FUNDAMENTALS OF COST ACCOUNTING

6th Edition

ISBN: 9781266742040

Author: LANEN

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 63P

Prepare Statements for a Manufacturing Company

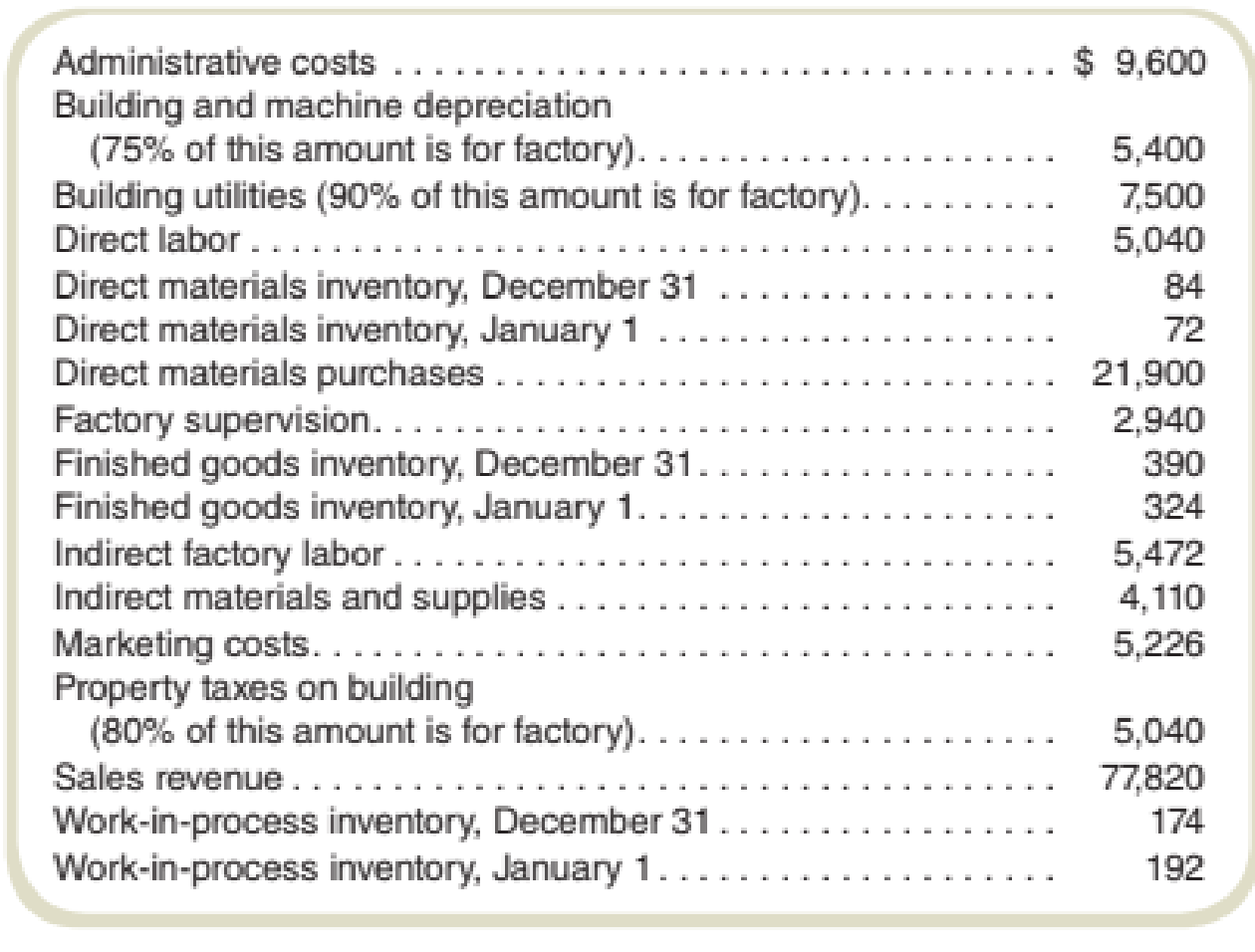

The administrative offices and manufacturing plant of Billings Tool & Die share the same building. The following information (in $000s) appears in the accounting records for last year:

Required

Prepare an income statement with a supporting cost of goods sold statement.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Calculate GP ratio round answers to decimal place

What is the gross profit percentage for this period

The company's gross margin percentage is ?

Chapter 2 Solutions

FUNDAMENTALS OF COST ACCOUNTING

Ch. 2 - What is the difference in meaning between the...Ch. 2 - What is the difference between product costs and...Ch. 2 - What is the difference between outlay cost and...Ch. 2 - Prob. 4RQCh. 2 - Is cost-of-goods sold an expense?Ch. 2 - Is cost-of-goods a product cost or a period cost?Ch. 2 - What are the similarities between the Direct...Ch. 2 - What are the three categories of product cost in a...Ch. 2 - Prob. 9RQCh. 2 - Prob. 10RQ

Ch. 2 - What do the terms step costs and semivariable...Ch. 2 - What do the terms variable costs and fixed costs...Ch. 2 - How does a value income statement differ from a...Ch. 2 - Why is a value income statement useful to...Ch. 2 - Materials and labor are always direct costs, and...Ch. 2 - Prob. 16CADQCh. 2 - In evaluating product profitability, we can ignore...Ch. 2 - Prob. 18CADQCh. 2 - The friend in question 2-18 decides that she does...Ch. 2 - Consider a digital music service such as those...Ch. 2 - Consider a ride-sharing service such as Uber or...Ch. 2 - Pick a unit of a hospital (for example, intensive...Ch. 2 - The dean of Midstate University Business School is...Ch. 2 - Prob. 24CADQCh. 2 - Prob. 25CADQCh. 2 - Basic Concepts For each of the following...Ch. 2 - Basic Concepts For each of the following costs...Ch. 2 - Basic Concepts For each of the following costs...Ch. 2 - Basic Concepts Place the number of the appropriate...Ch. 2 - Basic Concepts Intercontinental, Inc., provides...Ch. 2 - Prob. 31ECh. 2 - For each of the following costs incurred in a...Ch. 2 - Basic Concepts For each of the following costs...Ch. 2 - Basic Concepts The following data apply to the...Ch. 2 - Cost AllocationEthical Issues In one of its...Ch. 2 - Cost AllocationEthical Issues Star Buck, a coffee...Ch. 2 - Prepare Statements for a Manufacturing Company The...Ch. 2 - Prepare Statements for a Service Company Chucks...Ch. 2 - Prepare Statements for a Service Company Where2...Ch. 2 - Prepare Statements for a Service Company The...Ch. 2 - Prepare Statements for a Service Company Lead!...Ch. 2 - Prepare Statements for a Manufacturing Company The...Ch. 2 - Basic Concepts The following data refer to one...Ch. 2 - Basic Concepts The following data refers to one...Ch. 2 - Prepare Statements for a Merchandising Company The...Ch. 2 - Prepare Statements for a Merchandising Company...Ch. 2 - Cost Behavior and Forecasting Dayton, Inc....Ch. 2 - Sophia’s Restaurant served 5,000 meals last...Ch. 2 - Prob. 49ECh. 2 - Components of Full Costs Madrid Corporation has...Ch. 2 - Prob. 51ECh. 2 - Components of Full Costs Larcker Manufacturings...Ch. 2 - Prob. 53ECh. 2 - Gross Margin and Contribution Margin Income...Ch. 2 - Gross Margin and Contribution Margin Income...Ch. 2 - Value Income Statement Ralphs Restaurant has the...Ch. 2 - Value Income Statement DeLuxe Limo Service has the...Ch. 2 - Cost Concepts The following information comes from...Ch. 2 - Cost Concepts The controller at Lawrence...Ch. 2 - Cost Concepts Columbia Products produced and sold...Ch. 2 - Prepare Statements for a Manufacturing Company...Ch. 2 - Prepare Statements for a Manufacturing Company...Ch. 2 - Prepare Statements for a Manufacturing Company The...Ch. 2 - Cost Allocation with Cost Flow Diagram Coastal...Ch. 2 - Cost Allocation with Cost Flow Diagram Wayne...Ch. 2 - Cost Allocation with Cost Flow Diagram The library...Ch. 2 - Greenfield Consultants conducts analyses of public...Ch. 2 - Consider the Business Application, “Indirect Costs...Ch. 2 - Find the Unknown Information After a computer...Ch. 2 - Find the Unknown Information Just before class...Ch. 2 - Cost Allocation and Regulated Prices The City of...Ch. 2 - Koufax Materials Corporation produces plastic...Ch. 2 - Reconstruct Financial Statements San Ysidro...Ch. 2 - Westlake, Inc., produces metal fittings for the...Ch. 2 - Finding Unknowns Marys Mugs produces and sells...Ch. 2 - Finding Unknowns BST Partners has developed a new...