Concept explainers

Cost Concepts

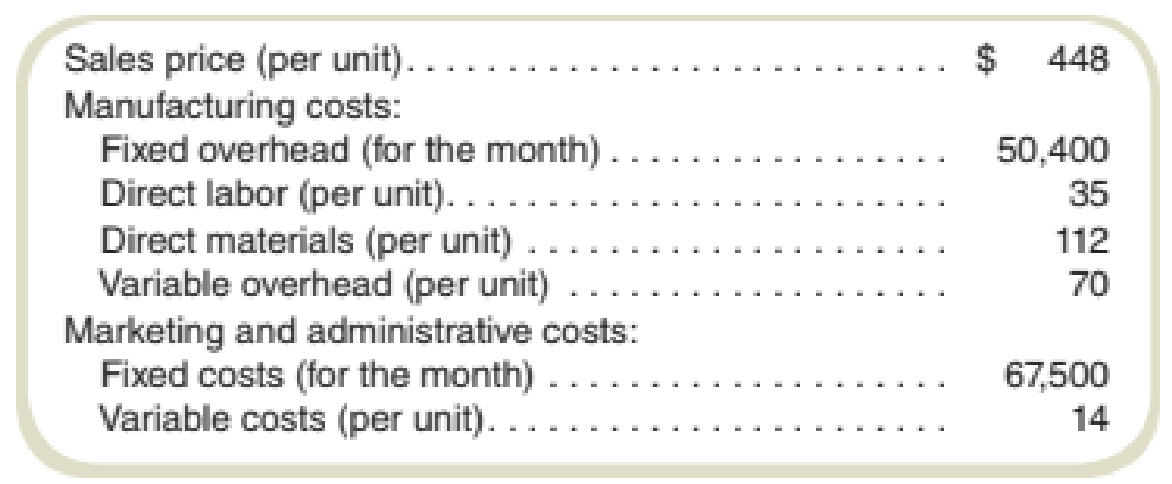

Columbia Products produced and sold 900 units of the company’s only product in March. You have collected the following information from the accounting records:

Required

- a. Compute:

- 1. Variable

manufacturing cost per unit. - 2. Full cost per unit.

- 3. Variable cost per unit.

- 4. Full absorption cost per unit.

- 5. Prime cost per unit.

- 6. Conversion cost per unit.

- 7. Profit margin per unit.

- 8. Contribution margin per unit.

- 9. Gross margin per unit.

- 1. Variable

- b. If the number of units produced increases from 900 to 1,200, which is within the relevant range, cost per unit will decrease (you can check this by redoing requirement [a] above). Therefore, we should recommend that Columbia Products increase its production to reduce its costs. Do you agree? Explain.

a.

Calculate the given values.

Explanation of Solution

1.

Variable manufacturing cost per unit:

Variable manufacturing cost is the manufacturing cost that varies with the change in the output of the production. It includes direct material, direct labor, and all the variable manufacturing overheads.

Calculate the variable manufacturing cost per unit:

Thus, the variable manufacturing cost per unit is $217.

2.

Full cost per unit:

The full cost of the product includes the fixed and variable cost of the production. It includes all the cost that was occurred in the process of the production.

Calculate the full cost per unit:

Thus, the full cost per unit is $362.

Working note 1:

Calculate the total fixed cost:

Working note 2:

Calculate the total fixed cost ($):

| Particulars | Amount |

| Fixed manufacturing costs | $50,400 |

| Fixed marketing and administrative costs | $67,500 |

| Total fixed costs | $117,900 |

Table: (1)

Working note 3:

Calculate the total variable cost:

| Particulars | Amount |

| Direct labor (per unit) | $35 |

| Direct materials (per unit) | $112 |

| Variable overhead (per unit) | $70 |

| Variable Marketing and administrative costs (per unit) | $14 |

| Total variable cost per unit | $231 |

Table: (2)

3.

Variable cost per unit:

Variable cost is the cost that varies with the change in the output of the production. It includes all the direct and indirect cost of the production that varies with the production.

Calculate the variable cost per unit:

| Particulars | Amount |

| Direct labor (per unit) | $35 |

| Direct materials (per unit) | $112 |

| Variable overhead (per unit) | $70 |

| Variable Marketing and administrative costs (per unit) | $14 |

| Total variable cost per unit | $231 |

Table: (3)

Thus, the total variable cost per unit is $231.

4.

Full absorption cost per unit:

Full absorption cost is the total cost that occurs in the process of production. It includes all the fixed and variable cost of the production. It includes the total manufacturing overhead and direct labor and direct material used in the production.

Calculate the Full absorption cost per unit:

Thus, the full absorption cost is $273.

Working note 4:

Calculate the fixed manufacturing overhead:

5.

Prime cost per unit:

Prime cost is the direct cost of producing the goods. It includes the material cost and labor cost of the production. The material and labor included in prime cost are direct.

Calculate the prime cost per unit:

Thus, the prime cost per unit is $147.

6.

Conversion cost:

Total conversion cost is the cost of converting the raw material into finished goods. It includes the labor required to covert the finished goods and other manufacturing overheads.

Calculate the conversion cost per unit:

Thus, the conversion cost per unit is $161.

7.

Profit margin:

Profit margin the net profit made by the business in a financial year. It is calculated by subtracting the total cost of the business from the sales of the business.

Calculate the profit margin:

Thus, the profit margin is $86.

8.

Contribution margin:

Contribution margin is the amount left from the sales for profit and fixed cost of the business. It is calculated by subtracting the variable cost from the sales of the business.

Calculate the contribution margin:

Thus, the contribution margin is $217.

9.

Gross margin:

Gross margin is the gross profit of the business. It shows the efficiency of the production process of the business. It is calculated by subtracting the direct cost of the production from the sales of the business.

Calculate the gross margin:

Thus, the gross margin is $175.

b.

Comment on the given statement.

Explanation of Solution

The suggestion of Company C:

The fixed cost per unit decreases as the production increases. The decrease in fixed cost per unit will result in the decreased overall cost of production.

The company should look for the profit variables instead of costing variables. Company C should look for contribution margin, gross margin and profit margin to decide whether they should increase the production or not.

Thus, the company should not consider the cost variables, but it should consider the profit variables to decide the increment in the volume.

Want to see more full solutions like this?

Chapter 2 Solutions

FUNDAMENTALS OF COST ACCOUNTING

- CEO salary is categorized as: a. Direct material cost. b. Direct labor cost. c. Manufacturing overhead cost. d. selling and marketing costs. e. general and administrative costs.arrow_forwardGeneral accountingarrow_forwardPlease answer do fast and step by step calculation for this general accounting questionarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning