Loose-leaf for Fundamentals of Financial Accounting with Connect

5th Edition

ISBN: 9781259619007

Author: Fred Phillips Associate Professor

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 2.12E

Analyzing the Effects of Transactions Using T-Accounts; Preparing and Interpreting a

Laser Delivery Services. Inc. (LDS) was incorporated January 1. The following transactions occurred during the year:

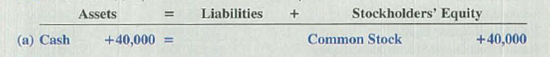

- a. Received $40,000 cash from the company’s founders in exchange for common stock.

- b. Purchased land for $12,000, signing a two-year note (ignore interest).

- c. Bought two used delivery trucks at the start of the year at a cost of $10,000 each; paid $2,000 cash and signed a note due in three years for $18,000 (ignore interest).

- d. Paid $2,000 cash to a truck repair shop for a new motor, which increased the cost of one of the trucks.

- e. Stockholder Jonah Lee paid $300,000 cash for a house for his personal use.

Required:

- 1. Analyze each item for its effects on the

accounting equation of LDS for the year ended December 31.

TIP: Transaction (a) is presented below as an example.

TIP: The new motor in transaction (d) is treated as an increase to the cost of the truck.

- 2. Record the effects of each item using a

journal entry .

TIP: Use the simplified journal entry format shown in the demonstration case on page 69.

- 3. Summarize the effects of the journal entries by account, using the T-account format shown in the chapter.

- 4. Prepare a classified balance sheet for LDS at December 31.

- 5. Using the balance sheet, indicate whether LDS’s assets at the end of the year were financed primarily by liabilities or stockholders’ equity.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you solve this general accounting question with accurate accounting calculations?

GENERAL ACCOUTING?

None

Chapter 2 Solutions

Loose-leaf for Fundamentals of Financial Accounting with Connect

Ch. 2 - Define the following: a. Asset b. Current asset c....Ch. 2 - Define a transaction anti give an example of each...Ch. 2 - For accounting purposes, what is an account?...Ch. 2 - What is the basic accounting equation?Ch. 2 - Prob. 5QCh. 2 - Prob. 6QCh. 2 - Prob. 7QCh. 2 - What is a journal entry? What is the typical...Ch. 2 - What is a T-account? What is its purpose?Ch. 2 - Prob. 10Q

Ch. 2 - Prob. 11QCh. 2 - Which of the following is not an asset account? a....Ch. 2 - Which of the following statements describe...Ch. 2 - Total assets on a balance sheet prepared on any...Ch. 2 - The duality of effects can best be described as...Ch. 2 - The T-account is used to summarize which of the...Ch. 2 - Prob. 6MCCh. 2 - A company was recently formed with 50,000 cash...Ch. 2 - Which of the following statements would be...Ch. 2 - Prob. 9MCCh. 2 - Prob. 10MCCh. 2 - Prob. 2.1MECh. 2 - Prob. 2.2MECh. 2 - Matching Terms with Definitions Match each term...Ch. 2 - Prob. 2.4MECh. 2 - Prob. 2.5MECh. 2 - Prob. 2.6MECh. 2 - Prob. 2.7MECh. 2 - Identifying Events as Accounting Transactions Half...Ch. 2 - Determining Financial Statement Effects of Several...Ch. 2 - Preparing Journal Entries For each of the...Ch. 2 - Posting to T-Accounts For each of the transactions...Ch. 2 - Reporting a Classified Balance Sheet Given the...Ch. 2 - Prob. 2.13MECh. 2 - Prob. 2.14MECh. 2 - Identifying Transactions and Preparing Journal...Ch. 2 - Prob. 2.16MECh. 2 - Prob. 2.17MECh. 2 - Prob. 2.18MECh. 2 - Prob. 2.19MECh. 2 - Prob. 2.20MECh. 2 - Prob. 2.21MECh. 2 - Prob. 2.22MECh. 2 - Prob. 2.23MECh. 2 - Prob. 2.24MECh. 2 - Prob. 2.25MECh. 2 - Prob. 2.1ECh. 2 - Prob. 2.2ECh. 2 - Classifying Accounts and Their Usual Balances As...Ch. 2 - Determining Financial Statement Effects of Several...Ch. 2 - Prob. 2.5ECh. 2 - Recording Journal Entries Refer to E2-4. Required:...Ch. 2 - Prob. 2.7ECh. 2 - Analyzing the Effects of Transactions in...Ch. 2 - Inferring Investing and Financing Transactions and...Ch. 2 - Analyzing Accounting Equation Effects, Recording...Ch. 2 - Recording Journal Entries and Preparing a...Ch. 2 - Analyzing the Effects of Transactions Using...Ch. 2 - Explaining the Effects of Transactions on Balance...Ch. 2 - Prob. 2.14ECh. 2 - Prob. 2.15ECh. 2 - Determining Financial Statement Effects of Various...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Determining Financial Statement Effects of Various...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Determining Financial Statement Effects of Various...Ch. 2 - Prob. 2.2PBCh. 2 - Prob. 2.3PBCh. 2 - Prob. 2.1SDCCh. 2 - Prob. 2.2SDCCh. 2 - Prob. 2.4SDCCh. 2 - Prob. 2.5SDCCh. 2 - Accounting for the Establishment of a Business...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please explain the solution to this general accounting problem with accurate explanations.arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY