Concept explainers

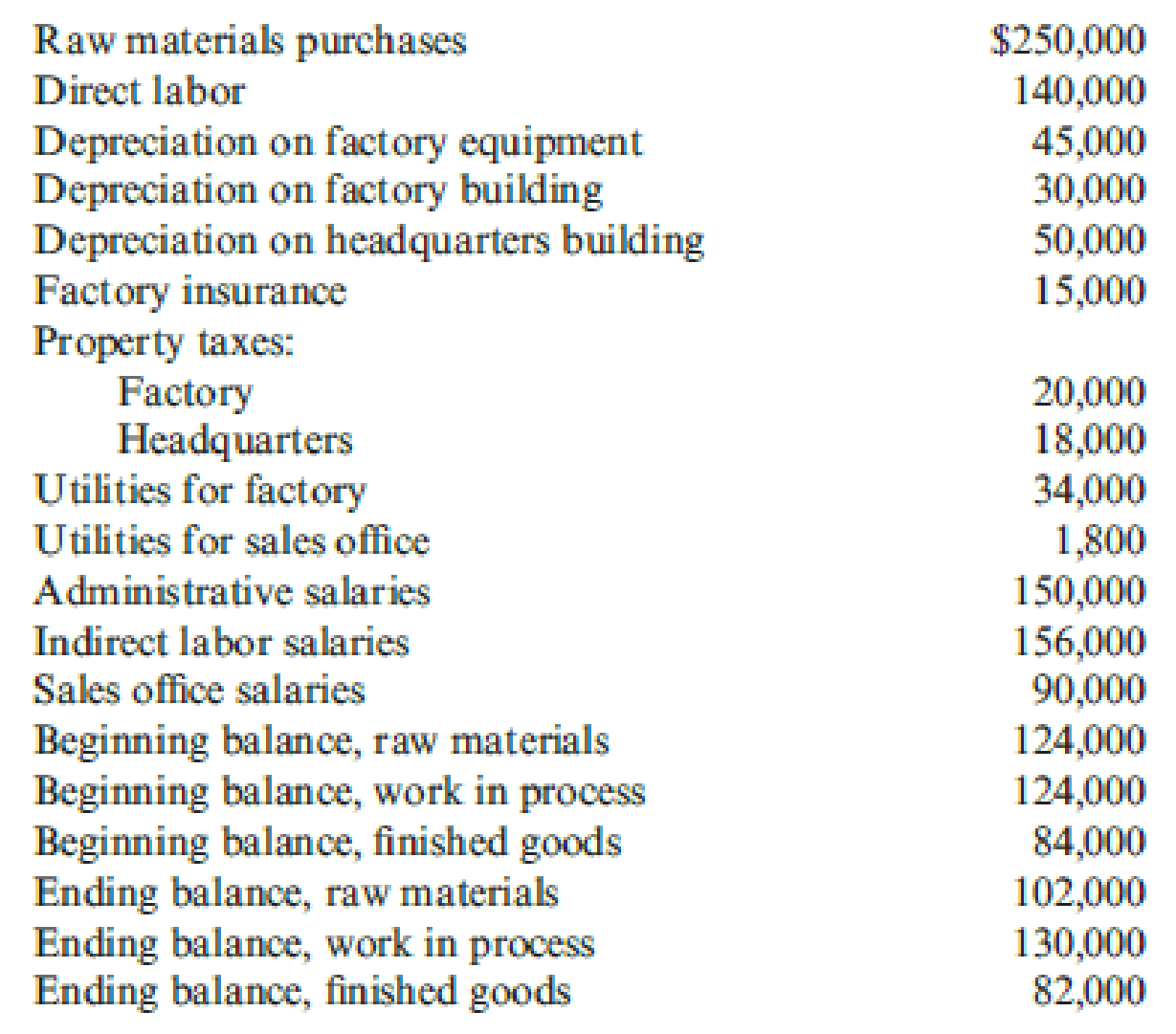

Brody Company makes industrial cleaning solvents. Various chemicals, detergent, and water are mixed together and then bottled in 10-gallon drums. Brody provided the following information for last year:

Last year, Brody completed 100,000 units. Sales revenue equaled $1,200,000, and Brody paid a sales commission of 5 percent of sales.

Required:

- 1. Calculate the direct materials used in production for last year.

- 2. Calculate total prime cost.

- 3. Calculate total conversion cost.

- 4. Prepare a cost of goods manufactured statement for last year. Calculate the unit product cost.

- 5. Prepare a cost of goods sold statement for last year.

- 6. Prepare an income statement for last year. Show the percentage of sales that each line item represents.

1.

Calculate the direct materials used by B Company for last year.

Explanation of Solution

Direct material cost: A cost indicates the payment of cash or the obligation to pay the cash in the future period for the generation of revenue or the service performed. A direct material cost is the cost of raw materials used for producing a product. Example: The cost of plastic is the direct material for manufacturing a bottle.

Calculate the direct materials.

2.

Calculate the total prime cost for B Company.

Explanation of Solution

Prime cost: Prime cost refers to a cost which is directly involved in the process of manufacturing an item. Prime cost includes direct material, and direct labor costs.

Calculate the total prime cost.

3.

Calculate the total conversion cost for B Company.

Explanation of Solution

Conversion cost: A conversion cost refers to the cost of converting the raw materials into a finished product. Conversion cost includes direct labor as well as factory overhead costs.

Calculate the total conversion cost.

Working notes:

a) Calculate the total overhead cost.

| Particulars | Amount ($) |

| Depreciation on the factory equipment | $45,000 |

| Depreciation on factory building | 30,000 |

| Factory insurance | 15,000 |

| Factory property taxes | 20,000 |

| Factory utilities | 34,000 |

| Indirect labor salaries | 156,000 |

| Total overhead | $300,000 |

Table (1)

4.

Prepare the statement of cost of goods manufactured and calculate the unit product cost for B Company.

Explanation of Solution

Cost of goods manufactured: Cost of goods manufactured refers to the cost incurred for a making a product, that are available for sales at the end of the accounting period.

Prepare the statement of cost of goods manufactured.

| B company | |

| Statement for the cost of goods manufactured | |

| For the last year | |

| Particulars | Amount ($) |

| Direct materials | $272,000 |

| Direct labor | 140,000 |

| Overhead | 300,000 |

| Total manufacturing cost | $712,000 |

| Add: Beginning work in progress | 124,000 |

| Less: Ending work in progress | (130,000) |

| Cost of goods manufactured | $706,000 |

Table (2)

Calculate the unit product cost for B.

5.

Prepare the statement of cost of goods sold.

Explanation of Solution

Cost of goods sold: Cost of goods sold is the accumulated total of all the costs incurred in manufacturing the goods or the products which has been sold during a period. Cost of goods sold involves direct material, direct labor, and manufacturing overheads.

Prepare the statement of cost of goods sold.

| B company | |

| Statement of cost of goods sold | |

| For Last year | |

| Particulars | Amount ($) |

| Cost of goods manufactured | $706,000 |

| Add: Beginning inventory, finished goods | 84,000 |

| Less: Ending inventory, finished goods | (82,000) |

| Cost of goods sold | $708,000 |

Table (3)

6.

Prepare the income statement including sales percentage for B Company.

Explanation of Solution

Income statement: The income statement is a financial statement that shows the net income earned or net loss suffered by a company through reporting all the revenues earned, and expenses incurred by the company over a specific period of time. An income statement is also known as an operation statement, an earning statement, a revenue statement, or a profit and loss statement. The net income is the excess of revenue over expenses.

Prepare the income statement.

| B company | ||

| Income statement | ||

| For last year | ||

| Particulars | Amount ($) | Percentage |

| Sales | $1,200,000 | 100 |

| Cost of goods sold [requirement (5)] | 708,000 | 59 |

| Gross margin | $492,000 | 41 |

| Less: Operating expenses | ||

| Selling expenses | 151,800 | 12.65 |

| Administrative expenses | 218,000 | 18.17 |

| Operating income | $122,200 | 10.18 |

Table (4)

Want to see more full solutions like this?

Chapter 2 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Don't use ai given answer accounting questionsarrow_forwardMultiple Choice 2-32 Educational Incentives (LO 2.14) Wendy is a single taxpayer and pays tuition of $7,800 in 2021. Her 2021 AGI is $66,000. What is the amount of Wendy's tuition deduction? X a. $2,000 O b. $0 O c. $3,733.33 O d. $4,000 O e. $7,800arrow_forwardMultiple Choice 2-32 Educational Incentives (LO 2.14) Wendy is a single taxpayer and pays tuition of $7,800 in 2021. Her 2021 AGI is $66,000. What is the amount of Wendy's tuition deduction? X a. $2,000 O b. $0 O c. $3,733.33 O d. $4,000 O e. $7,800arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College