ENTRIES FOR DISSOLUTION OF

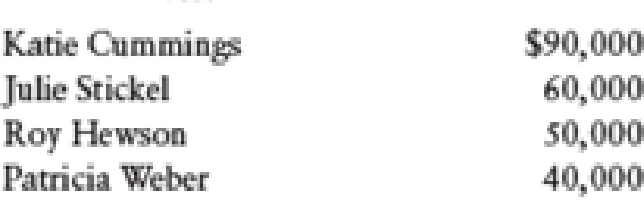

On August 10, after the business had been in operation for several years, Patricia Weber passed away. Mr. Weber wished to sell his wife’s interest for $30,000. After the books were closed, the partners’ capital accounts had credit balances as follows:

REQUIRED

1. Prepare the general

2. Assume instead that Mr. Weber is paid $60,000 for the book value of Patricia Weber’s capital account. Prepare the necessary journal entry.

3. Assume instead that Julie Stickel (with the consent of the remaining partners) purchased Weber’s interest for $70,000 and gave Mr. Weber a personal check for that amount. Prepare the general journal entry for the partnership only.

Trending nowThis is a popular solution!

Chapter 19 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

- Pricilla Company uses a standard costing system that allows 3 pounds of direct materials for one finished unit. During July, the company purchased 40,000 pounds of direct materials for $240,000 and manufactured 14,800 finished units. The standard direct materials cost allowed for the units manufactured is $155,000. The performance report shows that Pricilla has an unfavorable direct materials usage variance of $7,300. Also, the company records any price variance for materials at time of purchase. The number of pounds of direct materials used to produce July's output was__ Provide answerarrow_forwardHi expert please give me answer general accounting questionarrow_forwardGiven answer financial accounting questionarrow_forward

- Consider the following event: Purchased a truck by paying cash. Which of the following combination of changes in the accounting equation describes the given event? a. Liabilities decrease; Owners' equity increase b. Assets decrease; Liabilities decrease c. Assets decrease; Owners' equity decrease d. Assets increase; Assets decrease e. Assets increase; Liabilities increase f. Assets increase; Owners' equity increasearrow_forwardDuring the month of March, Neji Company used $32,800 of direct materials and incurred $46,100 of direct labor costs. Jacob applied overhead to products in the amount of $21,900. If the cost of goods manufactured was $138,000 and the ending work in process balance was $23,600, the beginning work in process must have been equal to _.arrow_forwardWhat is the net profitarrow_forward

- Provide correct answer general Accounting questionarrow_forwardAtkins Company collected $1,750 as payment for the amount owed by a customer from services provided the prior month on credit. How does this transaction affect the accounting equation for Atkins? a. Assets would decrease by $1,750 and liabilities would decrease by $1,750. b. One asset would increase by $1,750 and a different asset would decrease by $1,750, causing no effect. c. Assets would increase by $1,750 and equity would increase by $1,750. d. Assets would increase by $1,750 and liabilities would increase by $1,750. e. Liabilities would decrease by $1,750 and equity would increase by $1,750.arrow_forwardInternationalarrow_forward

- Photo Framing's cost formula for its supplies cost is $1,975 per month plus $24 per frame. For the month of November, the company planned for activity of 642 frames, but the actual level of activity was 623 frames. The actual supplies cost for the month was $17,250. The variance for supplies cost in November would be _.arrow_forwardNonearrow_forward?arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning