Exercise 2-27A Effect of accounting events on the income statement and statement of

Required

Explain how each of the following events or series of events and the related

- a. Paid $9,000 cash on October 1 to purchase a one-year insurance policy.

- b. Purchased $2,000 of supplies on account. Paid $500 cash on accounts payable. The ending balance in the Supplies account, after adjustment, was $300.

- c. Provided services for $10,000 cash.

- d. Collected $2,400 in advance for services to be performed in the future. The contract called for services to start on May 1 and to continue for one year

- e. Accrued salaries amounting to $5,600.

- f. Sold land that cost $3,000 for $3,000 cash.

- g. Acquired $15,000 cash from the issue of common stock.

- h. Earned $12,000 of revenue on account. Collected $8,000 cash from

accounts receivable . - i. Paid cash operating expenses of $4,500.

Explain the way each of the given events or series of events and the related adjusting entry will affect the amount of net income and the amount of cash flow from operating activities reported on the year-end financial statements. Identify the direction of change (increase, decrease, or NA) and the amount of the change. If an event does not have a related adjusting entry, then record only the effects of the event.

Explanation of Solution

Net income: Net income is the excess amount of revenue which arises after deducting all the expenses of a company. In simple terms, it is the difference between total revenue and total expenses of the company.

Cash flows from operating activities: These refer to the cash received or cash paid in day-to-day operating activities of a company.

Explain the way that the given events are affecting net income and cash flows from operating activities.

- a. Purchased one year insurance policy on October 1st for $9,000. It decreases the cash flows from the operating activities by $9,000, because there is a cash outflow of $9,000. On December 31st, three months amount is recognized as an expense through an adjusting entry. It decreases the net income in the income statement by $2,250 (1) (for three months).

- b. Purchased supplies for $2,000 on account. $500 paid on accounts payable. This will decrease the cash flows from operating activities, but not affect the net income. During the year $1,700 (2) supplies are used. Adjusting the supplies account will decrease supplies account and increase supplies expense account. Increase in expense decreases the net income in the income statement.

- c. $10,000 Services provided for cash. It increases the net income in the income statement and cash flows from the operating activities in the statement of cash flows by $10,000.

- d. Cash collected $2,400 in advance to render a service, which starts from May 1st and continued for one year. This increases the cash flows from operating activities, but not affected the net income. Till the end of December 31, total 8 months services are rendered. This will increase the net income in the income statement by $1,600 (3).

- e. Accrued salaries amounting to $5,600. This will decrease the net income by $5,600. Since there is no cash out flow, there is no change in the cash flow from operating activities.

- f. Sold land that cost $3,000 for $3,000 cash. It does not affect the net income and cash flows from operating activities. Because land and cash are the balance sheet items and sale of land is an investing activity in the statement of cash flows.

- g. Acquired $15,000 cash from the issue of common stock. It does not affect the net income and cash flows from operating activities. Because common stock and cash are the balance sheet items and issuing common stock is a financing activity in the statement of cash flows.

- h. Earned $12,000 revenue on account. It increases the net income in the income statement. Collected $8,000 cash from the accounts receivable. It increases the cash flows from the operating activities.

- i. Cash paid for operating expenses $4,500. It decreases the net income in the income statement and cash flows from operating activities.

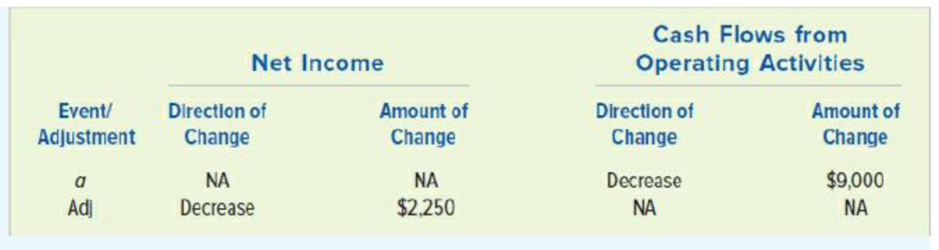

Identify the direction of change (increase, decrease, or NA) and the amount of the change for the given events.

| Event/Adjustment | Net Income |

Cash Flow from Operating Activities |

|||

| Direction of Change | Amount of Change | Direction of Change | Amount of Change | ||

| a |

Event Adjustment |

NA Decrease |

NA (1)$2,250 |

Decrease NA |

$9,000 NA |

| b |

Event Adjustment |

NA Decrease |

NA (2)1,700 |

Decrease NA |

500 NA |

| c |

Event No adjustment |

Increase | 10,000 | Increase | 10,000 |

| d |

Event Adjustment |

NA Increase |

NA (3)1,600 |

Increase NA |

2,400 NA |

| e |

Event No adjustment |

Decrease | 5,600 | NA | NA |

| f |

Event No adjustment |

NA | NA | NA | NA |

| g |

Event No adjustment |

NA | NA | NA | NA |

| h |

Event No adjustment |

Increase | 12,000 | Increase | 8,000 |

| i |

Event No adjustment |

Decrease | 4,500 | Decrease | 4,500 |

Table (1)

Working notes:

Calculate the adjustment amount for insurance policy (event a).

Purchased an insurance policy on October 1, and paid $9,000 cash. The year ending adjustment amount is calculated for 3 months (October 1st to December 31st).

Calculate the amount for supplies used during the year.

The supplies are purchased for $2,000. At the end of the year after adjustment, the balance amount of supplies is $300.

Calculate the amount of services performed during the year.

Cash collected $2,400 in advance to provide the service from May 1, and continued for one year.

Want to see more full solutions like this?

Chapter 2 Solutions

Survey Of Accounting

- Please explain the solution to this general accounting problem using the correct accounting principles.arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardWipro Plastics uses the weighted-average method in its process costing system. Department A had 4,000 units in beginning work-in-process (60% complete for conversion costs), started 16,000 new units during the period, and transferred 18,000 completed units to Department B. If the ending work-in-process in Department A was 2,000 units (30% complete for conversion costs), what are the equivalent units for conversion costs for the period?arrow_forward

- Can you solve this general accounting question with accurate accounting calculations?arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardI need the correct answer to this financial accounting problem using the standard accounting approach.arrow_forward

- I need assistance with this financial accounting question using appropriate principles.arrow_forwardI am searching for the accurate solution to this financial accounting problem with the right approach.arrow_forwardPlease explain the solution to this financial accounting problem with accurate principles.arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,