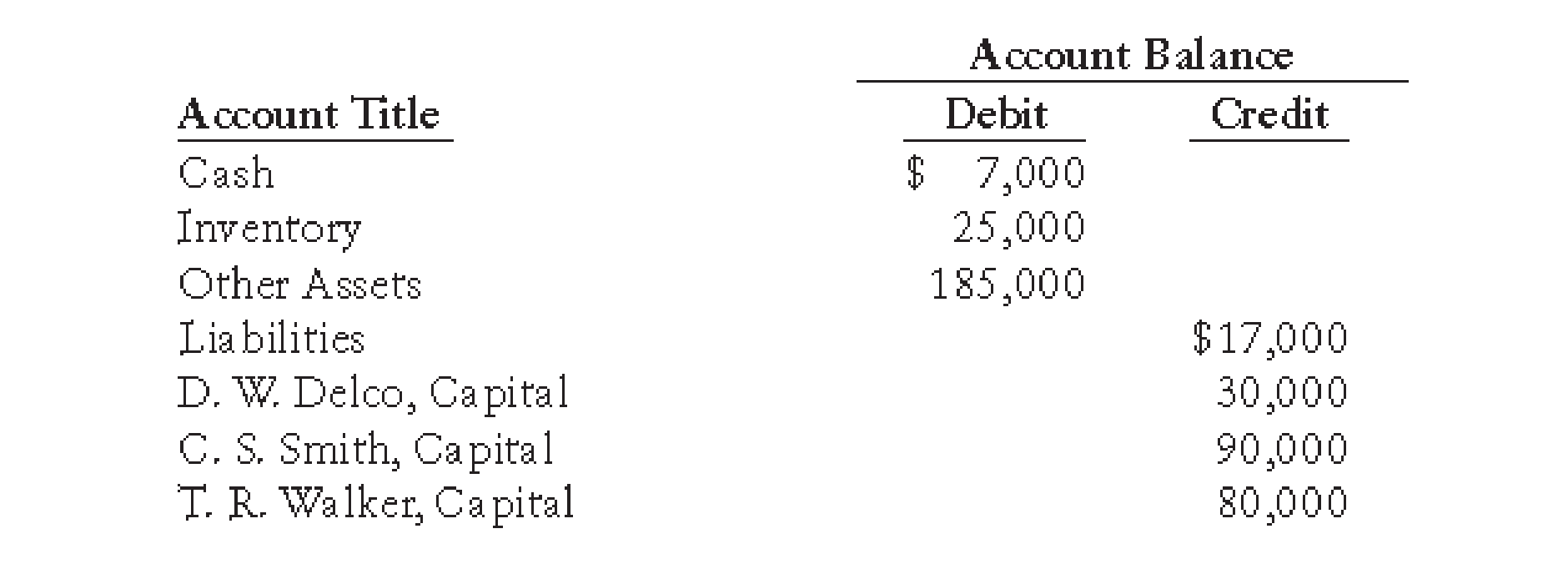

STATEMENT OF PARTNER SHIP LIQUIDATION WITH LOSS After several years of operations, the

The noncash assets are sold for $165,000.

REQUIRED

1. Prepare a statement of partnership liquidation for the period April 1–15, 20--, showing the following:

(a) The sale of noncash assets on April 1

(b) The allocation of any gain or loss to the partners on April 1

(c) The payment of the liabilities on April 12

(d) The distribution of cash to the partners on April 15

2. Journalize these four transactions in a general journal.

Want to see the full answer?

Check out a sample textbook solution

Chapter 19 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

- Need help with this general accounting questionarrow_forwardCullen Beatty plans to start a consulting business-Cullen Consulting Services. In preparation to do this, on April 1, 20X1, he invested $56,000 in cash and $23,000 in equipment, and opened an account at Office Plus by purchasing $1,750 in office supplies which is due by the end of the month. He then signed a one-year lease agreement on an office building for $8,400, paying the full amount in advance. Prepare a Balance Sheet for Cullen Consulting Services as of April 1, 20X1, before he conducts any services. Cash Equipment Prepaid rent CULLEN CONSULTING SERVICES Balance Sheet April 1, 20X1 Assets Liabilities $ 47,600 Accounts payable 23,000 8,400 Owner's Equity $ 1,750 Cullen Beatty, Capital 77,250 Total Assets $ 79,000 Total Liabilities and Owner's Equity $ 79,000arrow_forwardThe December 31, 2021, balance sheet of Chen, Incorporated, showed long-term debt of $1,420,000, $144,000 in the common stock account, and $2,690,000 in the additional paid-in surplus account. The December 31, 2022, balance sheet showed long-term debt of $1,620,000, $154,000 in the common stock account and $2,990,000 in the additional paid-in surplus account. The 2022 income statement showed an interest expense of $96,000 and the company paid out $149,000 in cash dividends during 2022. The firm’s net capital spending for 2022 was $1,000,000, and the firm reduced its net working capital investment by $129,000. What was the firm's 2022 operating cash flow, or OCF?arrow_forward

- River is a salaried exempt worker who earns $73,630 per year for a 35-hour workweek. During a biweekly pay period, River worked 105 hours. What is the gross pay?arrow_forwardThe industrial enterprise "HUANG S.A." purchased a sorting and packaging machine from a foreign company on 1/4/2017 at a cost of €500,000. The useful life of the machine was estimated by the Management at ten (10) years, while the residual value was estimated at zero. For the transportation of the machine from abroad to the company's factory, the amount of €20,000 was paid on 15/4/2017. As the insurance coverage of the machine during transportation was the responsibility of the selling company, HUANG S.A. proceeded to insure the machine from 16/4/2017 to 15/4/2018, paying the amount of €1,200. The delivery took place on 15/4/2017. As adequate ventilation of the multifunction device is essential for its proper operation, the company fitted an air duct on the multifunction device. The cost of the air duct amounted to €2,000 and was paid on 20/4/2017. On 25/4/2017, an external electrician was paid €5,000 for the electrical connection of the device. The company also paid €5,000 to an…arrow_forwardThe industrial enterprise "HUANG S.A." purchased a sorting and packaging machine from a foreign company on 1/4/2017 at a cost of €500,000. The useful life of the machine was estimated by the Management at ten (10) years, while the residual value was estimated at zero. For the transportation of the machine from abroad to the company's factory, the amount of €20,000 was paid on 15/4/2017. As the insurance coverage of the machine during transportation was the responsibility of the selling company, HUANG S.A. proceeded to insure the machine from 16/4/2017 to 15/4/2018, paying the amount of €1,200. The delivery took place on 15/4/2017. As adequate ventilation of the multifunction device is essential for its proper operation, the company fitted an air duct on the multifunction device. The cost of the air duct amounted to €2,000 and was paid on 20/4/2017. On 25/4/2017, an external electrician was paid €5,000 for the electrical connection of the device. The company also paid €5,000 to an…arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,