Concept explainers

Cash versus accrual accounting;

• LO2–4, LO2–5, LO2–8

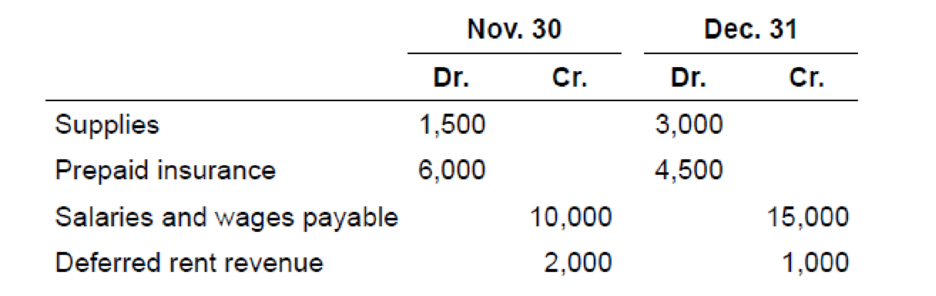

The Righter Shoe Store Company prepares monthly financial statements for its bank. The November 30 and December 31, 2018,

The following information also is known:

a. The December income statement reported $2,000 in supplies expense.

b. No insurance payments were made in December.

c. $10,000 was paid to employees during December for salaries and wages.

d. On November 1, 2018, a tenant paid Righter $3,000 in advance rent for the period November through January. Deferred rent revenue was credited.

Required:

1. What was the cost of supplies purchased during December?

2. What was the adjusting entry recorded at the end of December for prepaid insurance?

3. What was the adjusting entry recorded at the end of December for accrued salaries and wages?

4. What was the amount of rent revenue recognized in December? What adjusting entry was recorded at the end of December for deferred rent revenue?

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Intermediate Accounting

- I am searching for the accurate solution to this financial accounting problem with the right approach.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardStella Distributors generated revenues of $135,000 during 2023. The company’s expenses included: cost of goods sold of $72,000, operating expenses of $31,000, and a gain on the sale of machinery of $9,000. What is Stella’s gross profit?arrow_forward

- Baldwin Corporation incurs a cost of $42.75 per unit, of which $25.40 is variable, to make a product that normally sells for $64.90. A foreign wholesaler offers to buy 5,800 units at $37.60 each. Baldwin will incur additional costs of $3.20 per unit to imprint a logo and to pay for shipping. Compute the increase or decrease in net income Baldwin will realize by accepting the special order, assuming the company has sufficient excess operating capacity.arrow_forwardAdditionally, the firm pays $925,000 in legal fees.arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education