 Factory overhead 41,440 Bal., ? units, 55% completed ? Cost per equivalent units of $1.40 for Direct Materials and $2.10 for Conversion Costs. a. Based on the above data, determine the different costs listed below. Line Item Description Amount 1. Cost of beginning work in process inventory completed this period fill in the blank 1 of 4$ 2. Cost of units transferred to finished goods during the period fill in the blank 2 of 4$ 3. Cost of ending work in process inventory fill in the blank 3 of 4$ 4. Cost per unit of…arrow_forwardHii expert please given correct answer financial accountingarrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,