Concept explainers

Backflush, two trigger points, materials purchase and sale (continuation of 20-37). Assume the same facts for Acton Corporation as in Problem 20-37, except that now assume Acton uses a JIT production system and backflush costing with two trigger points for making entries in the accounting system:

- Purchase of direct materials

- Sale of finished goods

The inventory account is confined solely to direct materials, whether these materials are in a storeroom, in work in process, or in finished goods. No conversion costs are inventoried. They are allocated to the units sold at standard costs. Any under- or overallocated conversion costs are written off monthly to Cost of Goods Sold.

- 1. Prepare summary

journal entries for August, including the disposition of under- or overallocated conversion costs. Acton has no direct materials variances.

Required

- 2.

Post the entries in requirement 1 to T-accounts for Inventory Control, Conversion Costs Control, Conversion Costs Allocated, and Cost of Goods Sold.

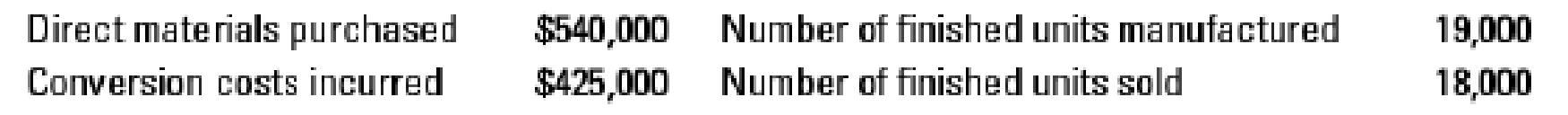

20-37 Backflush costing and JIT production. The Acton Corporation manufactures electrical meters. For August, there were no beginning inventories of direct materials and no beginning or ending work in process. Acton uses a JIT production system and backflush costing with three trigger points for making entries in the accounting system:

- Purchase of direct materials

- Completion of good finished units of product

- Sale of finished goods

Acton’s August

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Don't use ai given answer accounting questionsarrow_forwardSUBJECT:- GENERAL ACCOUNT Noninventoriable costs are charged against. in which the revenue is earned. a. sales b. production c. managerial d. investment revenue in the periodarrow_forwardHi expert please give me answer general accounting questionarrow_forward

- How many units were started in production? General Accountarrow_forwardCorrect Answer for this. General Accountarrow_forwardGeneral Account - At the beginning of the year, Morales Company had total assets of $845,000 and total liabilities of $532,000. lf total assets increased $150,000 during the year and total liabilities decreased $75,000, what is the amount of stockholders' equity at the end of the year?arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning