South-western Federal Taxation 2018: Individual Income Taxes

41st Edition

ISBN: 9781337385886

Author: William H. Hoffman, James C. Young, William A. Raabe, David M. Maloney, Annette Nellen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 20, Problem 38P

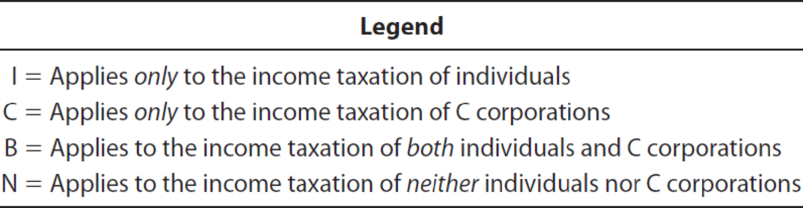

LO.3, 4, 5 Using the legend provided below, classify each statement under 2018 tax law.

- a. A foreign tax credit is available.

- b. The deduction of charitable contributions is subject to percentage limitation(s).

- c. Excess charitable contributions can be carried forward for five years.

- d. On the contribution of inventory to charity, the full amount of any appreciation can be claimed as a deduction.

- e. Excess capital losses can be carried forward indefinitely.

- f. Excess capital losses cannot be carried back.

- g. A net short-term

capital gain is subject to the same tax rate as ordinary income. - h. The deduction for qualified business income may be available.

- i. A dividends received deduction is available.

- j. The like-kind provisions of § 1031 are available.

- k. In 2018, a taxpayer with a fiscal year of May 1–April 30 has a due date for filing a Federal income tax return of July 15.

- l. Estimated Federal income tax payments may be required.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

L.L. Bean operates two factories that produce its popular Bean boots (also known as "duck boots") in its home state of Maine. Since L.L. Bean prides itself on manufacturing its boots in Maine and not outsourcing, backorders for its boots can be high. In 2014, L.L. Bean sold about 450,000 pairs of the boots. At one point during 2014, it had a backorder level of about 100,000 pairs of boots. L.L. Bean can manufacture about 2,200 pairs of its duck boots each day with its factories running 24/7.

In 2015, L.L. Bean expects to sell more than 500,000 pairs of its duck boots. As of late November 2015, the backorder quantity for Bean Boots was estimated to be about 50,000 pairs.

Question:

The standard rate per direct labor hour should

L.L. Bean operates two factories that produce its popular Bean boots (also known as "duck boots") in its home state of Maine. Since L.L. Bean prides itself on manufacturing its boots in Maine and not outsourcing, backorders for its boots can be high. In 2014, L.L. Bean sold about 450,000 pairs of the boots. At one point during 2014, it had a backorder level of about 100,000 pairs of boots. L.L. Bean can manufacture about 2,200 pairs of its duck boots each day with its factories running 24/7.

In 2015, L.L. Bean expects to sell more than 500,000 pairs of its duck boots. As of late November 2015, the backorder quantity for Bean Boots was estimated to be about 50,000 pairs.

Question:

1. Assume that 5% of the L.L. Bean boots are returned by customers for various reasons. L. Bean has a 100% refund policy for returns, no matter what the reason. What would the journal entry be to accrue L.L. Bean's sales returns for this one pair of boots? (Note: L.L. Bean most likely will make…

Chapter 20 Solutions

South-western Federal Taxation 2018: Individual Income Taxes

Ch. 20 - Prob. 1DQCh. 20 - LO.1 Sylvia and Trang want to enter into business...Ch. 20 - Prob. 3DQCh. 20 - Prob. 4DQCh. 20 - Prob. 5DQCh. 20 - Prob. 6DQCh. 20 - LO.3, 4, 5 Contrast the income taxation of...Ch. 20 - LO.3, 8, 9 The taxpayer has generated excess...Ch. 20 - Prob. 9DQCh. 20 - Prob. 10DQ

Ch. 20 - Prob. 11DQCh. 20 - Prob. 12DQCh. 20 - Prob. 13DQCh. 20 - Prob. 14DQCh. 20 - Prob. 15DQCh. 20 - Prob. 16DQCh. 20 - Prob. 17DQCh. 20 - Prob. 18DQCh. 20 - Prob. 19DQCh. 20 - Prob. 20DQCh. 20 - Prob. 21DQCh. 20 - Prob. 22DQCh. 20 - Prob. 23DQCh. 20 - Blaine, Cassie, and Kirstin are equal partners in...Ch. 20 - Prob. 25DQCh. 20 - LO.3 Green Corporation, a calendar year taxpayer,...Ch. 20 - Prob. 27CECh. 20 - Banana Corporation is a May 31 fiscal year...Ch. 20 - LO.4 Gold and Silver are two unrelated calendar...Ch. 20 - Maroon Corporation is a calendar year taxpayer....Ch. 20 - Prob. 32CECh. 20 - Prob. 33CECh. 20 - Prob. 34CECh. 20 - Drab Corporation, a calendar year S corporation,...Ch. 20 - Kim is a 40% shareholder in Taupe Corporation, a...Ch. 20 - Prob. 37CECh. 20 - LO.3, 4, 5 Using the legend provided below,...Ch. 20 - LO.3 Garnet has the following capital asset...Ch. 20 - LO.3, 8 Citron, a calendar year taxpayer, began...Ch. 20 - LO.3 Taupe, a calendar year taxpayer, has a...Ch. 20 - LO.3, 8 Robin had the following capital...Ch. 20 - Prob. 43PCh. 20 - Prob. 44PCh. 20 - Prob. 45PCh. 20 - Prob. 46PCh. 20 - Prob. 47PCh. 20 - Prob. 48PCh. 20 - Prob. 49PCh. 20 - Prob. 50PCh. 20 - Prob. 51PCh. 20 - Prob. 52PCh. 20 - Prob. 53PCh. 20 - Prob. 54PCh. 20 - During the current year, Thrasher (a calendar...Ch. 20 - Prob. 56PCh. 20 - Jim Olsen owns all of the stock in Drake, a...Ch. 20 - Prob. 58PCh. 20 - Prob. 59PCh. 20 - LO.9 The Pheasant Partnership reported the...Ch. 20 - Prob. 61PCh. 20 - Prob. 62PCh. 20 - Prob. 63PCh. 20 - Prob. 1RPCh. 20 - Prob. 2RPCh. 20 - Prob. 3RPCh. 20 - Prob. 5RPCh. 20 - On January 1, year 5, Olinto Corp., an accrual...Ch. 20 - Prob. 2CPACh. 20 - Prob. 3CPACh. 20 - Prob. 4CPACh. 20 - Prob. 5CPACh. 20 - Prob. 6CPACh. 20 - Prob. 7CPA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume that 5% of the L.L. Bean boots are returned by customers for various reasons. L. Bean has a 100% refund policy for returns, no matter what the reason. What would the journal entry be to accrue L.L. Bean's sales returns for this one pair of boots? (Note: L.L. Bean most likely will make monthly/quarterly adjusting entries for the total sales returns accruals, but here we will just look at the accrual associated with the sale of one pair of boots.)arrow_forwardWhat was the percentage rate of return on plan aasetsarrow_forwardQuestion 25arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Operating Loss Carryback and Carryforward; Author: SuperfastCPA;https://www.youtube.com/watch?v=XiYhgzSGDAk;License: Standard Youtube License