Concept explainers

P 20-2

Change in principle; change in method of accounting for long-term construction

• LO20–2

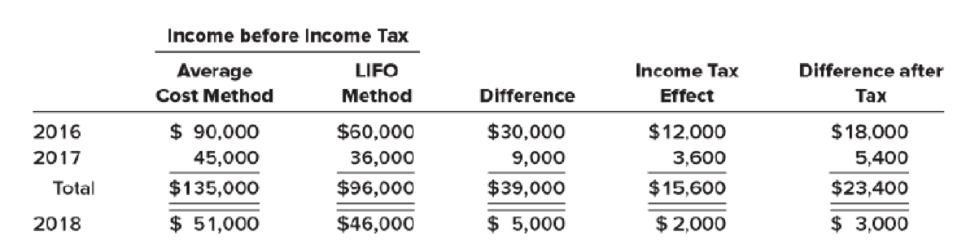

The Pyramid Company has used the LIFO method of accounting for inventory during its first two years of operation, 2016 and 2017. At the beginning of 2018, Pyramid decided to change to the average cost method for both tax and financial reporting purposes. The following table presents information concerning the change for 2016–2018. The income tax rate for all years is 40%.

Pyramid issued 50,000 $1 par, common shares for $230,000 when the business began, and there have been no changes in paid-in capital since then. Dividends were not paid the first year, but $10,000 cash dividends were paid in both 2017 and 2018.

Required:

- 1. Prepare the

journal entry to record the change in accounting principle. - 2. Prepare the 2018–2017 comparative income statements beginning with income before income taxes.

- 3. Prepare the 2018–2017 comparative statements of shareholders’ equity. [Hint: The 2016 statements reported

retained earnings of $36,000. This is $60,000 − ($60,000 × 40%).]

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

INTERMEDIATE ACCOUNTING(LL)-W/CONNECT

- Taron Productions has the following information from its process costing system: beginning work-in-process of 4,800 units (60% complete for conversion costs), 22,500 units started during the period, and ending work-in-process of 3,900 units (40% complete for conversion costs). Using the weighted average method, what are the equivalent units for conversion costs for the period?arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forward

- Please provide the solution to this financial accounting question using proper accounting principles.arrow_forwardCan you help me solve this general accounting problem using the correct accounting process?arrow_forwardWhat is the amount includible in income in the first year of withdrawals assuming 12 monthly payments?arrow_forward

- I need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forward

- Please give me answer with accounting questionarrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forwardGinga Marketing Group is a digital marketing business. At the end of its accounting period, December 31, 2023, Ginga had assets of $875,000 and liabilities of $320,000. Determine the net income (or loss) during 2024, assuming that as of December 31, 2024, assets were $960,000, liabilities were $290,000, and no additional capital stock was issued or dividends paid.arrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning