Exercise 2-27 Identifying transaction type and effect on the financial statements

Required

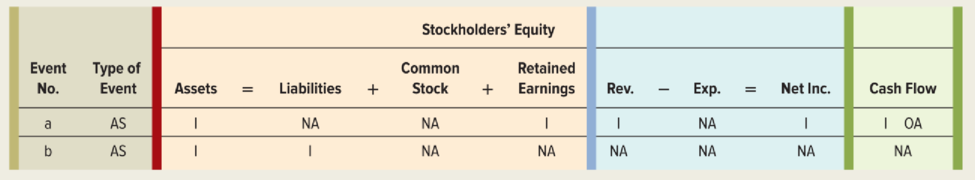

Identify whether each of the following transactions is an asset source (AS), asset use (AU), asset exchange (AE), or claims exchange (CE). Also show the effects of the events on the financial statements using the horizontal statements model. Indicate whether the event increases (I), decreases (D), or does not affect (NA) each element of the financial statements. In the

a. Provided services and collected cash.

b. Purchased supplies on account to be used in the future.

c. Paid cash in advance for one year’s rent.

d. Paid cash to purchase land.

e. Paid a cash dividend to the stockholders.

f. Received cash from the issue of common stock.

g. Paid cash on accounts payable.

h. Collected cash from

i. Received cash advance for services to be provided in the future.

j. Incurred other operating expenses on account.

k. Performed services on account.

l. Adjusted books to reflect the amount of prepaid rent expired during the period.

m. Paid cash for operating expenses.

n. Adjusted the books to record the supplies used during the period.

o. Recorded accrued salaries.

p. Paid cash for salaries accrued at the end of a prior period.

q. Recorded accrued interest revenue earned at the end of the accounting period.

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Survey Of Accounting

- 1) Identify whethere the company is paying out dividends based on the attached statement. 2) Describe in detail how that the company’s dividend payouts have changed over the past five years. 3)Describe in detail the changes in “total equity” (representing the current “book value” of the company).arrow_forwardWhich is not an objective of internal controls?A. Safeguard assetsB. Improve profitsC. Ensure accurate recordsD. Promote operational efficiencyneed helparrow_forwardWhich is not an objective of internal controls?A. Safeguard assetsB. Improve profitsC. Ensure accurate recordsD. Promote operational efficiencyno aiarrow_forward

- Can you solve this general accounting problem using appropriate accounting principles?arrow_forwardWhich is not an objective of internal controls?A. Safeguard assetsB. Improve profitsC. Ensure accurate recordsD. Promote operational efficiency no aiarrow_forwardPlease provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forward

- Please provide the correct answer to this financial accounting problem using valid calculations.arrow_forward20 Nelson and Murdock, a law firm, sells $8,000,000 of four-year, 8% bonds priced to yield 6.6%. The bonds are dated January 1, 2026, but due to some regulatory hurdles are not issued until March 1, 2026. Interest is payable on January 1 and July 1 each year. The bonds sell for $8,388,175 plus accrued interest. In mid-June, Nelson and Murdock earns an unusually large fee of $11,000,000 for one of its cases. They use part of the proceeds to buy back the bonds in the open market on July 1, 2026 after the interest payment has been made. Nelson and Murdock pays a total of $8,456,234 to reacquire the bonds and retires them. Required1. The issuance of the bonds—assume that Nelson and Murdock has adopted a policy of crediting interest expense for the accrued interest on the date of sale.2. Payment of interest and related amortization on July 1, 2026.3. Reacquisition and retirement of the bonds.arrow_forward13 Which of the following is correct about the difference between basic earnings per share (EPS) and diluted earnings per share? Question 13 options: Basic EPS uses comprehensive income in its calculation, whereas diluted EPS does not. Basic EPS is not a required disclosure, whereas diluted EPS is required disclosure. Basic EPS uses total common shares outstanding, whereas diluted EPS uses the weighted-average number of common shares. Basic EPS is not adjusted for the potential dilutive effects of complex financial structures, whereas diluted EPS is adjusted.arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning