Concept explainers

Change in inventory methods

• LO20–2

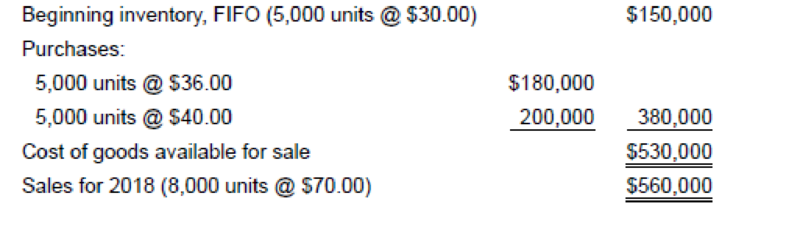

The Rockwell Corporation uses a periodic inventory system and has used the FIFO cost method since inception of the company in 1979. In 2018, the company decided to change to the average cost method. Data for 2018 are as follows:

Additional Information:

1. The company’s effective income tax rate is 40% for all years.

2. If the company had used the average cost method prior to 2018, ending inventory for 2017 would have been $130,000.

3. 7,000 units remained in inventory at the end of 2018.

Required:

1. Prepare the

2. In the 2018–2016 comparative financial statements, what will be the amounts of cost of goods sold and inventory reported for 2018?

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

INTERMEDIATE ACCOUNTING(LL)-W/CONNECT

- I am looking for the correct answer to this financial accounting question with appropriate explanations.arrow_forwardGive correct answer Global Fitness LLC reported a debt-to-equity ratio of 1.5 times at the end of 2024. If the firm's total assets at year-end were $36.8 million, how much of their assets are financed with equity?arrow_forwardCan you help me solve this financial accounting problem using the correct accounting process?arrow_forward

- Global Fitness LLC reported a debt-to-equity ratio of 1.5 times at the end of 2024. If the firm's total assets at year-end were $36.8 million, how much of their assets are financed with equity?a. $14.72 millionb. $22.08 millionc. $9.2 milliond. $55.2 million i need helparrow_forwardPlease provide the accurate answer to this financial accounting problem using valid techniques.arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning