Concept explainers

Recording Transactions (in a Journal and T-Accounts); Preparing and Interpreting the

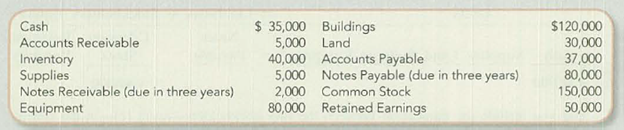

Performance Plastics Company (PPC) has been operating for three years. The beginning account balances are:

During the year, the company had the following summarized activities:

- a. Purchased equipment that cost $21,000: paid $5,000 cash and signed a two-year note for the balance.

- b. Issued an additional 2,000 shares of common stock for $20,000 cash.

- c. Borrowed $50,000 cash from a local bank, payable June 30, in two years.

- d. Purchased supplies for $4,000 cash.

- e. Built an addition to the factory buildings for $41,000; paid $12,000 in cash and signed a three- year note for the balance.

- f. Hired a new president to start January I of next year. The contract was for $95,000 for each full year worked.

Required:

- 1. Analyze transactions (a)-(f) to determine their effects on the

accounting equation. TIP: You won’t need new accounts to record the transactions described above, so have a quick look at the ones listed in the beginning of this question before you begin.

TIP: In transaction (e), three different accounts are affected.

TIP: In transaction (f), consider whether PPC owes anything to its new president for the current year ended December 31.

- 2. Record the transaction effects determined in requirement 1 using journal entries.

- 3. Summarize the journal entry effects from requirement 2. Use T-accounts if this requirement is being completed manually; if you are using the GL tool in Connect, the journal entries will have been posted automatically to general ledger accounts that are similar in appearance to Exhibit 2.9.

- 4. Explain your response to event (f).

- 5. Prepare a classified balance sheet at December 31.

- 6. As of December 31, has the financing for PPC’s. investment in assets primarily come from liabilities or stockholders’ equity?

Requirement – 1

To analyze: The given transaction, and explain their effect on the accounting equation.

Explanation of Solution

Accounting equation:

Accounting equation is an accounting tool expressed in the form of equation, by creating a relationship between the resources or assets of a company, and claims on the resources by the creditors and the owners. Accounting equation is expressed as shown below:

Accounting equation for each transaction is as follows:

Figure (1)

Figure (1)

Therefore, the total assets are equal to the liabilities and stockholder’s equity.

Requirement – 2

To record: The journal entries based on requirement 1.

Explanation of Solution

Journal:

Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Journal entries of Company P are as follows:

a. Equipment purchased on account and in cash:

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Equipment (+A) | 21,000 | |||

| Cash (-A) | 5,000 | |||

| Notes payable (+L) | 16,000 | |||

| (To record purchase of equipment on account and in cash) |

Table (1)

- Equipment is an assets account and it increased the value of asset by $21,000. Hence, debit the equipment account for $21,000.

- Cash is an assets account and it decreased the value of asset by $5,000. Hence, credit the cash account for $5,000.

- Notes payable is a liability account, and it increased the value of liabilities by $16,000. Hence, credit the notes payable for $16,000.

b. Issuance of common stock:

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Cash (+A) | 20,000 | |||

| Common stock (+SE) | 20,000 | |||

| (To record the issuance of common stock) |

Table (2)

- Cash is an assets account and it increased the value of asset by $20,000. Hence, debit the cash account for $20,000.

- Common stock is a component of stockholder’s equity and it increased the value of stockholder’s equity by $20,000, Hence, credit the common stock for $20,000.

c. Cash borrowed from bank (long term)

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Cash (+A) | 50,000 | |||

| Notes payable (+L) | 50,000 | |||

| (To record cash borrowed from bank) |

Table (3)

- Cash is an assets account and it increased the value of asset by $50,000. Hence, debit the cash account for $50,000.

- Notes payable is a liability account, and it increased the value of liabilities by $50,000. Hence, credit the notes payable for $50,000.

d. Supplies purchased in cash:

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Supplies (+A) | 4,000 | |||

| Cash (-A) | 4,000 | |||

| (To record purchase of supplies in cash) |

Table (4)

- Supplies are an assets account and it increased the value of asset by $4,000. Hence, debit the supplies account for $4,000.

- Cash is an assets account and it decreased the value of asset by $4,000. Hence, credit the cash account for $4,000.

e. Building purchased on account and in cash:

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Building (+A) | 41,000 | |||

| Cash (-A) | 12,000 | |||

| Notes payable (+L) | 29,000 | |||

| (To record purchase of building on account and in cash) |

Table (5)

- Building is an assets account and it increased the value of asset by $41,000. Hence, debit the building account for $41,000.

- Cash is an assets account and it decreased the value of asset by $12,000. Hence, credit the cash account for $12,000.

- Notes payable is a liability account, and it increased the value of liabilities by $29,000. Hence, credit the notes payable for $29,000.

f. Hired a new president:

In this case, no entry required, because it is not a business transaction.

Requirement – 3

To prepare: T-account for each account listed in the requirement 2.

Explanation of Solution

T-account:

T-account refers to an individual account, where the increasesor decreases in the value of specific asset, liability, stockholder’s equity, revenue, and expenditure items are recorded.

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

- (a) The title of the account

- (b) The left or debit side

- (c) The right or credit side

T-accounts of company P are as follows:

| Cash (A) | |||

| Beg. Bal. | 35,000 | ||

| (b) | 20,000 | 5,000 | (a) |

| (c) | 50,000 | 4,000 | (d) |

| 12,000 | (e) | ||

| End. Bal. | 84,000 | ||

| Accounts receivable (A) | |||

| Beg. Bal. | 5,000 | ||

| End. Bal. | 5,000 | ||

| Inventory (A) | |||

| Beg. Bal. | 40,000 | ||

| End. Bal. | 40,000 | ||

| Supplies (A) | |||

| Beg. Bal. | 5,000 | ||

| (d) | 4,000 | ||

| End. Bal. | 8,000 | ||

| Equipment (A) | |||

| Beg. Bal. | 80,000 | ||

| (a) | 21,000 | ||

| End. Bal. | 101,000 | ||

| Building (A) | |||

| Beg. Bal. | 120,000 | ||

| (e) | 41,000 | ||

| End. Bal. | 161,000 | ||

| Notes receivable (A) | |||

| Beg. Bal. | 2,000 | ||

| End. Bal. | 2,000 | ||

| Land (A) | |||

| Beg. Bal. | 30,000 | ||

| End. Bal. | 30,000 | ||

| Accounts payable (L) | |||

| 37,000 | Beg. Bal. | ||

| 37,000 | End. Bal. | ||

| Notes payable (L) | |||

| 80,000 | Beg. Bal. | ||

| 16,000 | (a) | ||

| 50,000 | (c) | ||

| 29,000 | (e) | ||

| 175,000 | End. Bal. | ||

| Common stock (SE) | |||

| 150,000 | Beg. Bal | ||

| 20,000 | (b) | ||

| 170,000 | End. Bal. | ||

| Retained earnings(SE) | |||

| 50,000 | Beg. Bal | ||

| 50,000 | End. Bal. | ||

Requirement – 4

To explain: The response for event (f).

Explanation of Solution

Business transaction:

Business transaction is a record of any economic activity, resulting in the change in the value of the assets, the liabilities, and the stockholder’s equities, of a business. Business transaction is also referred to as financial transaction.

In this case, hiring of new president is not creating any impact on assets, liabilities and stockholder’s equity of the business, because it is not a business transaction.

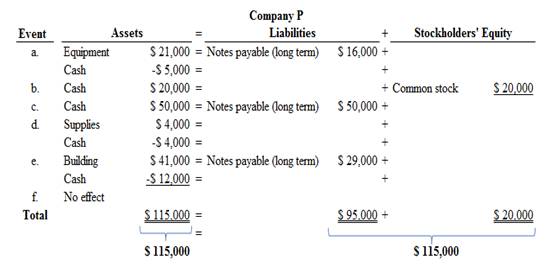

Requirement – 5

To prepare: The classified balance sheet of Company P at December 31.

Explanation of Solution

Classified balance sheet:

This is the financial statement of a company which shows the grouping of similar assets and liabilities under subheadings.

Classified balance sheet of Company P is as follows:

Figure (2)

Therefore, the total assets of Company P are$432,000, and the total liabilities and stockholders’ equity are $432,000.

Requirement – 6

Explanation of Solution

The invested amount of assets are primarily come from stockholder’s’ equity of Company P, because the stockholder’s equity (common stock) financed $220,000 of the Company P’s total assets, and liabilities financed $212,000.

Want to see more full solutions like this?

Chapter 2 Solutions

Loose-leaf for Fundamentals of Financial Accounting with Connect

- Solve this following requirements on these general accounting questionarrow_forwardWhat is the coat of the merchandise assuming the discount is taken on these financial accounting question?arrow_forwardHow many direct labor hours were estimated for the year on these general accounting question?arrow_forward

- You have been asked by the owner of your company to advise her on the process of purchasing some expensive long-term equipment for your company. • Give a discussion of the different methods she might use to make this capital investment decision. • Explain each method and its strengths and weaknesses. • Indicate which method you would prefer to use and why.arrow_forwardWhat is the value of Stockholders' equity at the end of the year on these financial accounting question?arrow_forwardRecord the following journal entries for Young Company: (Click the icon to view the transactions.) (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) 6. Purchased raw materials on account, $5,000. Date 6. Accounts Payable Accounts and Explanation Debit Credit Accounts Receivable Cash Cost of Goods Sold Finished Goods Inventory Manufacturing Overhead Raw Materials Inventory Sales Revenues Wages Payable Work-in-Process Inventory More info 6. Purchased materials on account, $5,000. 7. Used $2,000 in direct materials and $700 in indirect materials in production. 8. Incurred $9,000 in labor costs, of which 60% was direct labor. Print Done - Xarrow_forward

