Concept explainers

Recording Transactions (in a Journal and T-Accounts); Preparing and Interpreting the

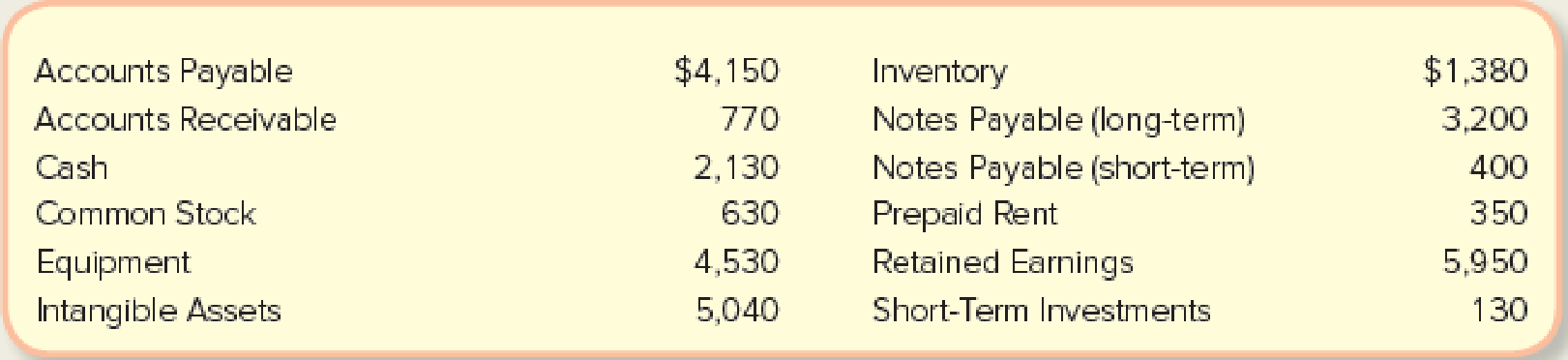

Starbucks is a coffee company—a big coffee company. During a 10-year period, the number of Starbucks locations in China grew from 24 to over 1,000. The following is adapted from Starbucks’s annual report for the year ended October 2, 2016, and dollars are reported in millions.

Assume that the following events occurred in the following quarter, which ended December 31, 2016. Dollars are in millions.

- a. Paid $1,000 cash for additional intangible assets.

- b. Issued additional shares of common stock for $10,000 in cash.

- c. Purchased equipment; paid $4,000 in cash and signed additional long-term loans for $9,500.

- d. Paid $800 cash for accounts payable owed at October 2.

- e. Conducted negotiations to purchase a coffee farm, which is expected to cost $8,400.

Required:

- 1. Calculate Starbucks’s

current ratio at October 2, 2016, prior to the transactions listed above. Based on this calculation and the analysis of Apple’s current ratio in the chapter, indicate which company is in a better position to pay liabilities as they come due in the next year. - 2. Analyze transactions (a)–(e) to determine their effects on the

accounting equation. Use the format shown in the demonstration case. - 3. Record the transaction effects determined in requirement 2 using journal entries.

- 4. Using the October 2, 2016, ending balances (reported above) as the beginning balances for the October–December 2016 quarter, summarize the

journal entry effects from requirement 3. Use T-accounts if this requirement is being completed manually; if you are using the general ledger tool in Connect, the journal entries will have been posted automatically to general ledger accounts that are similar in appearance to Exhibit 2.9. - 5. Explain your response to event (e).

- 6. Prepare a classified balance sheet at December 31, 2016.

- 7. Use your response to requirement 6 to calculate Starbucks’s current ratio after the transactions listed in (a)–(e). Based on this calculation and the calculation in requirement 1, indicate whether the above transactions increase or decrease the company’s ability to pay liabilities as they come due in the next year.

- 8. As of December 31, 2016, has the financing for the investment in assets made by Starbucks primarily come from liabilities or stockholders’ equity?

1.

Ascertain the current ratio of Company S at October 2, 2016 and compare the current ratio of Company S with current ratio of Company A.

Explanation of Solution

Current Ratio: A part of liquidity ratios, current ratio reflects the ability to oblige the short term debts of a company. It is calculated based on the current assets and current liabilities; a company has in an accounting period. A current ratio is a useful tool for analysis of financials of a company.

Calculate the current ratio of Company S and Company A at October 2, 2016as follows:

Company S:

Here,

Current assets = $ 4,760 million

Current liabilities= $4,550 million

Company A:

Current ratio of Company S is 1.05 and Company A is 1.35, so Company S has less current ratio than Company A and this indicates that Company A has better position to repay the liabilities than Company S.

2.

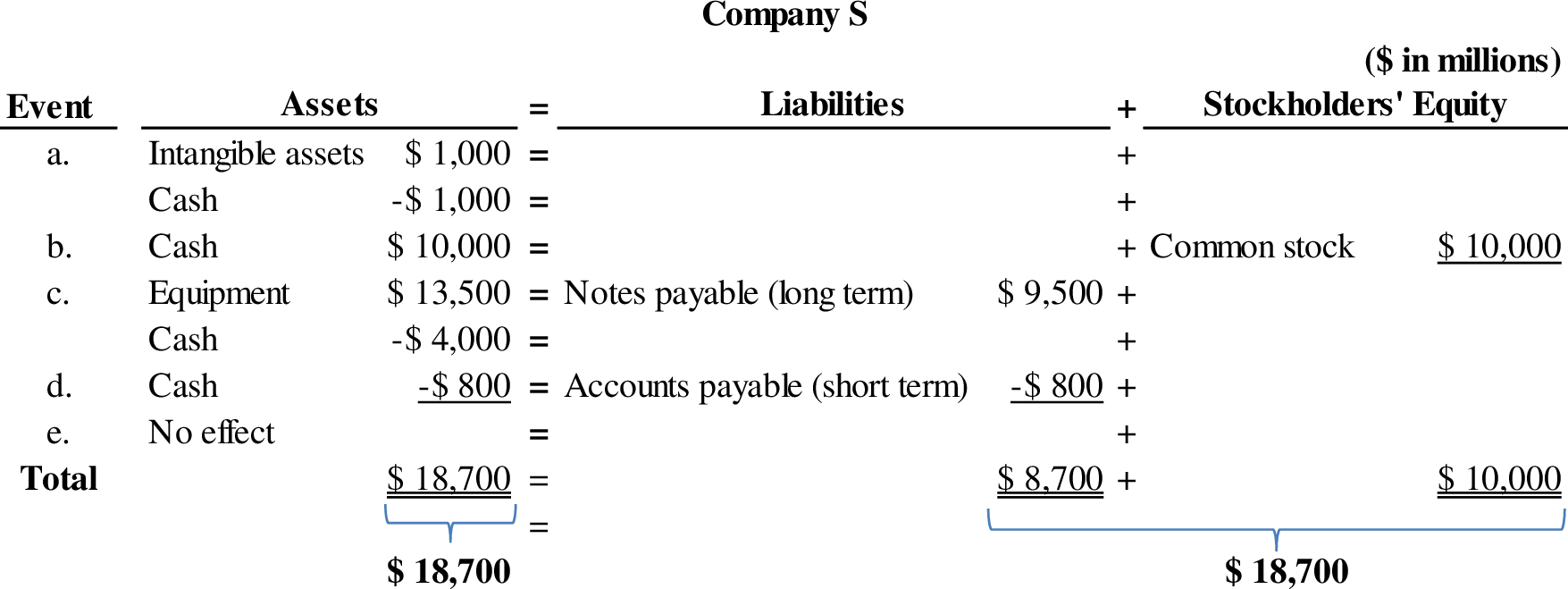

Analyze the given transaction, and explain their effect on the accounting equation.

Explanation of Solution

Accounting equation: Accounting equation is an accounting tool expressed in the form of equation, by creating a relationship between the resources or assets of a company, and claims on the resources by the creditors and the owners. Accounting equation is expressed as shown below:

Accounting equation for each transaction is as follows:

Figure (1)

Therefore, the total assets are equal to the liabilities and stockholder’s equity.

3.

Record the journal entries based on requirement 2.

Explanation of Solution

Journal: Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Rules of Debit and Credit: Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, and expenses.

Journal entries of Company S are as follows ($ in millions):

a. Intangible assets purchased in cash:

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Intangible assets (+A) | 1,000 | |||

| Cash (-A) | 1,000 | |||

| (To record the purchase of intangible assets in cash) |

Table (1)

- Intangible assets are an assets account and it increases the value of asset by $1,000. Hence, debit the intangible assets account for $1,000.

- Cash is an assets account and it decreases the value of asset by $1,000. Hence, credit the cash account for $1,000.

b. Issuance of common stock:

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Cash (+A) | 10,000 | |||

| Common stock (+SE) | 10,000 | |||

| (To record the issuance of common stock) |

Table (2)

- Cash is an assets account and it increases the value of asset by $10,000. Hence, debit the cash account for $10,000.

- Common stock is a component of stockholder’s equity and it increases the value of stockholder’s equity by $10,000, Hence, credit the common stock account for $10,000.

c. Equipment purchased on account and in cash:

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Equipment (+A) | 13,500 | |||

| Cash (-A) | 4,000 | |||

| Notes payable (+L) | 9,500 | |||

| (To record the purchase of equipment on account and in cash) |

Table (3)

- Equipment is an assets account and it increases the value of asset by $13,500. Hence, debit the equipment account for $13,500.

- Cash is an assets account and it decreases the value of asset by $4,000. Hence, credit the cash account for $4,000.

- Notes payable is a liability account, and it increases the value of liabilities by $9,500. Hence, credit the notes payable account for $9,500.

d. Cash borrowed from bank (short term):

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Cash (+A) | 800 | |||

| Accounts payable (+L) | 800 | |||

| (To record cash borrowed from bank) |

Table (4)

- Cash is an assets account and it increases the value of asset by $800. Hence, debit the cash account for $800.

- Accounts payable is a liability account, and it increases the value of liabilities by $800. Hence, credit the accounts payable for $800.

e. Conducted negotiations to purchase a coffee farm:

For this case, no entry is required, because it is not a business transaction.

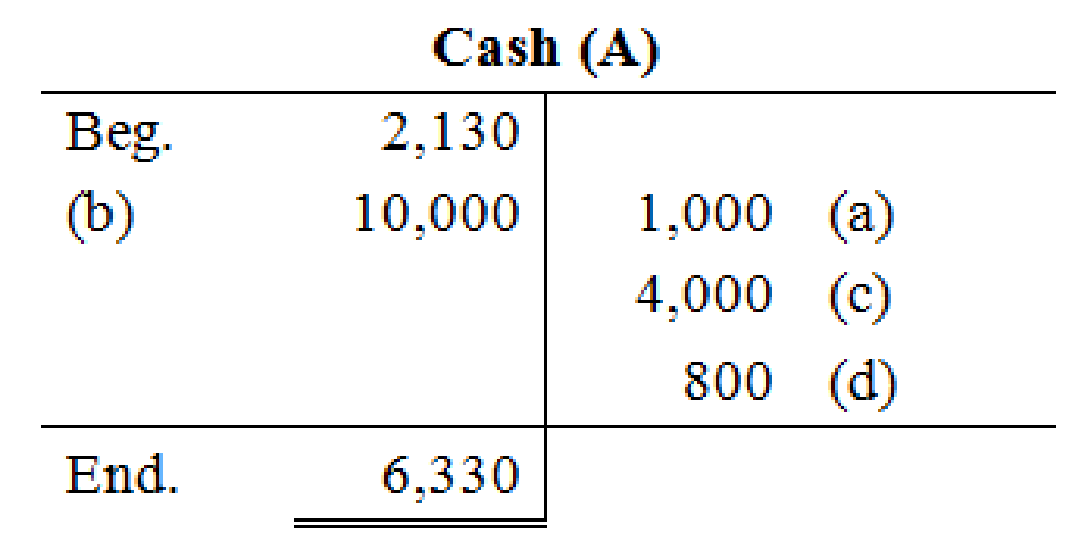

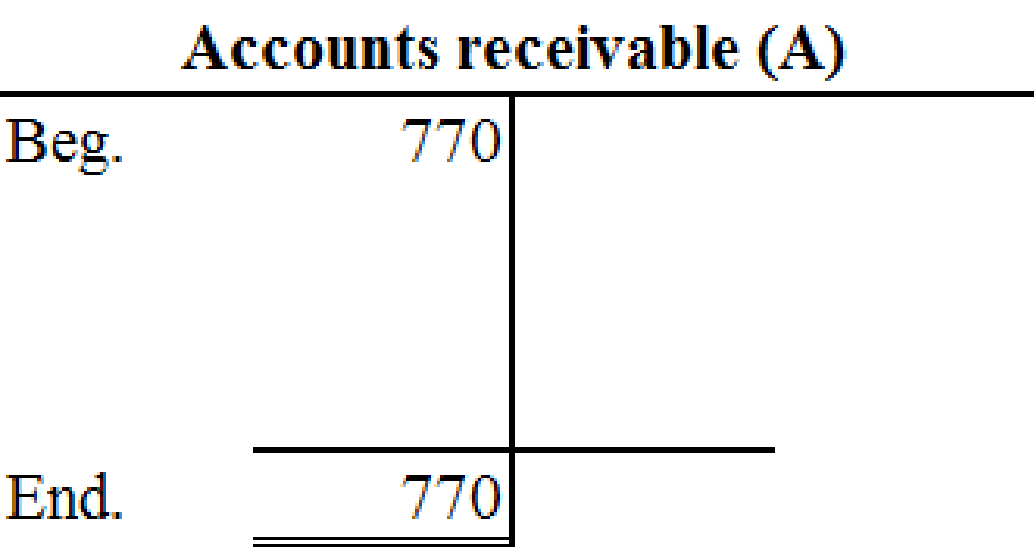

4.

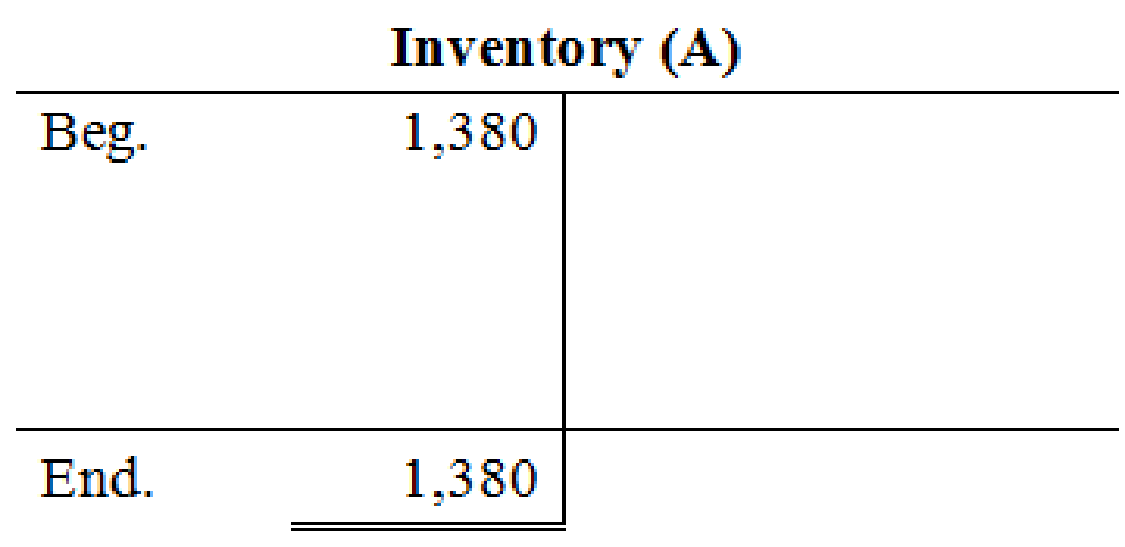

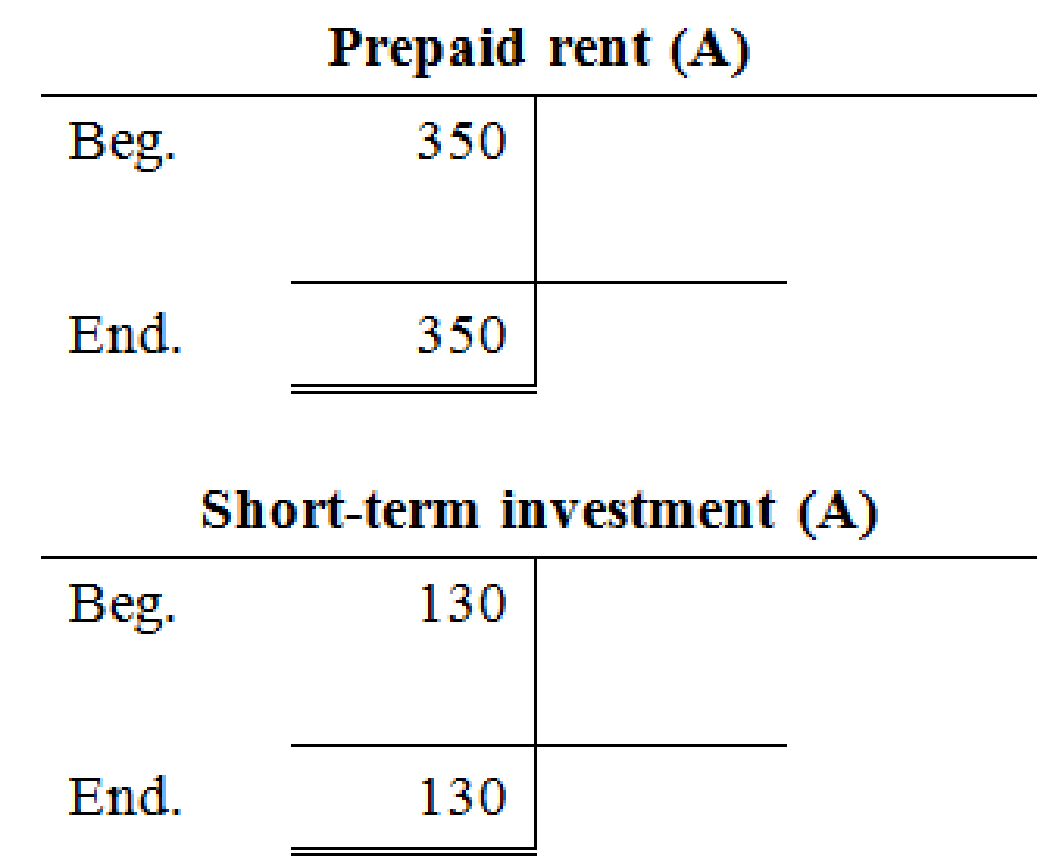

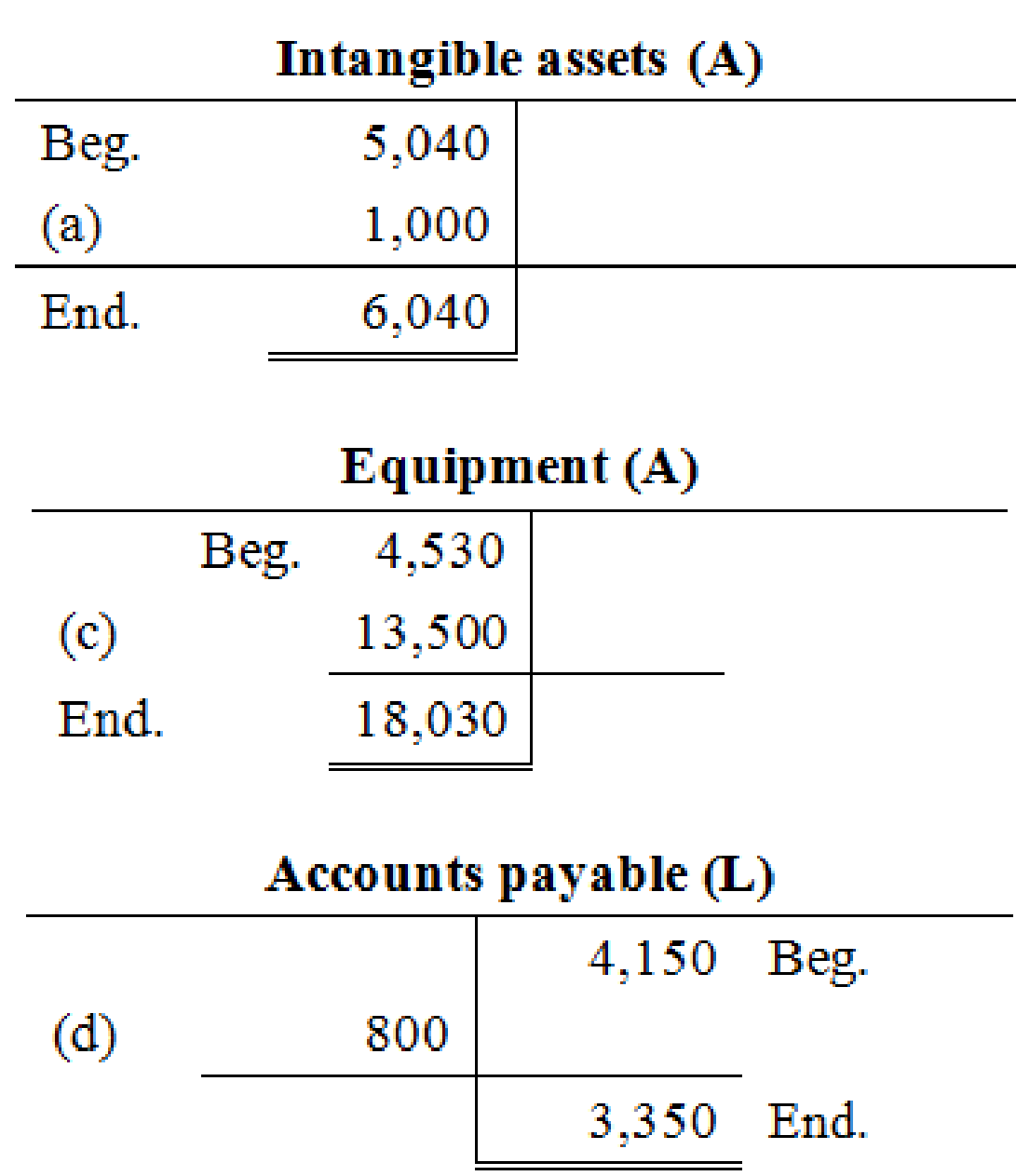

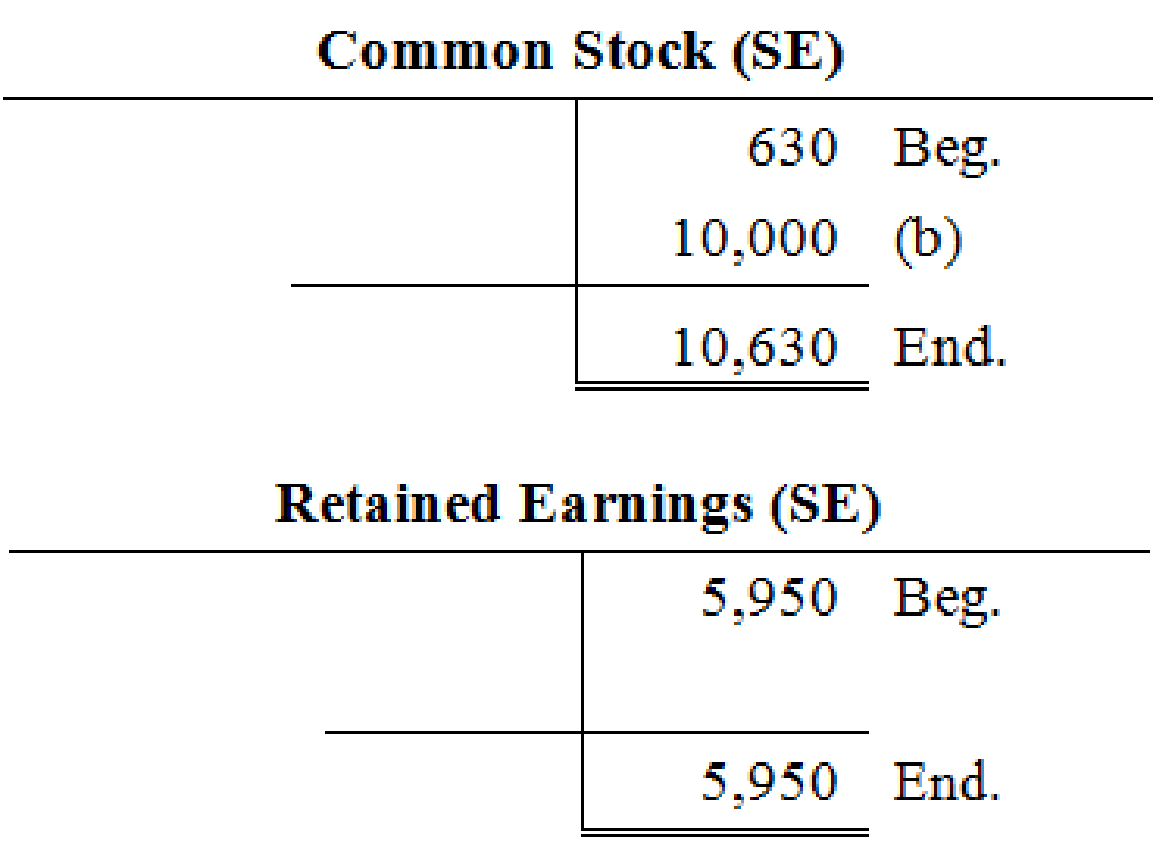

Prepare T-account for each account listed in the requirement 2.

