FUNDAMENTALS OF COST ACCOUNTING

6th Edition

ISBN: 9781266742040

Author: LANEN

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 73P

Reconstruct Financial Statements

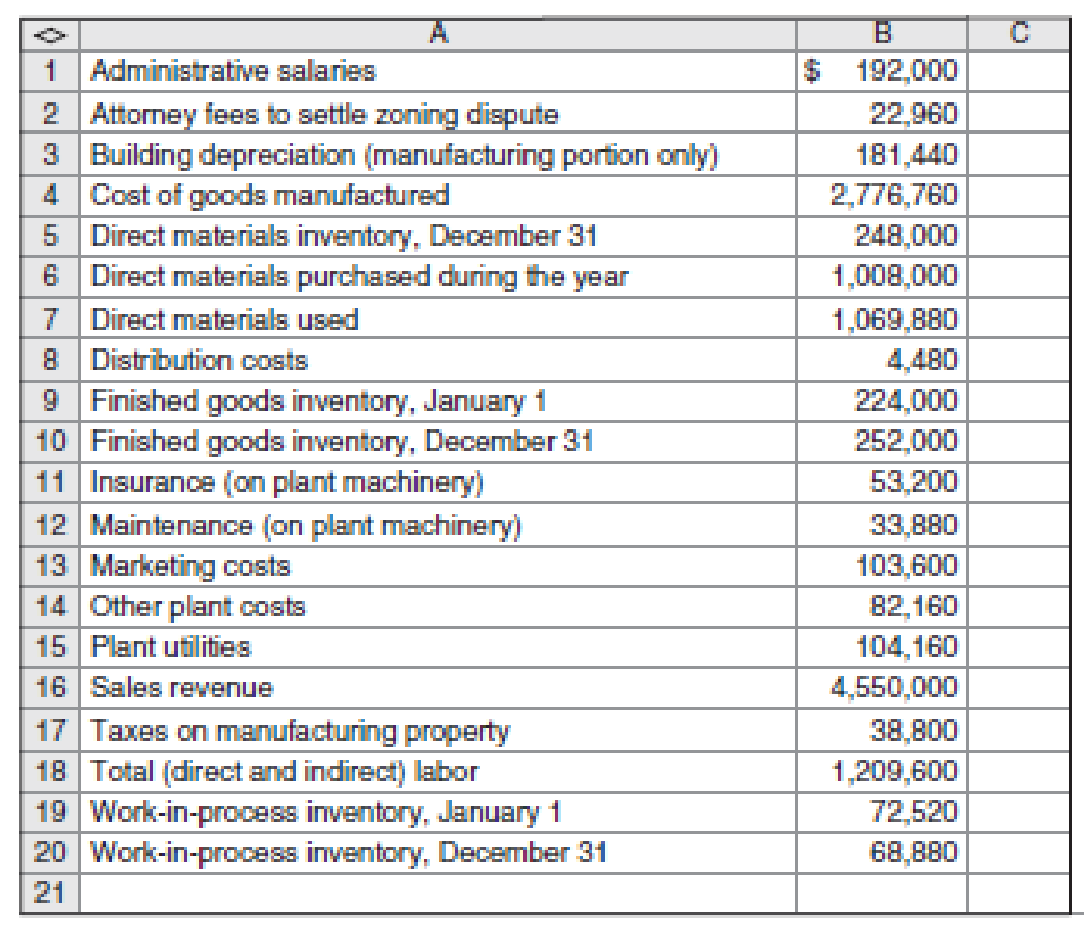

San Ysidro Company manufactures hiking equipment. The company’s administrative and manufacturing operations share the company’s only building. Eighty percent of the building is used for manufacturing and the remainder is used for administrative activities. Indirect labor is 8 percent of direct labor.

The cost accountant at San Ysidro has compiled the following information for the year ended December 31:

Required

Prepare a cost of goods manufactured and sold statement and an income statement.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

please answer part d. include rates for amortization and MACRS.

General Accounting question

Provide correct option general Accounting

Chapter 2 Solutions

FUNDAMENTALS OF COST ACCOUNTING

Ch. 2 - What is the difference in meaning between the...Ch. 2 - What is the difference between product costs and...Ch. 2 - What is the difference between outlay cost and...Ch. 2 - Prob. 4RQCh. 2 - Is cost-of-goods sold an expense?Ch. 2 - Is cost-of-goods a product cost or a period cost?Ch. 2 - What are the similarities between the Direct...Ch. 2 - What are the three categories of product cost in a...Ch. 2 - Prob. 9RQCh. 2 - Prob. 10RQ

Ch. 2 - What do the terms step costs and semivariable...Ch. 2 - What do the terms variable costs and fixed costs...Ch. 2 - How does a value income statement differ from a...Ch. 2 - Why is a value income statement useful to...Ch. 2 - Materials and labor are always direct costs, and...Ch. 2 - Prob. 16CADQCh. 2 - In evaluating product profitability, we can ignore...Ch. 2 - Prob. 18CADQCh. 2 - The friend in question 2-18 decides that she does...Ch. 2 - Consider a digital music service such as those...Ch. 2 - Consider a ride-sharing service such as Uber or...Ch. 2 - Pick a unit of a hospital (for example, intensive...Ch. 2 - The dean of Midstate University Business School is...Ch. 2 - Prob. 24CADQCh. 2 - Prob. 25CADQCh. 2 - Basic Concepts For each of the following...Ch. 2 - Basic Concepts For each of the following costs...Ch. 2 - Basic Concepts For each of the following costs...Ch. 2 - Basic Concepts Place the number of the appropriate...Ch. 2 - Basic Concepts Intercontinental, Inc., provides...Ch. 2 - Prob. 31ECh. 2 - For each of the following costs incurred in a...Ch. 2 - Basic Concepts For each of the following costs...Ch. 2 - Basic Concepts The following data apply to the...Ch. 2 - Cost AllocationEthical Issues In one of its...Ch. 2 - Cost AllocationEthical Issues Star Buck, a coffee...Ch. 2 - Prepare Statements for a Manufacturing Company The...Ch. 2 - Prepare Statements for a Service Company Chucks...Ch. 2 - Prepare Statements for a Service Company Where2...Ch. 2 - Prepare Statements for a Service Company The...Ch. 2 - Prepare Statements for a Service Company Lead!...Ch. 2 - Prepare Statements for a Manufacturing Company The...Ch. 2 - Basic Concepts The following data refer to one...Ch. 2 - Basic Concepts The following data refers to one...Ch. 2 - Prepare Statements for a Merchandising Company The...Ch. 2 - Prepare Statements for a Merchandising Company...Ch. 2 - Cost Behavior and Forecasting Dayton, Inc....Ch. 2 - Sophia’s Restaurant served 5,000 meals last...Ch. 2 - Prob. 49ECh. 2 - Components of Full Costs Madrid Corporation has...Ch. 2 - Prob. 51ECh. 2 - Components of Full Costs Larcker Manufacturings...Ch. 2 - Prob. 53ECh. 2 - Gross Margin and Contribution Margin Income...Ch. 2 - Gross Margin and Contribution Margin Income...Ch. 2 - Value Income Statement Ralphs Restaurant has the...Ch. 2 - Value Income Statement DeLuxe Limo Service has the...Ch. 2 - Cost Concepts The following information comes from...Ch. 2 - Cost Concepts The controller at Lawrence...Ch. 2 - Cost Concepts Columbia Products produced and sold...Ch. 2 - Prepare Statements for a Manufacturing Company...Ch. 2 - Prepare Statements for a Manufacturing Company...Ch. 2 - Prepare Statements for a Manufacturing Company The...Ch. 2 - Cost Allocation with Cost Flow Diagram Coastal...Ch. 2 - Cost Allocation with Cost Flow Diagram Wayne...Ch. 2 - Cost Allocation with Cost Flow Diagram The library...Ch. 2 - Greenfield Consultants conducts analyses of public...Ch. 2 - Consider the Business Application, “Indirect Costs...Ch. 2 - Find the Unknown Information After a computer...Ch. 2 - Find the Unknown Information Just before class...Ch. 2 - Cost Allocation and Regulated Prices The City of...Ch. 2 - Koufax Materials Corporation produces plastic...Ch. 2 - Reconstruct Financial Statements San Ysidro...Ch. 2 - Westlake, Inc., produces metal fittings for the...Ch. 2 - Finding Unknowns Marys Mugs produces and sells...Ch. 2 - Finding Unknowns BST Partners has developed a new...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Job Cost Sheet - Job Cost Accounting System; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=ElD8nKNXE1I;License: Standard Youtube License