Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 22E

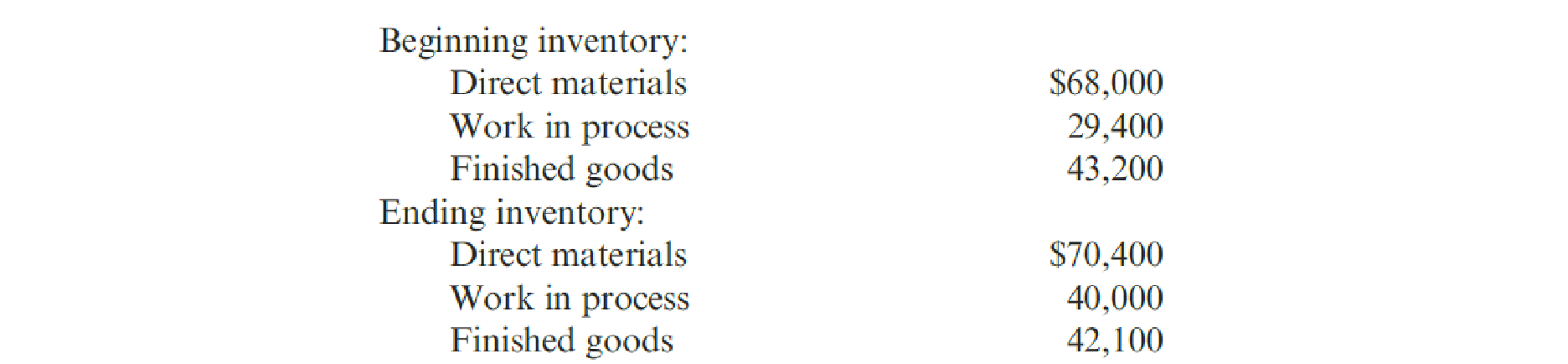

Ellerson Company provided the following information for the last calendar year:

During the year, direct materials purchases amounted to $278,000, direct labor cost was $189,000, and

Refer to Exercise 2.21. Last calendar year, Ellerson recognized revenue of $1,312,000 and had selling and administrative expenses of $204,600.

Required:

- 1. What is the cost of goods sold for last year?

- 2. Prepare an income statement for Ellerson for last year.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

General accounting

Help with problem and accounting question

Please give me true answer this financial accounting question

Chapter 2 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 2 - What is an accounting information system?Ch. 2 - What is the difference between a financial...Ch. 2 - What are the objectives of a cost management...Ch. 2 - Define and explain the two major subsystems of the...Ch. 2 - What is a cost object? Give some examples.Ch. 2 - Prob. 6DQCh. 2 - What is a direct cost? An indirect cost?Ch. 2 - Prob. 8DQCh. 2 - What is allocation?Ch. 2 - Explain how driver tracing works.

Ch. 2 - What is a tangible product?Ch. 2 - Prob. 12DQCh. 2 - Give three examples of product cost definitions....Ch. 2 - Prob. 14DQCh. 2 - Prob. 15DQCh. 2 - Pietro Frozen Foods, Inc., produces frozen pizzas....Ch. 2 - For next year, Pietro predicts that 50,000 units...Ch. 2 - Pietro expects to produce 50,000 units and sell...Ch. 2 - Refer to Cornerstone Exercises 2.2 and 2.3. Next...Ch. 2 - Jean and Tom Perritz own and manage Happy Home...Ch. 2 - Jean and Tom Perritz own and manage Happy Home...Ch. 2 - Jean and Tom Perritz own and manage Happy Home...Ch. 2 - Jean and Tom Perritz own and manage Happy Home...Ch. 2 - Prob. 9ECh. 2 - The following items are associated with a cost...Ch. 2 - Nizam Company produces speaker cabinets. Recently,...Ch. 2 - Three possible product cost definitions were...Ch. 2 - Wyandotte Company provided the following...Ch. 2 - For each of the following independent situations,...Ch. 2 - LeMans Company produces specialty papers at its...Ch. 2 - Kildeer Company makes easels for artists. During...Ch. 2 - Anglin Company, a manufacturing firm, has supplied...Ch. 2 - Lakeesha Barnett owns and operates a package...Ch. 2 - Millennium Pharmaceuticals, Inc. (MPI), designs...Ch. 2 - Jazon Manufacturing produces two different models...Ch. 2 - Ellerson Company provided the following...Ch. 2 - Ellerson Company provided the following...Ch. 2 - Orinder Company provided the following information...Ch. 2 - Last year, Orsen Company produced 25,000 juicers...Ch. 2 - Last year, Orsen Company produced 25,000 juicers...Ch. 2 - The ability to assign a cost directly to a cost...Ch. 2 - Selected information concerning the operations of...Ch. 2 - Brody Company makes industrial cleaning solvents....Ch. 2 - Wright Plastic Products is a small company that...Ch. 2 - The following items are associated with a...Ch. 2 - The actions listed next are associated with either...Ch. 2 - Spencer Company produced 200,000 cases of sports...Ch. 2 - Prob. 33PCh. 2 - Mason, Durant, and Westbrook (MDW) is a tax...Ch. 2 - Orman Company produces neon-colored covers for...Ch. 2 - High drug costs are often in the news. Consumer...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License