Explanation of Solution

T-account: T-account refers to an individual account, where the increases or decreases in the value of specific asset, liability, stockholder’s equity, revenue, and expenditure items are recorded.

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

- (a) The title of the account

- (b) The left or debit side

- (c) The right or credit side

T-accounts of Company S are as follows:

5.

Explain the appropriate response for event (e).

Explanation of Solution

Business transaction: Business transaction is a record of any economic activity, resulting in the change in the value of the assets, the liabilities, and the stockholder’s equities, of a business. Business transaction is also referred to as financial transaction.

Explain the appropriate response for event (e) as follows:

In this case, conducting negotiation to purchase a saw mill is not creating any impact on assets, liabilities and stockholder’s equity of the business, because it is not a business transaction.

6.

Prepare the classified balance sheet of Company S at December 31, 2016.

Explanation of Solution

Classified balance sheet: This is the financial statement of a company which shows the grouping of similar assets and liabilities under subheadings.

Classified balance sheet of Company S is as follows ($ in millions):

| Company S | ||

| Balance sheet | ||

| At December 31, 2016 | ||

| Assets | $ | $ |

| Current Assets | ||

| Cash | 6,330 | |

| Short-term Investments | 130 | |

| Accounts Receivable | 770 | |

| Inventory | 1,380 | |

| Prepaid Rent | 350 | |

| Total Current Assets | 8,960 | |

| Property, Plant, and Equipment | 18,030 | |

| Intangible Assets | 6,040 | |

| Total Assets | 33,030 | |

| Liabilities | ||

| Current Liabilities | ||

| Accounts Payable | 3,350 | |

| Notes Payable (short-term) | 400 | |

| Total Current Liabilities | 3,750 | |

| Notes Payable (long-term) | 12,700 | |

| Total Liabilities | 16,450 | |

| Stockholders’ Equity | ||

| Common Stock | 10,630 | |

| Retained Earnings | 5,950 | |

| Total Stockholders’ Equity | 16,580 | |

| Total Liabilities and Stockholders’ Equity | 33,030 | |

Table (1)

Therefore, the total assets of Company S are $33,030 million, and the total liabilities and stockholders’ equity $33,030 million.

7.

Ascertain the current ratio of Company S based on requirement 6 and indicate whether the given transactions has increased or decreased the company’s ability to pay current liabilities.

Explanation of Solution

Ascertain the current ratio of Company S based on requirement 6 and indicate whether the given transactions has increased or decreased the company’s ability to pay current liabilities as follows:

Calculate the current ratio of Company S as follows (refer requirement 6):

Current ratio of Company S at December 31, 2016 (2.39) is higher than the current ratio at October 2, 2016(1.05). It clearly shows that, the given transaction has increased the company’s ability to pay its current liabilities.

8.

Indicate whether the total assets of Company S were primarily financed by liabilities or stockholder’s equity.

Explanation of Solution

Indicate whether the total assets of Company S were primarily financed by liabilities or stockholder’s equity as follows:

The invested amounts of assets primarily come from stockholder’s equity (common stock and retained earnings) of Company S, because stockholder’s equities (common stock) have financed $16,580,000,000 of Company S’s total assets, whereas liabilities (non-current and current liabilities) have financed only $16,450,000,000.

Want to see more full solutions like this?

Chapter 2 Solutions

Fundamentals Of Financial Accounting

- Oriole Company sells product 2005WSC for $55 per unit and uses the LIFO method. The cost of one unit of 2005WSC is $52, and the replacement cost is $51. The estimated cost to dispose of a unit is $6, and the normal profit is 40% of selling price. At what amount per unit should product 2005WSC be reported, applying lower-of-cost-or-market?arrow_forwardNonearrow_forwardGeneral accountingarrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College