- The following information pertains to Miller Company for the year (Click the icon to view the information.) 13. Calculate the predetermined overhead allocation rate using direct labor hours as the allocation base 14. Determine the amount of overhead allocated during the year. Record the journal entry. 15. Determine the amount of underallocated or overallocated overhead. Record the journal entry to adjust Manufacturing Overhead. Data table 13. Calculate the predetermined overhead allocation rate using direct labor hours as the allocation base Estimated overhead cost $ 420,000 Estimated direct labor hours 12,000 Predetermined overhead allocation rate Estimated manufacturing overhead Estimated direct labor hours $420,000 Actual manufacturing overhead 12,000 hours Actual direct labor hours $500,000 12,650 hours 35 per direct labor hour 14. Determine the amount of overhead allocated during the year. Record the journal entry. Predetermined overhead allocation rate 35 Actual direct labor…arrow_forwardProblem 3-5B Applying the accounting cycle P1 P3 P4 P5 P6 On July 1, Lula Plume created a new self-storage business, Safe Storage Co. The following transactions occurred during the company's first month. July 2 Plume invested $30,000 cash and buildings worth $150,000 in the company in exchange for its common stock. 3 5 10. 14. 24. 28. 29. 30. 31 The company rented equipment by paying $2,000 cash for the first month's (July) rent. The company purchased $2,400 of office supplies for cash. The company paid $7,200 cash for a 12-month insurance policy. Coverage begins on July 11. The company paid an employee $1,000 cash for two weeks' salary earned. The company collected $9,800 cash for storage revenue from customers. The company paid $1,000 cash for two weeks' salary earned by an employee. The company paid $950 cash for minor repairs to buildings. The company paid $400 cash for this month's telephone bill. The company paid $2,000 cash in dividends. The company's chart of accounts follows:…arrow_forwardWhats a good response and question to this post? Choosing Canada to grow a business and would be a great idea do to the same similarities that the United States has within their politics, legal system, and their economics POLITICS Even though Canada is ruled by a monarchy the legislature and monarchy still work together, making very similar to the US government.The Canadian government also has a constitution that states “system of fundamental laws and principles that outline the nature, functions, and limits of Canada’s system of government, both federal and provincial”.Canada has a reputation of having a very welcoming business platform throughout their politics. Legal System Canada's legal system used both civil and common law based on French and English laws.These ideas were brought to them in the 17th century by the columnist.Canada is one of the only countries that has common law and civil law at the same stature. Throughout Canada everyone from common people to government…arrow_forward

- What is a good response to this post? The Hofstede Country Comparison tool provides an analytical framework for comprehending cultural subtleties via variables such as power distance, individualism, masculinity, uncertainty avoidance, long-term orientation, and indulgence. The comparison of Russia, China, and the United States unveils unique cultural landscapes. The United States exhibits a low Power Distance score of 40, indicating a social inclination towards equality and dispersed power systems. This starkly contrasts with Russia's score of 93, which signifies a strong acceptance of hierarchical order, and China's score of 80, where power is similarly consolidated, demonstrating a society that prioritizes authority and hierarchy. The United States gets 91 in individualism, highlighting the importance of personal rights and accomplishments. Russia, scoring 39 and China, scoring 20, exhibit a collectivist inclination where group allegiance and communal interests frequently take…arrow_forwardWhats a good response to this post? Comparing USA to Germany and Japan Hofstede's dimensions include Power, Distance, Individualism, Masculinity, Uncertainty Avoidance, Long-Term Orientation and Indulgence. Power: USA 40, Germany 35, Japan 54 The USA and Germany have relatively low scores, indicating a preference for equality and decentralized power structures. Japan's score suggests a more Hierarchical society with greater acceptance of unequal power distribution. IDV: USA 91, Germany 67, Japan 46 The USA scores very very high, reflecting a strong emphasis on individual rights. Germany also values IDV but to a lesser extent while Japan has the lowers store, showing more collectivism, emphasizing group harmony and loyalty. MAS, USA 62, Germany 66, Japan 95 All three have pretty high scores but Japan outranks. Indicating a strong focus on competition, achievement and success. UAI: USA 46, Germany 65, Japan 92 The USA has a low score, suggesting a higher tolerance for ambiguity and…arrow_forwardWhats a good response and question to ask to this post? The county that I am choosing to expand to is Denmark. Below is a brief overview of their political, economic, and legal systems. Political System Denmark is a Constitutional Monarchy. Their chief of state is the Queen and their head of government is the Prime Minister. The government is broken up into three branches, the executive branch, judicial branch, and legislative branch. Economic System Denmark is a developed country with a high income. Not much is able to sway Denmark. Unlike most countries, when Covid was wreaking havoc all over the world, their economy recessed by only 2% in 2020 and continued on to jump back up by 3.8% by 2022. They also have a very low unemployment rate of only 2.7%. Legal System Denmark operates by a civil law system with roots in Germanic Law. They have a medium corruption score of 88 out of 200. Denmark has a great business perspective overall. The only part that I would question is, how would the…arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning