College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN: 9781305666160

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 19, Problem 10SPA

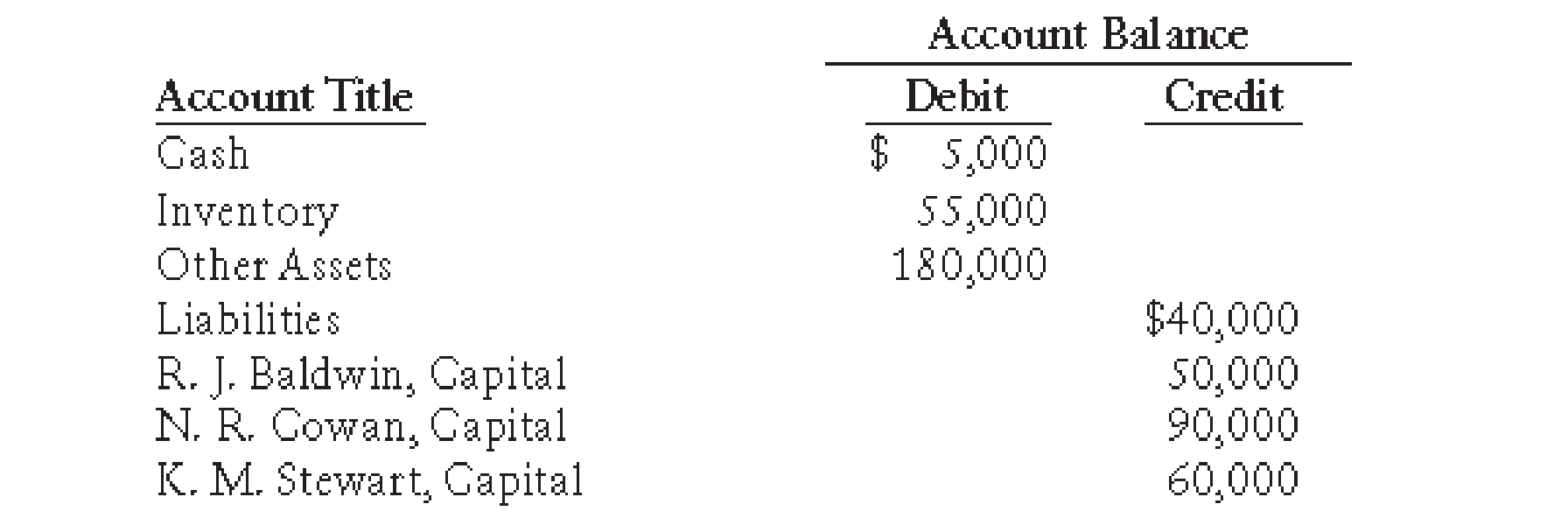

STATEMENT OF PARTNER SHIP LIQUIDATION WITH LOSS After several years of operations, the

REQUIRED

1. Prepare a statement of partnership liquidation for the period July 1–20, 20--, showing the following:

(a) The sale of noncash assets on July 1

(b) The allocation of any gain or loss to the partners on July 1

(c) The payment of the liabilities on July 15

(d) The distribution of cash to the partners on July 20

2. Journalize these four transactions in a general journal.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Calculate falcon enterprise s gross margin ratio

General Accounting

How much did they charge for each pair?

Chapter 19 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

Ch. 19 - Prob. 1TFCh. 19 - Prob. 2TFCh. 19 - Prob. 3TFCh. 19 - Prob. 4TFCh. 19 - Prob. 5TFCh. 19 - Prob. 1MCCh. 19 - Prob. 2MCCh. 19 - Prob. 3MCCh. 19 - Prob. 4MCCh. 19 - Prob. 5MC

Ch. 19 - Prob. 1CECh. 19 - Prob. 2CECh. 19 - Prob. 3CECh. 19 - Prob. 4CECh. 19 - Prob. 5CECh. 19 - Prob. 1RQCh. 19 - Prob. 2RQCh. 19 - Prob. 3RQCh. 19 - Prob. 4RQCh. 19 - Prob. 5RQCh. 19 - Prob. 6RQCh. 19 - Prob. 7RQCh. 19 - Prob. 8RQCh. 19 - Prob. 9RQCh. 19 - Prob. 1SEACh. 19 - Prob. 2SEACh. 19 - Prob. 3SEACh. 19 - Prob. 4SEACh. 19 - ENTRIES: PARTNERSHIP LIQUIDATION On liquidation of...Ch. 19 - Prob. 6SPACh. 19 - Prob. 7SPACh. 19 - Prob. 8SPACh. 19 - Prob. 9SPACh. 19 - STATEMENT OF PARTNER SHIP LIQUIDATION WITH LOSS...Ch. 19 - Prob. 1SEBCh. 19 - Prob. 2SEBCh. 19 - Prob. 3SEBCh. 19 - Prob. 4SEBCh. 19 - Prob. 5SEBCh. 19 - Prob. 6SPBCh. 19 - Prob. 7SPBCh. 19 - ENTRIES FOR DISSOLUTION OF PARTNERSHIP Cummings...Ch. 19 - Prob. 9SPBCh. 19 - STATEMENT OF PARTNER SHIP LIQUIDATION WITH LOSS...Ch. 19 - Prob. 1MYWCh. 19 - Prob. 1ECCh. 19 - Prob. 1MPCh. 19 - Prob. 1CPCh. 19 - Prob. 1COP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- General Accountingarrow_forwardAmount of equity for quantum industries?arrow_forwardR-Mart has a beginning receivables balance on February 1 of $1050. Sales for February through May are $625, $698, $975, and $1,990, respectively. The accounts receivable period is 30 days. What is the amount of the April collections? Assume a year has 360 days. NO AI ANSWERarrow_forward

- What is the cash balance at the end of September on these general accounting question?arrow_forwardR-Mart has a beginning receivables balance on February 1 of $1050. Sales for February through May are $625, $698, $975, and $1,990, respectively. The accounts receivable period is 30 days. What is the amount of the April collections? Assume a year has 360 days.arrow_forwardTutor, solve this Accounting problemarrow_forward

- The monthly cost (in dollars) of a data plan for Mercury Communications is a linear function of the total data usage (in gigabytes). The monthly cost for 25 gigabytes of data is $45.50 and the monthly cost for 40 gigabytes is $58.00. What is the monthly cost for 28 gigabytes of data?solve this?arrow_forwardGeneral Accounting Question please answer this questionarrow_forwardWhat is the firm's equity on these financial accounting question?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

What is liquidity?; Author: The Finance Storyteller;https://www.youtube.com/watch?v=XtjS7CfUSsA;License: Standard Youtube License