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Problem 19-13 (Algo) Shoney Video Concepts produces a line of video streaming servers that are linked to personal computers for storing movies. These devices have very fast access and large storage capacity. Shoney is trying to determine a production plan for the next 12 months. The main criterion for this plan is that the employment level is to be held constant over the period. Shoney is continuing in its R&D efforts to develop new applications and prefers not to cause any adverse feelings with the local workforce. For the same reason, all employees should put in full workweeks, even if that is not the lowest-cost alternative. The forecast for the next 12 months is MONTH FORECAST DEMAND January February March April 530 730 830 530 May June 330 230 July 130 August 130 September 230 October 630 730 800 November December Manufacturing cost is $210 per server, equally divided between materials and labor. Inventory storage cost is $4 per unit per month and is assigned based on the ending…arrow_forwardCompute 007s gross profit percentage and rate of inventory turnover for 2016arrow_forwardHeadland Company pays its office employee payroll weekly. Below is a partial list of employees and their payroll data for August. Because August is their vacation period, vacation pay is also listed. Earnings to Weekly Vacation Pay to Be Employee July 31 Pay Received in August Mark Hamill $5,180 $280 Karen Robbins 4,480 230 $460 Brent Kirk 3,680 190 380 Alec Guinness 8,380 330 Ken Sprouse 8,980 410 820 Assume that the federal income tax withheld is 10% of wages. Union dues withheld are 2% of wages. Vacations are taken the second and third weeks of August by Robbins, Kirk, and Sprouse. The state unemployment tax rate is 2.5% and the federal is 0.8%, both on a $7,000 maximum. The FICA rate is 7.65% on employee and employer on a maximum of $142,800 per employee. In addition, a 1.45% rate is charged both employer and employee for an employee's wages in excess of $142,800. Make the journal entries necessary for each of the four August payrolls. The entries for the payroll and for the…arrow_forward

- Subject. General accountingarrow_forwardCompute the assets turnover ratioarrow_forwardExercise 5-18 (Algo) Calculate receivables ratios (LO5-8) Below are amounts (in millions) from three companies' annual reports. WalCo TarMart Costbet Beginning Accounts Receivable $1,795 6,066 609 Ending Accounts Receivable $2,742 6,594 645 Net Sales $320,427 65,878 66,963 Required: 1. Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet 2. Which company appears most efficient in collecting cash from sales? Complete this question by entering your answers in the tabs below. Required 1 Required C Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet. (Enter your answers in millions rounded to 1 decimal place.) Receivables Turnover Ratio: WalCo S TarMart. S CostGet S Choose Numerator Choose Numerator "ValCo FarMart CostGet 320,427 $ 65.878 66,963 Choose Denominator Receivables turnover ratio 2,742.0 116.9 times 0 times 0 times Average Collection Period Choose Denominator Average…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Job Cost Sheet - Job Cost Accounting System; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=ElD8nKNXE1I;License: Standard Youtube License