Financial & Managerial Accounting

13th Edition

ISBN: 9781285866307

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 20, Problem 20.4APR

Salespersons' report and analysis

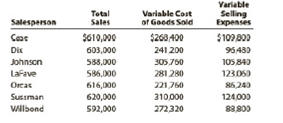

Walthman Industries Inc. employs seven salespersons to sell and distribute- its product throughout the state. Data taken from reports received from the .salespersons during the year ended December 31 are as follows:

Instructions

- 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. (Round whole percent to one digit after decimal point.)

- 2. Which salesperson generated the highest contribution margin ratio for the year and why?

- 3. Briefly list factors other than contribution margin that should be considered in evaluating the performance of salespersons.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

hi expert please help me financial accounting

need help this questions

Selected comparative financial statements of Korbin Company follow.

Sales

KORBIN COMPANY

Comparative Income Statements

For Years Ended December 31

2021

2020

$ 512,008 $ 392,240

2019

$ 272,200

Cost of goods sold

308,229

245,542

174,208

Gross profit

203,779

146,698

97,992

Selling expenses

72,705

54,129

35,930

Administrative expenses

46,081

34,517

22,593

Total expenses

118,786

88,646

58,523

Income before taxes

.84,993

58,052

39,469

Income tax expense

15,809

11,901

8,012

Net income

$ 69,184

$ 46,151

$ 31,457

KORBIN COMPANY

Comparative Balance Sheets

Assets

Current assets

Long-term investments

Plant assets, net

Total assets

Liabilities and Equity

Current liabilities

Common stock

Other paid-in capital

Retained earnings

December 31

2021

2020

2019

$ 54,370

0

$ 36,390

600

$ 48,645

3,870

99,436

90,776

53,339

Total liabilities and equity

$ 153,806 $ 127,766 $ 105,854

$ 22,456 $ 19,037

$ 18,524

68,000

68,000

50,000

8,500

8,500

5,556

54,850

32,229

31,774

$ 153,806 $ 127,766 $ 105,854

Chapter 20 Solutions

Financial & Managerial Accounting

Ch. 20 - What types of costs are customarily included in...Ch. 20 - Which type of manufacturing cost (direct...Ch. 20 - Which of the following costs would be included in...Ch. 20 - In the variable costing income statement, how are...Ch. 20 - Since all costs of operating a business are...Ch. 20 - Discuss how financial data prepared on the basis...Ch. 20 - Why might management analyze product...Ch. 20 - Explain why rewarding sales personnel on the basis...Ch. 20 - Discuss the two factors affecting both sales and...Ch. 20 - How is the quantity factor for an increase or a...

Ch. 20 - Explain why service companies use different...Ch. 20 - Prob. 20.1APECh. 20 - Variable costing Marley Company has the following...Ch. 20 - Variable costingproduction exceeds sales Fixed...Ch. 20 - Variable costingproduction exceeds sales Fixed...Ch. 20 - Variable costingsales exceed production The...Ch. 20 - Variable costing sales exceed production The...Ch. 20 - Analyzing income under absorption and variable...Ch. 20 - Analyzing income under absorption and variable...Ch. 20 - Contribution margin by segment The following...Ch. 20 - Contribution margin by segment The following...Ch. 20 - Contribution margin analysis The actual price for...Ch. 20 - Contribution margin analysis The actual variable...Ch. 20 - Inventory valuation under absorption costing and...Ch. 20 - Income statements under absorption costing and...Ch. 20 - Income statements under absorption costing and...Ch. 20 - Cost of goods manufactured, using variable costing...Ch. 20 - Variable costing income statement On June 50, the...Ch. 20 - Absorption costing income statement On July 31,...Ch. 20 - Variable costing income statement The following...Ch. 20 - Estimated income statements, using absorption and...Ch. 20 - Variable and absorption costing Ansara Company had...Ch. 20 - Variable and absorption costingthree products...Ch. 20 - Prob. 20.11EXCh. 20 - Product profitability analysis Power Train Sports...Ch. 20 - Territory and product profitability analysis Coast...Ch. 20 - Prob. 20.14EXCh. 20 - Segment profitability analysis The marketing...Ch. 20 - Prob. 20.16EXCh. 20 - Prob. 20.17EXCh. 20 - Prob. 20.18EXCh. 20 - Contribution margin analysis variable costs Based...Ch. 20 - Variable costing income statement for a service...Ch. 20 - Contribution margin reporting and analysis for a...Ch. 20 - Variable costing income statement and contribution...Ch. 20 - Prob. 20.1APRCh. 20 - Income statements under absorption costing and...Ch. 20 - Absorption and variable costing income statements...Ch. 20 - Salespersons' report and analysis Walthman...Ch. 20 - Prob. 20.5APRCh. 20 - Contribution margin analysis Dozier Industries...Ch. 20 - Absorption and variable costing income statements...Ch. 20 - Income statements under absorption costing and...Ch. 20 - Absorption and variable costing income statements...Ch. 20 - Salespersons' report and analysis Pachec Inc....Ch. 20 - Prob. 20.5BPRCh. 20 - Contribution margin analysis Mathews Company...Ch. 20 - Prob. 20.1CPCh. 20 - Prob. 20.3CPCh. 20 - Prob. 20.4CPCh. 20 - Prob. 20.5CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- provide correct answer mearrow_forwardgeneral accountingarrow_forwardE3-17 (Algo) Calculating Equivalent Units, Unit Costs, and Cost Assigned (Weighted-Average Method) [LO 3-2] Vista Vacuum Company has the following production Information for the month of March. All materials are added at the beginning of the manufacturing process. Units . • Beginning Inventory of 3,500 units that are 100 percent complete for materials and 28 percent complete for conversion. 14,600 units started during the period. Ending Inventory of 4,200 units that are 14 percent complete for conversion. Manufacturing Costs Beginning Inventory was $20,500 ($10,100 materials and $10,400 conversion costs). Costs added during the month were $28,400 for materials and $51,500 for conversion ($26.700 labor and $24,800 applied overhead). Assume the company uses Weighted-Average Method. Required: 1. Calculate the number of equivalent units of production for materials and conversion for March. 2. Calculate the cost per equivalent unit for materials and conversion for March. 3. Determine the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License