Warranty expense

• LO20–4

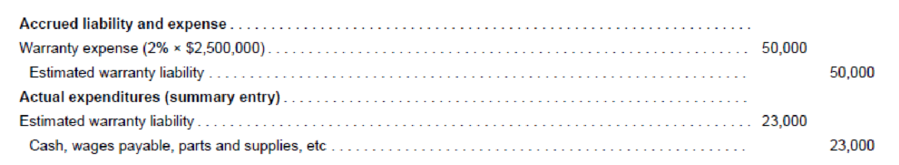

Woodmier Lawn Products introduced a new line of commercial sprinklers in 2017 that carry a one-year warranty against manufacturer’s defects. Because this was the first product for which the company offered a warranty, trade publications were consulted to determine the experience of others in the industry. Based on that experience, warranty costs were expected to approximate 2% of sales. Sales of the sprinklers in 2017 were $2,500,000. Accordingly, the following entries relating to the contingency for warranty costs were recorded during the first year of selling the product:

In late 2018, the company’s claims experience was evaluated and it was determined that claims were far more than expected—3% of sales rather than 2%.

Required:

1. Assuming sales of the sprinklers in 2018 were $3,600,000 and warranty expenditures in 2018 totaled $88,000, prepare any

2. Assuming sales of the sprinklers were discontinued after 2017, prepare any journal entries in 2018 related to the warranty.

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

INTERMEDIATE ACCOUNTING(LL)-W/CONNECT

- Please solve this problem general accounting questionarrow_forwardThe Cavy Company estimates that the factory overhead for the following year will be $1,620,000. The company has decided that the basis for applying factory overhead should be machine hours, which is estimated to be 45,000 hours. Calculate the predetermined overhead rate to apply factory overhead.arrow_forwardAnswer? Financial accounting questionarrow_forward

- In December 2019, Solar Systems Inc. management establishes the 2020 predetermined overhead rate based on direct labor cost. The information used in setting this rate includes estimates that the company will incur $920,000 of overhead costs and $600,000 of direct labor cost in year 2020. During March 2020, Solar Systems began and completed Job No. 20-78. What is the predetermined overhead rate for year 2020?arrow_forwardGive me Solutionarrow_forwardPlease see an attachment for details financial accounting questionarrow_forward

- Titan Corporation issued $750,000 of 8-year bonds at a 6% annual interest rate, payable semiannually. • What is the total interest expense over the life of the bonds? • What is the semiannual interest payment?arrow_forwardHello tutor please provide this question solution general accountingarrow_forwardFinancial accountingarrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning