South-western Federal Taxation 2018: Individual Income Taxes

41st Edition

ISBN: 9781337385886

Author: William H. Hoffman, James C. Young, William A. Raabe, David M. Maloney, Annette Nellen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 20, Problem 60P

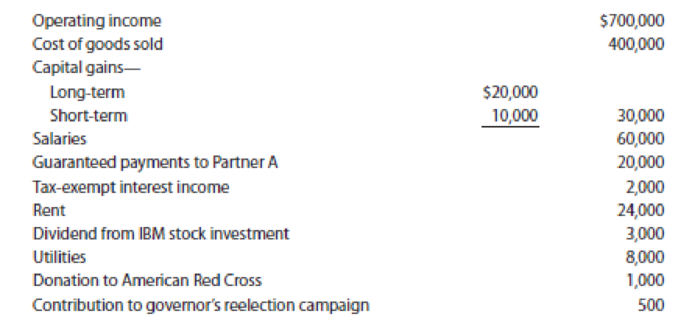

LO.9 The Pheasant

- a. What is Pheasant’s ordinary income (or loss)?

- b. What are Pheasant’s separately stated items?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Do companies maintain two sets of depreciation schedules, one for financial reporting and the other one for tax purposes?

none ??

Need help with this accounting questions

Chapter 20 Solutions

South-western Federal Taxation 2018: Individual Income Taxes

Ch. 20 - Prob. 1DQCh. 20 - LO.1 Sylvia and Trang want to enter into business...Ch. 20 - Prob. 3DQCh. 20 - Prob. 4DQCh. 20 - Prob. 5DQCh. 20 - Prob. 6DQCh. 20 - LO.3, 4, 5 Contrast the income taxation of...Ch. 20 - LO.3, 8, 9 The taxpayer has generated excess...Ch. 20 - Prob. 9DQCh. 20 - Prob. 10DQ

Ch. 20 - Prob. 11DQCh. 20 - Prob. 12DQCh. 20 - Prob. 13DQCh. 20 - Prob. 14DQCh. 20 - Prob. 15DQCh. 20 - Prob. 16DQCh. 20 - Prob. 17DQCh. 20 - Prob. 18DQCh. 20 - Prob. 19DQCh. 20 - Prob. 20DQCh. 20 - Prob. 21DQCh. 20 - Prob. 22DQCh. 20 - Prob. 23DQCh. 20 - Blaine, Cassie, and Kirstin are equal partners in...Ch. 20 - Prob. 25DQCh. 20 - LO.3 Green Corporation, a calendar year taxpayer,...Ch. 20 - Prob. 27CECh. 20 - Banana Corporation is a May 31 fiscal year...Ch. 20 - LO.4 Gold and Silver are two unrelated calendar...Ch. 20 - Maroon Corporation is a calendar year taxpayer....Ch. 20 - Prob. 32CECh. 20 - Prob. 33CECh. 20 - Prob. 34CECh. 20 - Drab Corporation, a calendar year S corporation,...Ch. 20 - Kim is a 40% shareholder in Taupe Corporation, a...Ch. 20 - Prob. 37CECh. 20 - LO.3, 4, 5 Using the legend provided below,...Ch. 20 - LO.3 Garnet has the following capital asset...Ch. 20 - LO.3, 8 Citron, a calendar year taxpayer, began...Ch. 20 - LO.3 Taupe, a calendar year taxpayer, has a...Ch. 20 - LO.3, 8 Robin had the following capital...Ch. 20 - Prob. 43PCh. 20 - Prob. 44PCh. 20 - Prob. 45PCh. 20 - Prob. 46PCh. 20 - Prob. 47PCh. 20 - Prob. 48PCh. 20 - Prob. 49PCh. 20 - Prob. 50PCh. 20 - Prob. 51PCh. 20 - Prob. 52PCh. 20 - Prob. 53PCh. 20 - Prob. 54PCh. 20 - During the current year, Thrasher (a calendar...Ch. 20 - Prob. 56PCh. 20 - Jim Olsen owns all of the stock in Drake, a...Ch. 20 - Prob. 58PCh. 20 - Prob. 59PCh. 20 - LO.9 The Pheasant Partnership reported the...Ch. 20 - Prob. 61PCh. 20 - Prob. 62PCh. 20 - Prob. 63PCh. 20 - Prob. 1RPCh. 20 - Prob. 2RPCh. 20 - Prob. 3RPCh. 20 - Prob. 5RPCh. 20 - On January 1, year 5, Olinto Corp., an accrual...Ch. 20 - Prob. 2CPACh. 20 - Prob. 3CPACh. 20 - Prob. 4CPACh. 20 - Prob. 5CPACh. 20 - Prob. 6CPACh. 20 - Prob. 7CPA

Additional Business Textbook Solutions

Find more solutions based on key concepts

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (5th Edition)

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

Much of risk management consists of reducing risky behavior. What kinds of risky behavior have you observed amo...

Understanding Business

A typical discounted price of a AAA battery is 0.75. It is designed to provide 1.5 volts and 1.0 amps for about...

Engineering Economy (17th Edition)

The Warm and Toasty Heating Oil Company used to deliver heating oil by sending trucks that printed out a ticket...

Essentials of MIS (13th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Carichem Company produces sanitation products after processing specialized chemicals. The following relates to its activities: 1 Kilogram of chemicals purchased for $4000 and with an additional $2000 is processed into 400 grams of Crystals and 80 litres of a Cleaning agent. At split-off, a gram of Crystal can be sold for $2 and the Cleaning agent can be sold for $8 per litre. At an additional cost of $800, Carichem can process the 400 grams of Crystal into 500 grams of Detergent that can be sold for $4 per gram. The 80 litres of Cleaning agent is packaged at an additional cost of $600 and made into 200 packs of Softener that can be sold for $4 per pack. Required: 1. Allocate the joint cost to the Detergent and the Softener using the following: a. Sales value at split-off method b. NRV method 2. Should Carichem have processed each of the products further? What effect does the allocation method have on this decision?arrow_forwardGeneral accountingarrow_forwardKindly help me with accounting questionsarrow_forward

- Don't use ai given answer accounting questionsarrow_forwardPlease provide correct solution this financial accounting questionarrow_forwardAllocate the two support departments’ costs to the two operating departments using the following methods: a. Direct method b. Step-down method (allocate HR first) c. Step-down method (allocate IS first) d. The Algebraic method.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

How to (Legally) Never Pay Taxes Again; Author: Next Level Life;https://www.youtube.com/watch?v=q63F1pBrUHA;License: Standard Youtube License